ASSESSMENT ADMINISTRATION MANUAL

OFFICE OF THE

PROPERTY VALUATION ADMINISTRATOR

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

OFFICE OF PROPERTY VALUATION

2023

i

PREFACE

An assessment administration manual has been part of Kentucky property tax professionals’ libraries for

nearly seventy years. In January 1950, following the historic 1949 Special Session of the General

Assembly, the “Kentucky Property Assessment Administration Manual” was printed and distributed to all

120 Tax Commissioners (since renamed Property Valuation Administrators, or PVAs). This manual has

taken various forms throughout the years, and became a mandate when the 1988 General Assembly directed

the Department of Revenue to develop up-to-date manuals outlining uniform procedures for assessing all

categories of real and personal property (KRS 131.140).

This manual is to be used by all PVAs and staff to ensure a standardized approach to property tax assessment

administration across the Commonwealth. It is updated periodically to reflect changes in the law or

revisions of policy that may affect administration and valuation processes. Kentucky Revised Statute

(KRS) citations have been included in the body of the text for additional reference, emphasis, or clarity.

Full versions of statutes are available at https://legislature.ky.gov. Deviations from the standardized

methods or procedures due to unique or exceptional circumstances may be permitted upon specific

authorization from the Office of Property Valuation. Detailed information on virtually any aspect of

assessment administration is available under the numerous offerings of the Office of Property Valuation

Education Program, as well as other instructional functions such as the annual Conference on Assessment

Administration. Any PVA with a question regarding technical or administrative procedures is encouraged

to contact the Office of Property Valuation.

This version of the Assessment Administration Manual supersedes all previous versions.

December, 2022

ii

T A B L E O F C O N T E N T S

Page

Chapter 1 General Duties and Professional Development of the

Property Valuation Administrator

A. Introduction to the Market Value Standard .................................................. 1-1

B. General Duties .............................................................................................. 1-2

C. Continuing Education Requirements ............................................................ 1-3

D. Professional Designation Program ................................................................ 1-5

Chapter 2 Property Tax Duties of the Department of Revenue

A. Introduction ................................................................................................... 2-1

B. Annual Conference on Assessment Administration ..................................... 2-1

C. Monitoring Responsibilities of the Department of Revenue ........................ 2-2

Chapter 3 Property Subject to Taxation

A. Introduction ................................................................................................... 3-1

B. Real Property Classification ......................................................................... 3-1

C. Personal Property Classification ................................................................... 3-3

D. Property Subject to Preferential Tax Rates ................................................... 3-4

Chapter 4 Property Exempt from Taxation

A. Introduction ................................................................................................... 4-1

B. Procedures for Listing Exempt Property ....................................................... 4-1

C. Public Property Used for Public Purposes .................................................... 4-2

D. Property Owned by a Non-Profit Institution of Education ........................... 4-3

E. Property Owned and Real Property Owned and Occupied by an Institution

of Religion ................................................................................................... 4-3

F. Homestead/Disability Exemption ................................................................. 4-5

G. Other Constitutionally Exempt Property ...................................................... 4-6

H. Leased Property ............................................................................................ 4-7

I. Application for Exemption ........................................................................... 4-8

J. Personal Property Exempt by Statute ............................................................ 4-9

iii

Chapter 5 Property Tax Relief Programs

A. Introduction ................................................................................................... 5-1

B. Agricultural Value ........................................................................................ 5-1

C. Assessment Moratorium Program................................................................. 5-3

D. Foreign Trade Zones ...................................................................................... 5-4

E. Tax Increment Financing ............................................................................... 5-4

F. Brownfields .................................................................................................... 5-5

Chapter 6 The Kentucky Property Tax Calendar

A. Introduction ................................................................................................... 6-1

B. Assessment Date ........................................................................................... 6-3

C. Listing Period ................................................................................................ 6-3

D. Estimate Submitted to the County Judge-Executive ..................................... 6-5

E. Notification of Taxpayers ............................................................................. 6-5

F. Preparation of Tax Roll and PVA Recapitulation .......................................... 6-6

G. The Inspection Period .................................................................................... 6-7

H. Notice of the Inspection Period...................................................................... 6-7

I. Board of Assessment Appeals ....................................................................... 6-8

J. Board of Tax Appeals .................................................................................... 6-9

K. Final Recap to the Department of Revenue ................................................. 6-10

L. Department of Revenue Certification .......................................................... 6-10

M. Tax Bill Preparation ..................................................................................... 6-11

N. Tax Bills Delivered to Sheriff ...................................................................... 6-11

O. Payment of Tax Bills ................................................................................... 6-11

Chapter 7 Property Tax Rate Structure

A. Introduction ................................................................................................... 7-1

B. Real Property Tax Rates ............................................................................... 7-1

C. Tangible Property Tax Rates ........................................................................ 7-2

D. Intangible Property Tax Rates ...................................................................... 7-2

E. Setting Local Property Tax Rates ................................................................. 7-2

F. Rates by Property Class ................................................................................. 7-3

Chapter 8 Assessment/Sales Ratio Study Program

A. Introduction ................................................................................................... 8-1

B. Data Collection and Verification .................................................................. 8-2

C. Statistical Analysis ........................................................................................ 8-6

D. Median Ratios ............................................................................................... 8-6

E. Coefficient of Dispersion .............................................................................. 8-7

iv

F. Interpretation of the Median Ratio and Coefficient of Dispersion ................ 8-7

G. Significance of the Assessment/Sales Ratio .................................................. 8-8

H. Release of Information ................................................................................. 8-13

Chapter 9 Assessment Quality and Equalization

A. Introduction ................................................................................................... 9-1

B. Biennial Performance Audit and Record and Mapping Review .................... 9-1

C. Equalization Methods ................................................................................... 9-2

Chapter 10 Physical Examination of Real Property

A. Introduction .................................................................................................. 10-1

B. Assessment Planning ................................................................................... 10-1

C. Submission of Review Schedule .................................................................. 10-2

D. Guidelines for Quadrennial Physical Examination ...................................... 10-2

E. Periodic Revaluations .................................................................................. 10-3

Chapter 11 Maintenance of Property Identification Mapping Systems

A. Introduction .................................................................................................. 11-1

B. Maintenance of Maps and Records .............................................................. 11-2

C. The Future of Mapping ................................................................................ 11-6

D. Upgrading Obsolete Mapping Systems ....................................................... 11-6

E. Map Sales and Data ..................................................................................... 11-7

F. Aerial Photography ...................................................................................... 11-8

Chapter 12 Assessment of Real Property

A. Introduction .................................................................................................. 12-1

B. The Sales Comparison Approach to Value .................................................. 12-1

C. The Cost Approach to Value........................................................................ 12-4

D. The Income Approach to Value ................................................................... 12-9

E. The Concept of Mass Appraisal ................................................................. 12-12

Chapter 13 Assessment of Personal Property

A. Introduction .................................................................................................. 13-1

B. Listing of Personal Property ........................................................................ 13-2

C. Return Processing and Entry ........................................................................ 13-2

D. Valuation of Personal Property .................................................................... 13-3

v

Chapter 14 Special or Unique Valuation Procedures

A. Introduction .................................................................................................. 14-1

B. Telecommunications Property ..................................................................... 14-1

Chapter 15 Motor Vehicle Assessment (MOTAX) System

A. Introduction .................................................................................................. 15-1

B. Vehicle Valuation ........................................................................................ 15-1

C. Valuation Guides ......................................................................................... 15-2

D. The Collection of Motor Vehicle Taxes ...................................................... 15-3

E. Reports from the Department....................................................................... 15-3

F. Delinquent Motor Vehicle Taxes ................................................................. 15-6

G. Assessment Appeals..................................................................................... 15-7

Chapter 16 Assessment of Unmined Coal and Mineral Property

A. Introduction .................................................................................................. 16-1

B. Reporting of Mineral Resource Property ..................................................... 16-1

C. Billing and Appeals Procedures ................................................................... 16-2

D. Responsibility of the PVA ........................................................................... 16-2

Chapter 17 State Assessed Property

A. Introduction .................................................................................................. 17-1

B. Domestic Life Insurance Companies ........................................................... 17-1

C. Bank Deposits .............................................................................................. 17-1

D. Public Service Companies ........................................................................... 17-2

E. Commercial Watercraft ................................................................................ 17-3

F. Distilled Spirits ............................................................................................ 17-3

G. Trucks, Tractors, Semi-trailers and Buses ................................................... 17-3

Chapter 18 Property Tax Collection

A. Introduction .................................................................................................. 18-1

B. Property Tax Collection Cycle..................................................................... 18-2

Chapter 19 Omitted Property

A. Introduction .................................................................................................. 19-1

B. Omitted Real Property ................................................................................. 19-1

vi

C. Omitted Personal Property ........................................................................... 19-2

Chapter 20 Exonerations and Property Tax Refunds

A. Introduction .................................................................................................. 20-1

B. Exonerations ................................................................................................ 20-1

C. Property Tax Refunds .................................................................................. 20-2

D. Clerical Errors .............................................................................................. 20-2

Chapter 21 Assessment Appeals

A. Introduction .................................................................................................. 21-1

B. Conference with Taxpayer ........................................................................... 21-1

C. Local Board of Assessment Appeals ........................................................... 21-2

D. Personal Property and State Assessed Property Appeals ............................. 21-3

E. Board of Tax Appeals .................................................................................. 21-4

F. Appeals to the Courts ................................................................................... 21-5

Chapter 22 Delinquent Property

A. Introduction .................................................................................................. 22-1

B. The PVA’s Role Regarding Delinquent Property ........................................ 22-1

Chapter 23 Open Records

A. Introduction .................................................................................................. 23-1

B. Definitions.................................................................................................... 23-2

C. General Requirements .................................................................................. 23-3

D. Public Records Open for Inspection ............................................................ 23-4

E. Public Records NOT Open for Inspection ................................................... 23-5

F. Fee Schedule for Open Records Requests ................................................... 23-5

Chapter 24 Records Retention

A. Introduction .................................................................................................. 24-1

B. Public Records ............................................................................................. 24-1

C. Local Disposal of Records ........................................................................... 24-2

1 - 1

CHAPTER ONE

GENERAL DUTIES AND PROFESSIONAL DEVELOPMENT

OF THE PROPERTY VALUATION ADMINISTRATOR

A. Introduction to the Market Value Standard

The primary duty of the Property Valuation Administrator (PVA) is to equitably assess the

value of real and personal property listed by taxpayers in his or her county. The Constitution of

Kentucky requires that “All property, not exempted from taxation by this Constitution, shall be

assessed for taxation at its fair cash value, estimated at the price it would bring at a fair voluntary

sale.” This language has not been amended since the current (fourth) Kentucky Constitution was

adopted in 1891. KRS 160.460 states unequivocally that “…all real property located in the state

and subject to local taxation shall be assessed at one hundred percent (100%) of fair cash value.”

These mandates, backed up by the historic (1965) Russman v. Luckett decision, establish the

market value standard as law in Kentucky.

For the purposes of assessment administration, “market value” and “fair cash value” should be

considered synonymous. Market value is defined by the International Association of Assessing

Officers (IAAO) in Property Assessment Valuation, Third Edition (2010) as follows:

Market value is the most probable price which a property should

bring in a competitive and open market under all conditions

requisite to a fair sale, the buyer and seller each acting prudently

and knowledgeably, and assuming the price is not affected by undue

stimulus.

1 - 2

Obviously, the most reliable indicator of market value for a particular parcel of property is a

recent sale price that meets the criteria established above. If a recent market price is not available,

the PVA must estimate the fair cash value based on the most probable price a willing buyer would

pay a willing seller, provided both parties are fully informed and act voluntarily. This hypothetical

“sale price”, or value, must be derived by using standard appraisal practices. Every effort should

be made to arrive at a fair assessment, as "any grossly discriminatory valuation shall be construed

as an intentional discrimination." (KRS 132.450) The information needed for an appraisal can be

gathered through visits with the taxpayer, property tax returns, physical or virtual inspection of the

property, deeds and records, and from any other source the PVA may be able to obtain, including

from the PVA's personal knowledge.

B. General Duties

In the process of accomplishing the primary function of the PVA office, to assess all property

at market value, many supporting functions must be performed. Tax rolls, maps, photographs, and

computer data must be constantly maintained and updated. Personal property tax returns must be

entered into the centralized statewide computer system. Property owners must be informed of

pertinent filing dates and of changes affecting property tax liabilities, and PVAs must use various

means and methods to locate and assess omitted property. PVAs also provide a variety of

information management services as custodians of the parcel ownership database, most of which

is public information subject to disclosure pursuant to the Kentucky Open Records Act.

1 - 3

In order to effectively carry out the many duties required of the PVA office, an office staff

must be hired, trained, and directed by the PVA. A bank account must be maintained for the

management of local funds and a budget must be set to purchase needed supplies and equipment.

The PVA is a statutory state official and the deputies and assistants in the PVA office are

unclassified state employees (KRS 132.370). As part of the executive branch of state government,

the PVA office, although responsible for assessments in only one county, is a state office and

subject to state office statutory provisions. The PVA is required to keep scheduled office hours

and be engaged in official duties at least five days a week (KRS 132.410).

PVAs are elected in the same year as other local officials and take office the first Monday in

December. They are sworn in by the county judge-executive with the following oath of office:

I do solemnly swear (or affirm, as the case may be) that I will support the

Constitution of the United States and the Constitution of this Commonwealth, and

be faithful and true to the Commonwealth of Kentucky so long as I continue a citizen

thereof, and that I will faithfully execute, to the best of my ability, the office of

Property Valuation Administrator according to law; and I do further solemnly

swear (or affirm) that since the adoption of the present Constitution, I, being a

citizen of this State, have not fought a duel with deadly weapons within this State

nor out of it, nor have I sent or accepted a challenge to fight a duel with deadly

weapons, nor have I acted as a second in carrying a challenge, nor aided or

assisted any person thus offending, so help me God.

C. Continuing Education Requirements

Due to the extensive and ever-changing body of knowledge needed to successfully run the

PVA office, PVAs participate in two separate statutory continuing education programs, both based

upon completion of annual requirements for hours of education. Since 1986, qualifying PVAs

1 - 4

have received a monthly expense allowance which is tied to classroom attendance at educational

functions; and since 2000, qualifying PVAs have been awarded an annual training incentive, based

on continuing participation in the Education Program and adjusted by the consumer price index.

Each of these programs have separate rules, but PVAs are allowed to earn hours of education

toward both concurrently.

The specific requirements that PVAs must meet to qualify for the annual expense allowance

are identified in KRS 132.597. Each PVA must participate in a minimum of 30 classroom hours

of “professional instruction conducted or approved by the Department of Revenue” within each

calendar year in order to qualify for the expense allowance for the subsequent calendar year. Hours

of education in excess of the 30 hour requirement lapse at the end of the year in which they have

been earned, and cannot be carried forward into subsequent years. PVAs who have earned the

Senior Kentucky Assessor (SKA) designation must meet a reduced requirement of just 15

classroom hours per calendar year in order to qualify for the annual expense allowance for the

subsequent year. The requirements for the professional designations are described in the following

section. Should a PVA fail to meet the educational requirement in any year, the annual expense

allowance will be withheld for the subsequent year.

Under KRS 132.590, in addition to the monthly expense allowance described above, PVAs

also receive a lump sum training incentive for each training unit completed.

Under the training incentive program set forth in the statute, PVAs must earn a training unit of

forty hours of education per calendar year in order to qualify for the training incentive payment.

1 - 5

Unlike the expense allowance program, up to forty hours of approved education in excess of the

training unit are allowed to be carried over into the next calendar year, to qualify for that year’s

training unit. Payment is in a lump sum at the end of the month following the attainment of the

training unit of forty hours. Therefore, a PVA carrying over the maximum of forty hours can

qualify in January of the succeeding calendar year and be approved for payment during February.

PVAs may earn only one training incentive per year but can receive up to four per year depending

on tenure and accumulated training units. The statutory amount of the incentive ($1,169.77 in year

2022 dollars) is adjusted annually with the consumer price index, so the actual payment varies

from year to year.

More specific rules and procedures governing the training incentive program for PVAs are

included in the Education and Professional Designation Program Student Manual, published by

the Office of Property Valuation, Local Officials Compliance Branch.

D. Professional Designation Program

The Department of Revenue, in cooperation with the Kentucky PVA’s Association, has

developed an education and professional designation program, with two professional designations

available to PVAs, their staffs, and Department of Revenue employees. To obtain the first level

designation, Certified Kentucky Assessor (CKA), a candidate must complete a structured program

of 120 hours of classroom instruction, pass comprehensive examinations over the subject matter,

and have three years of experience in Kentucky property tax administration. An advanced

designation, Senior Kentucky Assessor (SKA), can be earned by successfully completing an

1 - 6

additional 90 hours of classroom instruction, passing comprehensive examinations over the

material, and acquiring an additional two years of experience in property tax administration (KRS

132.385).

A standard curriculum has been designed to meet the education requirements. A variety of

Kentucky property tax courses have been developed in-house and more are being designed. The

curriculum also includes courses offered by the International Association of Assessing Officers

(IAAO), which is the leading professional organization in the field of property tax assessment

administration. For a more detailed analysis of these courses as well as professional designation

requirements, please refer to the Education and Professional Designation Program Student Manual

published by the Office of Property Valuation, Local Officials Compliance Branch.

2 - 1

CHAPTER TWO

PROPERTY TAX DUTIES OF THE DEPARTMENT OF REVENUE

A. Introduction

The Department of Revenue is an agency of the executive branch of state government. Within

the Department, the Office of Property Valuation has three divisions charged with various

responsibilities regarding property tax assessment administration: the Local Support Division, the

State Valuation Division, and the Minerals Taxation and GIS Services Division. The statutory

authority of the Department of Revenue requires it to "exercise all administrative functions of the

state in relation to the state revenue and tax laws." (KRS 131.030). The Office of Property

Valuation is charged with administering the property tax assessment administration process

throughout the state, which includes monitoring and providing assistance to the state's 120

Property Valuation Administrators.

B. The Annual Conference on Assessment Administration

In order to provide a flexible program of continuing education and updates in the

administrative and appraisal process, the Department of Revenue is required by law to conduct an

annual conference on assessment administration (KRS 131.140). This conference, a tradition in

Kentucky property tax administration since 1918, is normally held in the fall for no more than five

days. All PVAs are required to attend the conference "unless prevented by illness or other reason

satisfactory to the commissioner" of the Department of Revenue. If the PVA takes part in all

2 - 2

sessions of the conference and submits itemized receipts for actual and necessary expenses related

to attending, the PVA will be reimbursed, with fifty percent (50%) of the expenses paid by the

respective county and fifty percent (50%) by the Department.

C. Monitoring Responsibilities of the Department of Revenue

The 1988 General Assembly enacted legislation which significantly increased the

responsibility and authority of the Department of Revenue in monitoring assessment quality and

equity throughout the state. In addition, the 1990 General Assembly amended KRS 132.370 to

grant the Commissioner of the Department of Revenue the authority to remove a PVA from office

for the following reasons:

1. Willful disobedience of any just or legal order of the department;

2. Misfeasance or malfeasance in office;

3. Willful neglect in the discharge of official duties, including intentional

underassessment or overassessment of properties and chronic underassessment of

properties.

"Chronic underassessment" is defined as a widespread pattern and practice of assessing

properties at levels substantially below fair market value and persisting for a period of two or more

years. Assessment/sales ratio studies, random sample appraisals, special audits, or other means

reasonably calculated to present an accurate determination of assessment practices in a county are

used to determine the presence or absence of chronically underassessed property. An

2 - 3

assessment/sales ratio level of below eighty percent for two consecutive calendar years indicates

the presence of chronic underassessment in a county, and automatically triggers a special audit by

the department (KRS 133.250).

If the commissioner determines that a PVA should be removed from office, the PVA must be

notified in writing. The notice shall state the specific reasons for removal and the PVA has the

right to a preremoval conference and an administrative hearing. The PVA has six (6) working

days from the date on which the notice is received to request a preremoval conference. The

conference shall be scheduled within seven (7) working days of the date on which the request is

received and the commissioner has five (5) working days after the conference in which to render

a decision. A PVA removed from office by the Commissioner of the Department of Revenue has

the right to appeal the action within 30 days after the entry of the final order from the

Commissioner. The appeal proceedings shall be held in a Circuit Court of a judicial circuit

adjacent to the county in which the PVA serves. PVAs who are unsuccessful in the appeal process

shall be ineligible to serve in the office at any future date and shall forfeit all certifications from

the Department of Revenue pertaining to the office of Property Valuation Administrator (KRS

132.370).

3 - 1

CHAPTER THREE

PROPERTY SUBJECT TO TAXATION

A. Introduction

The foundation for property taxation in Kentucky is the Constitution of Kentucky (Sections 3,

170, 171, and 172), which requires that all property be assessed for taxation at fair cash value.

Property assessed by the PVA is broken down into two basic types: real property and personal

property. Real property consists of the three general classes of farm, residential and

commercial/industrial property. Personal property is comprised of the categories of tangible and

intangible personal property. The legislature is authorized by the Constitution to divide property

into classes and to determine which classes of personal property are exempt from local taxes. All

real property is taxable for state purposes unless specifically exempted by the Constitution. All

assessments shall be equitable and the tax rates uniform within the same class of property.

B. Real Property Classification

For the purposes of assessment administration real property is divided into three primary sub-

classes: residential, farm, and commercial/industrial. Interests in real estate such as unmined

minerals (oil, gas, limestone and coal) and timber are also assessed as real property.

Residential property is comprised of small parcels (generally less than ten acres), usually

measured in square footage, linear front footage, or acreage. This property typically contains

3 - 2

residential improvements. However, vacant land intended or zoned for residential purposes is also

classified as residential property. Duplexes and single-family dwellings converted to multiple

family use are generally classified as residential. However, apartment buildings and complexes

(which are intended solely for income producing purposes) must be classified as commercial

property. Condominiums are considered to be residential property, since they are individually

owned and conveyed.

Commercial property is land with buildings constructed for business purposes, such as retail,

wholesale, or manufacturing. Vacant land intended for business purposes is also classified as

commercial. Commercial parcels may be relatively small, such as in the central business districts

of urban areas and measured by the square foot or linear front footage. However, large shopping

centers or industrial parks may cover many acres.

Industrial property is included with other commercial property for assessment administration

purposes. In general, industrial property can be described as land and/or buildings intended for

the use of manufacturing. Typically, fairly large tracts of land are needed for industrial purposes.

Most manufacturing improvements are designed and constructed specifically for a particular

manufacturing process.

Farm property is land used for the purpose of producing agricultural products such as corn,

tobacco, wheat, soybeans, fruit, vegetables, pork, beef, poultry, and livestock such as cattle or

horses. Timberland is also classified as farm property. In practice, any large (generally over 10

acres) parcel of land that is not specifically used for commercial or residential purposes is classified

3 - 3

as farm property. This does not mean, however, that all property classified as farm is eligible for

the agricultural deferment program (please refer to Chapter 5).

The real estate owner may sever and/or transfer the ownership of timber rights or subsurface

rights such as coal, oil, and gas to another person or corporation. These rights are assessed as real

property against the person or corporation to whom the rights are transferred. A lessee may be

liable for property tax on a leasehold interest if it has value. The separation of the ownership of

improvements from land is also recognized. Thus, the building owner and the owner of the land

may be assessed separately.

C. Personal Property Classification

Personal property is broken down into two sub-classes for appraisal purposes: tangible

personal property and intangible personal property.

In general, tangible personal property is physical property which is not real property, usually

movable, that has intrinsic value and utility. “Real property” is defined as all lands within this

state and improvements thereon (KRS 132.010 and KRS 136.010). In determining whether an

item is real property or tangible personal property, the following aspects must be considered: (1)

annexation - the manner in which the item is fixed or attached to the real estate, (2) adaptation -

whether the item adapted or applied to the use or purpose of the part of the realty to which it is

connected or annexed has been devoted, (3) intention of the party who attached the item (to leave

3 - 4

it permanently or to remove it at some future time, based on objective evidence observable by a

disinterested third party).

Generally items remain tangible personal property if they can be removed without serious

damage to the real estate or to the item itself. Machinery bolted to the floor to prevent movement

while in operation would remain personal property. However, if the machinery were built into the

building in such a manner that its removal would produce considerable damage to the building, it

would be part of the real estate.

Intangible personal property is property which represents evidence of value or the right to

value. Examples of intangible personal property include bonds, notes, mortgages, receivables,

copyrights and patents. Other than domestic life insurance capital, no intangible personal property

is subject to local property tax rates. KRS 132.208 exempts most intangible personal property with

the exception of property assessed under KRS 132.030 or KRS Chapter 136.

D. Property Subject to Preferential Rates

Kentucky utilizes the classified rate structure to distribute the property tax burden among

various types of property, and therefore taxpayers. While other states use mill rates, dollars per

thousand or a combination of rate schemes, property tax rates in this state are expressed in dollars

and cents per $100 of assessed property value. Most property tax rates are established locally and

vary from year to year. These rates are discussed further in Chapter 7.

3 - 5

While the Constitution stresses that all property must be assessed for taxation unless

specifically exempted, some classes of property require further explanation, having been virtually

exempted by statute through low tax rates. The General Assembly, for reasons related to economic

development, has reduced rates on some types of property to the level where it is not economically

feasible to collect the tax. Section 171 of the Constitution of Kentucky states in part, “The General

Assembly shall provide by law an annual tax, which, with other resources, shall be sufficient to

defray the estimated expenses of the Commonwealth for each fiscal year.” A tax rate of 1/10¢ per

$100, or an effective tax rate of .001 percent, will yield only one dollar in tax revenue per one

hundred thousand dollars of assessed value. Considering the cost of discovery, listing, valuation,

billing and collection, it is not feasible for the PVA office to initiate the assessment process for

any property where the final bill would be less than $5.00, which in the 1/10 ¢ per $100 rate class

would have an assessed value of under $500,000.

Farm machinery and livestock are taxed at the state rate of 1/10¢ per $100 of valuation and are

exempt from local property taxes (KRS 132.020). Fluidized bed energy facilities have also earned

the 1/10¢ per $100 rate in recognition of their environmental benefits (KRS 132.020). No special

effort should be made by the PVA to secure listings of any of these types of property. If a taxpayer

does file a return with only these items listed, the PVA should file or scan the return for reference,

but no tax bill should be generated unless the amount to be collected obviously exceeds the cost

of assessing the tax for this property.

An amendment to the Constitution passed by the voters in 1998 gave the General Assembly

the authority to exempt any class of personal property. This allowed the 2000 General Assembly

3 - 6

to pass legislation (HB 749) exempting personal property placed in a warehouse or distribution

center for subsequent shipment to an out of state location from state tax (KRS 132.097). This bill

also phased out local property tax rates (other than for special taxing districts) for this type of

property (KRS 132.099).

In 2005, the General Assembly exempted most intangible personal property with the passage

of HB 272, the tax modernization bill. (See Chapter 4).

4 - 1

CHAPTER FOUR

PROPERTY EXEMPT FROM TAXATION

A. Introduction

Sections 170 and 171 of the Kentucky Constitution identify several types of property that are

exempt from property taxation in Kentucky. These exemptions are administratively categorized

into the following classifications:

1. Federally owned property;

2. State owned property;

3. County owned property;

4. City owned property;

5. Property owned by a non-profit institution of education;

6. Personal property owned and real property owned and occupied by an

institution of religion;

7. Homestead and disability exemptions;

8. Cemeteries and property owned by purely public charities.

B. Procedures for Listing Exempt Property

Even though the above classes of property are exempt, the PVA must review and assess all

exempt real property every year in the same manner that taxable property is valued (KRS 132.220).

4 - 2

The exempt property is not added to the tax roll. However, the PVA shall maintain a listing of all

exempt property. Each property should be described completely, the location of the parcel should

be given, and a breakdown of value between land and improvements should be included. A copy

of this listing is then submitted to the Department by March 31, thirty days after the close of the

listing period. The Department submits each county's exempt list to the Governor's office and the

Legislative Research Commission by April 30 of each year for review.

C. Public Property Used for Public Purposes

The first four classes of exempt property listed in Subsection A are fairly easy to identify, and

include such property as courthouses, municipal buildings, and municipal water treatment plants.

If the property is publicly owned and used for public purposes, it is usually tax exempt. Some

projects that are financed through bond issues, such as airports, roads and industrial parks, are also

exempt. However, they can become taxable when the bond is retired and the property reverts to

private ownership. Furthermore, it is possible for a manufacturing facility to be partially taxable if

only a portion of it has been financed through an Industrial Revenue Bond. PVAs should check

with the Economic Development Cabinet regarding the status of Industrial Revenue Bonds (refer

to Subsection H for further information regarding leased publicly financed property).

4 - 3

D. Property Owned by a Non-Profit Institution of Education

Educational property includes the property of any non-profit institution located in Kentucky

where a systematic method of learning is taught. It does not include schools that teach dancing,

horse-back riding, gymnastics or other areas of special accomplishment. Income-producing

property of an educational institution is also exempt when the income is used solely for educational

purposes. For example, if an institution operates income-producing properties such as a laundry,

a printing department, or a craft shop, and the profit from these endeavors supports its education

programs, the properties are exempt.

E. Property Owned and Real Property Owned and Occupied by an Institution of Religion

Section 170 of the Constitution states that: ". . . real property owned and occupied by, and

personal property both tangible and intangible owned by, institutions of religion" are exempt from

property taxation. Clearly, the property tax exemption applies to all personal property owned by

a church, synagogue, mosque, or other organized religious institution. As such, all motor vehicles,

office equipment, furniture, and any other personal property held in the institution’s name are

exempt from taxation.

Tax exemptions granted to real property owned by an institution of religion are not as

straightforward. Real property must not only be owned but also be occupied by the institution in

order to qualify for the tax exemption.

4 - 4

The test for determining taxability of real estate owned by an institution of religion relies on

the actual use of the property. Is it being regularly used in a religious capacity? The following

properties would be considered both owned and occupied by a religious institution, and therefore

tax exempt:

1. Places of religious worship;

2. A minister-occupied parsonage, co-located on the same parcel as a place

of religious worship or a directly adjacent parcel;

3. Land and improvements used for summer camps attended by members;

4. Meeting halls and social centers used by its members;

5. Outdoor recreation areas held for use by its members;

A common example of property that needs to be on the tax roll is vacant land held for future

expansion on which no religious activities occur. This type of property cannot be considered to

be occupied by the institution of religion and must be taxed. Other examples of taxable church-

owned property include property that is leased to or used by another individual or business for a

non-religious purpose, residential housing held by a church but not used as a parsonage, and

acreage utilized as farmland.

It is inevitable that many situations will be encountered that will require an examination of all

the facts and circumstances involved. PVAs with questions should supply the Department with as

many details as possible surrounding the issue and the Department will issue a recommendation

regarding whether a property should be exempt.

4 - 5

F. Homestead/Disability Exemption

The Homestead exemption applies to any real property owned and maintained as the permanent

residence of a taxpayer who is sixty-five years of age or older. For property owned by a married

couple, the property may qualify for the exemption as long as either spouse is at least sixty-five

years old. Only one exemption is allowed per household, however, even if both spouses meet the

age requirement. Once an application has been filed and accepted, the application is good for

subsequent years as long as the original applicant owns and lives on the property. If the property

is sold, the new owner must apply for the exemption if eligible. In other words, the exemption is

tied to the owner, not to the property.

The Homestead exemption is also extended to anyone who is totally disabled under a program

authorized or administered by an agency of the United States Government or any retirement system

either within or without the Commonwealth of Kentucky. To qualify, the applicant must have

maintained the disability classification for the entirety of the particular taxation period, must have

received disability payments under this classification, and must submit verification documentation

before December 31. Most applicants qualifying for a homestead exemption due to their total

disability will only need to file an initial application. KRS 132.810 exempts “service-connected

totally disabled veterans of the United States Armed Forces” and individuals found disabled under

the applicable rules of the social security administration, the applicable rules of the Kentucky

Retirement System, or any other provision of the Kentucky Revised Statutes from the yearly filing

requirement. Therefore, after the initial application process has been completed for a totally

disabled person described above, it will not be necessary for that property owner to reapply for the

4 - 6

exemption in subsequent years. Only applicants who are classified as totally disabled by a state or

local agency outside of Kentucky must continue to apply annually with the PVA office to receive

the disability exemption.

Form 62A350 is used for both the age exemption and the disability exemption. These forms

must be kept on file in the PVA office. Approval does not exempt the entire value of the property

from taxation; only the amount approved by the Department of Revenue may be deducted from

the assessed value of the property. This amount is adjusted every two years, as required by law,

to account for changes in the purchasing power of the dollar. The exemption has increased from

$6,500 in 1972 to $46,350 for the 2023 and 2024 property tax assessment periods (KRS 132.810).

G. Other Constitutionally Exempt Property

The last classification of constitutionally exempt property includes such items as cemeteries

and all property owned by purely public charities. Cemeteries are exempt if they are not held for

private or corporate gain. However, it needs to be noted that this exemption applies only to the

real property. Any tangible property owned by a cemetery remains taxable.

Institutions that perform charitable work in Kentucky must be nonprofit in order to qualify for

the exemption. The work performed can be providing food and shelter to the needy poor; character

building, such as in Boy Scout and Girl Scout organizations; care giving as by nonprofit hospitals;

or even improving the natural environment. Some very worthwhile nonprofit organizations are

not tax exempt because, although they may undertake a few charitable activities throughout each

4 - 7

year, their principal activities are centered around promoting the interests and gratifying the wishes

of their own members. Determinations of eligibility for the purely public charity exemption are

often on a case-by-case basis, examining all of the pertinent facts and financial information made

available for review by the applicant to the PVA and/or the Department. In 2021, the General

Assembly passed House Bill 249, which defined a “veteran service organization” (KRS 132.310)

and allows them to qualify as an institution of purely public charity if over fifty (50) percent of

their income is spent on veterans and charitable causes (KRS 132.212). A PVA should seek

guidance from the Department when an application is received from a veteran service organization.

H. Leased Property

Any real or personal property owned by a tax-exempt entity, but leased to an individual or a

profit making business, is subject to the same tax rates on the leasehold interest in the property as

nonexempt property owners (KRS 132.193, 132.195). The taxes are to be assessed to the lessee

and collected in the same manner as regular tax bills except that past due taxes shall not become a

lien against the property.

An example of this situation occurs when a nonprofit hospital leases office space, medical

equipment, and parking facilities at less than market rent to a physician engaged in a profit-making

practice. The difference between the market rent and the actual rent is capitalized into an assessed

value which is taxable to the physician at the applicable tax rates on both the tangible and real

property.

4 - 8

All privately-owned leasehold interests in industrial buildings which are owned and financed

by a tax-exempt governmental unit qualify for the 1½¢ per $100 of value state rate (KRS 132.020)

and are exempt from local ad valorem taxes (KRS 132.200). However, if the tenant provides

private financing for the project, that portion of the total value of the leasehold interest represented

by private financing is not eligible for the 1½¢ state rate only. Instead, it would be taxed at full

state and local rates. If the debt on the structure has been retired, and the occupant is paying less

than market rent to the governmental unit, the leasehold interest created is fully taxable to the

lessee.

I. Application for Exemption

Revenue Form 62A023, Application for Exemption from Property Taxation, should be filled

out by any organization applying for the first time for exempt status. The application should be

returned to the PVA's office for approval. If the PVA is unsure if the organization qualifies, then

all the information submitted should be forwarded to the Department for review. The Department

will issue a written recommendation to the PVA addressing whether or not the organization

qualifies for an exemption. The PVA then sends an official ruling letter to the entity. Exempt

status has been established for a number of organizations. However, if an organization indicates

that it has been previously approved for an exemption, the PVA should verify that information

with the Department.

4 - 9

J. Personal Property Exempt by Statute

As was mentioned in the previous chapter, the legislature now has the authority to exempt any

type of personal property. House Bill 229, of the 1998 General Assembly, put the question to a

referendum (Amendment 2), which passed by more than a three to one majority on November 3,

1998. This Amendment, which also expanded the eligibility requirements for the disability

exemption, added the following sentence to Section 170 of the Constitution:

Notwithstanding the provisions of Sections 3, 172, and 174 of this Constitution to

the contrary, the General Assembly may provide by law an exemption for all or

any portion of the property tax for any class of personal property.

The General Assembly has been cautious in exercising this authority, primarily due to budget

concerns. Only two types of personal property have been exempted since 1998:

• KRS 132.097 exempts from state taxation personal property placed in a warehouse or

distribution center for the purpose of subsequent shipment to an out-of-state destination within

six months of its being placed. KRS 132.099 exempts the same personal property from county,

city, and school taxes, and taxation is optional for special taxing districts.

• KRS 132.208 exempts certain types of intangible personal property, primarily stocks and

mutual funds, in response to the St. Ledger v. Revenue Cabinet decision; In 2005, the General

Assembly amended KRS 132.208 to include “All intangible personal property except that

which is assessed under KRS 132.030 or KRS Chapter 136…”

4 - 10

Two other statutes which had been considered by many to be unconstitutional exemptions of

personal property are now clearly constitutional since the passage of Amendment 2 in 1998:

• KRS 132.190 (1) (a) exempts twenty-five domestic fowl to each family;

• KRS 290.635 exempts deposits in Kentucky credit unions.

No application process is necessary for personal property exempt by statute. It is not required

to be listed on a property tax return, since the listing statutes refer to “any tangible personal

property taxable in this state” (KRS 132.220).

For more detailed information about property tax exemptions, a “Property Exemption

Guidelines” manual and a “Guidelines for Administering the Homestead Exemption” manual have

been developed to assist PVAs in this area of property tax assessment administration. The manuals

are on the PVA network: https://revenue.ky.gov/pvanetwork/pages/default.aspx

5 - 1

CHAPTER FIVE

PROPERTY TAX RELIEF PROGRAMS

A. Introduction

Several property tax relief programs have been approved in Kentucky and require special

consideration for appraisal and taxing purposes. Included in this area are agricultural value,

assessment moratoriums, foreign trade zones, tax increment financing, and brownfields.

B. Agricultural Value

The purpose of the agricultural value program is to stimulate the continuation of farming

operations and encourage the preservation of farmland in Kentucky by providing property tax

relief. The value of land used for farm production is assessed at a “use” value, which results in a

lower taxable dollar value per acre than the fair cash value for the same land. This program was

enacted through a constitutional referendum in 1969 to keep rising property assessments,

particularly in developing areas, from forcing farmers out of business and accelerating the land

conversion process.

The statutory definition of “agricultural land” stipulates that any tract of land, ten acres or

more, used for the production of agricultural products, including timber, qualifies for this

preferential treatment. Any tract of land five acres or more used for aquaculture is also defined as

agricultural. “Horticultural land” is defined as a tract of at least five acres commercially used for

5 - 2

the cultivation of orchard or the raising of fruits or nuts, vegetables, flowers, or ornamental plants.

(KRS 132.010).

Land occupied by improvements related to the income-producing nature of the farm, including

barns, silos, sheds, tenant houses, ponds, etc., is included under this acreage requirement.

However, land used for residential purposes, including the primary residence of the property

owner, lawns, drives, pools, etc., must be excluded from the calculation of qualifying agricultural

land. (KRS 132.450). A farm residence occupied by the farm owner must be assessed at its fair

cash value and is not eligible for an agricultural value. However, houses used by farm managers

or tenants actually working on the farm can be valued according to the contribution they make to

the agriculturally related income production.

In some cases, where a farm has little developmental potential, it may be found that the fair

cash value and the agricultural value of land are nearly the same. The difference is most

pronounced for farms located at the urban fringe. Each year both the fair cash value and the

agricultural value must be determined by the PVA for all property which qualifies for the

agricultural value program (KRS 132.450). These values are calculated based on standard

appraisal techniques, using the methodology established by the Office of Property Valuation,

which is the subject of Kentucky Property Tax Course Ninety, “Farm Real Property Appraisal”.

5 - 3

C. Assessment Moratorium Program

The assessment moratorium program was established in 1982 in order to provide incentives

for repairing, rehabilitating, restoring or stabilizing qualifying residential or commercial buildings

in Kentucky. Approval for the moratorium must come from the local governing bodies of a county

or city. Certain guidelines and standards must be met before approval is granted (Ky. Const., Sec.

172, KRS 99.595-600, 132.010, 132.190, 132.452).

The PVA should maintain two values on property that has been approved for an assessment

moratorium: a “frozen” value and a “current” value. The value of the property as of January 1 of

the year in which the moratorium is granted as well as the value of the property on January 1 of

each year of the moratorium period must be assessed. The logic behind this dual assessment lies

in the fact that the property tax break applies only to those counties and cities that have adopted

the program.

Local tax rates for participating governments are applied to the original value under

moratorium, and the state rate, school rate, and non-participating local rates are applied to the

market value of the property as the improvements are made. A home may be on the tax roll at

$25,000 one year (value before any improvements); at $50,000 the next year (improvements made

in that year); and at $100,000 the following year (value after the restoration project is completed).

The state rate and local rates for non-participating governments are applied to the increasing values

and the local rates for participating governments continue to be applied to the original value of

5 - 4

$25,000. The assessment moratorium is limited to a five-year period for individual properties,

with the possibility of a subsequent reapplication within three years of the original moratorium.

D. Foreign Trade Zones

Foreign trade zones are established for the purpose of stimulating economic activity under the

federal Foreign Trade Zones Act (see 19 C.F.R. §18). Within a foreign trade zone, tangible

personal property is nearly exempt, being subject to the 1/10¢ per $100 state rate and no local

rates. However, the foreign trade zone must be activated (19 C.F.R. §146.6 (e)). Until it is

activated in accordance with the governing federal regulations, the property does not qualify for

the preferential rate. Currently foreign trade zones are located in Jefferson County and Northern

Kentucky, however each of these zones have subzones which are located throughout the state.

E. Tax Increment Financing

The 2000 and 2001 General Assemblies passed several bills for the purpose of enabling an

economic development incentive known as tax increment financing (TIF). This concept is based

on the use of “tax increments”, or the difference between current revenues and future revenues to

be derived from revitalized areas. Under TIF, an urban renewal/community development agency

enters into a contract with the state and/or local taxing districts (the current TIF structure

specifically excludes school districts) to release to the agency the tax increments, which must be

used solely within the development area.

5 - 5

TIF, being based on revenues, does not enter into the assessment process except as the basis

for an increase in the increment, particularly in a situation where property tax rates are declining

under the House Bill 44 process. Therefore, property located within the boundaries of a TIF zone

must be assessed at the current year market value.

F. Brownfields

KRS 132.020(1)(f)2 provides that the ad valorem tax rate for real property where the owner

has corrected the effect of all known releases of hazardous substances, pollutants, contaminants,

petroleum, or petroleum products located on the property consistent with a corrective action plan

approved by the Energy and Environment Cabinet shall be 1.5¢ per $100 of value (state rate only)

for a period of three years following the Energy and Environment Cabinet's issuance of a No

Further Action Letter or its equivalent. After the third tax year the regular state tax rate for real

property applies to the property.

6 - 1

CHAPTER SIX

THE KENTUCKY PROPERTY TAX CALENDAR

A. Introduction

The framework of the Kentucky Property Tax Calendar is established by the major statutory

deadlines of various components of the assessment cycle. These dates have been mandated by the

legislature in an attempt to establish uniformity of the cycle across the state, and ensure continuity

of services provided by taxing jurisdictions, as well as to promote the equitable and timely

assessment and collection of property taxes. All activities of the PVA are arranged to follow this

schedule.

The Property Tax Calendar is split along the lines of duties associated with real and personal

property assessment. After the common assessment date of January 1, real property duties follow

a schedule which allows maximum individual and public input into the assessment process.

Personal property duties, administered through a centralized computer system, follow a schedule

which is more closely related to data management and income tax return preparation. The Property

Tax Calendar is reunified at the point of tax roll certification, from which the rate setting, billing

and collection processes commence for all classes of property.

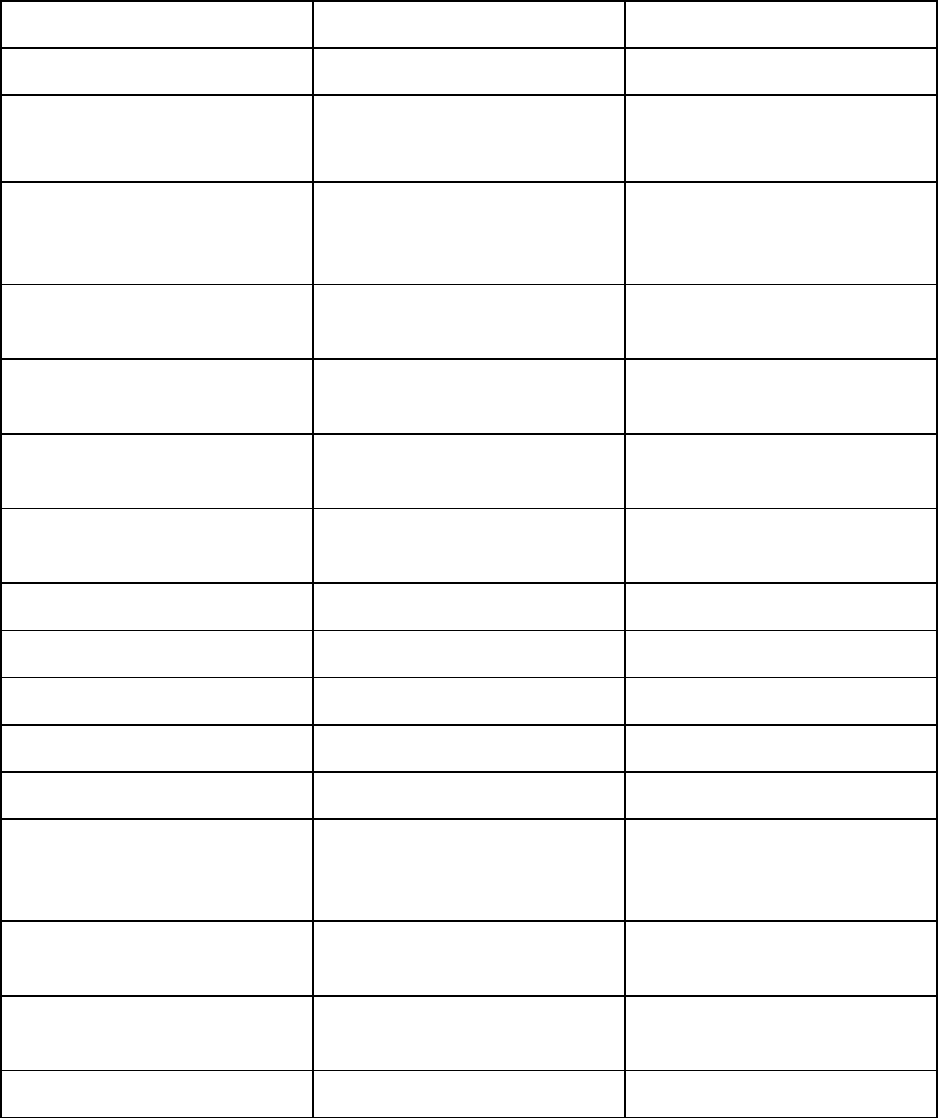

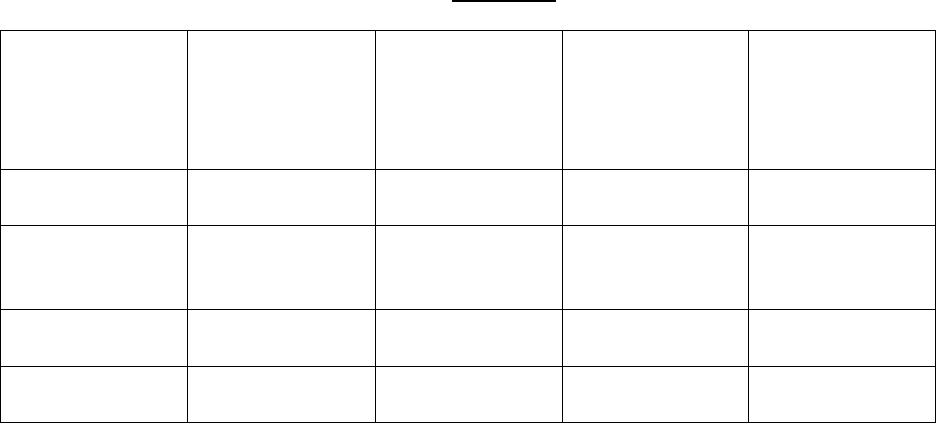

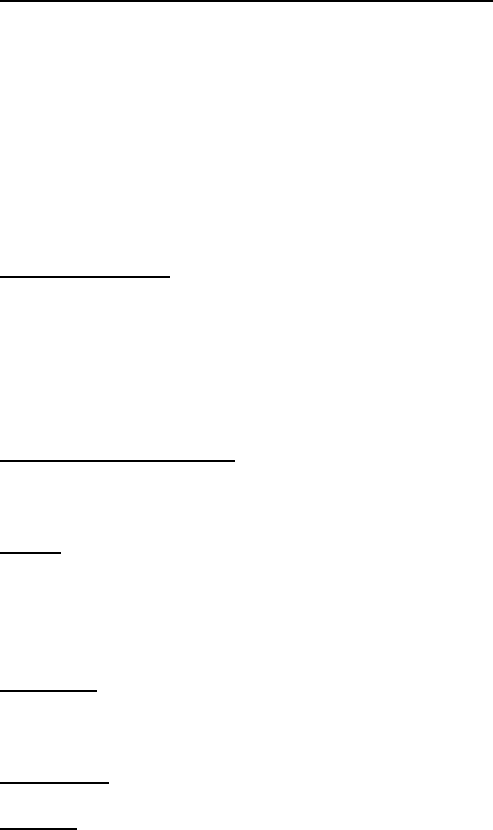

A diagram of the property tax calendar is presented on the following page.

6 - 2

KENTUCKY PROPERTY TAX CALENDAR

REAL PROPERTY PERSONAL

PROPERTY

Assessment Date

January 1

January 1

Listing Period

January 1 - March 1

January 1 - May 15

First Recap to Department of

Revenue

First Monday in April

Public Inspection of Tax

Roll/PVA Conferences

13 Days Beginning First

Monday in May (6 days per

week, including Saturday)

Final Recap to Department of

Revenue

No Later Than 6 Work Days

After the Close of Inspection

Department of Revenue

Certification

Upon Completion of Action

by Department

Upon Completion of Action

by Department

Board of Assessment

Appeals

5 Days Beginning 25 to 35

Days After Inspection

Delivery of Assessment/Sales

Ratio Study to PVA

Sept. 1 or Within 30 Days

After Final Recap

Tax Bills Delivered to Sheriff

By September 15

By September 15

Pay With Discount

By November 1

By November 1

Pay Without Discount

November 2 - December 31

November 2 - December 31

Tax Bills Delinquent

January 1

January 1

Pay With 5 Percent Penalty

January 1 - January 31

January 1 - January 31

Pay With 10 Percent Penalty

and 10 Percent Sheriff’s Add-

on Fee

After January 31

After January 31

Tax Bills Transferred to

County Clerks

April 15 - Sheriff collects tax

through close of business

April 15 - Sheriff collects tax

through close of business

County Clerk’s Sale of

Certificates of Delinquency

July 14 through August 28*

Sheriff’s Settlement

September 1

*Counties with delinquent unmined mineral or oil and gas tax bills have an additional 60-day time period to schedule their tax sale

6 - 3

B. Assessment Date

The assessment date for most property, both real and personal, is January 1 (KRS 132.220).

Some centrally assessed properties have an assessment date one day earlier (December 31 of the

year prior to the tax year) in order to coordinate information with the income tax filing process.

(KRS 136.120). The value of the property is established as of the assessment date for the entire

assessment and collection cycle, and the owner of record as of January 1 is liable for the taxes

regardless of whether the property has been sold, transferred, destroyed or otherwise disposed of.

C. Listing Period

The listing period for real property is from January 1 through March 1 (KRS 132.220), other

than minerals (KRS 132.820) and centrally assessed properties (KRS 136.130). During this period,

taxpayers may declare the value of all land and improvements in person or by mail, with the PVA.

A property which was purchased in the preceding year and for which a value was stated in the

deed according to the provisions of KRS 382.135 may be considered by the owner to be listed for

the current year if no changes that could potentially affect the assessed value have been made to

the property. KRS 132.220(2). Any deed value that is used must be based on an arm’s length

transaction.

Once real property is on the tax roll, the owner is not required to list it again in the following

years, unless changes have occurred which could potentially affect the assessed value of the

6 - 4

property. However, it is the responsibility of the PVA to adjust the value of the property when

necessary due to changes in the market.

Tangible personal property (exclusive of motor vehicles) and property of public service

companies listed under KRS 136.120 is listed from January 1 through May 15. This deadline

recognizes the need to integrate personal property assessment with the income tax schedule, since

most tax preparers are handling the same documents related to both taxes. The tangible property

tax form (62A500) is available on the Department of Revenue website: https://revenue.ky.gov/Get-

Help/Pages/Forms.aspx

It is the responsibility of the owner to annually list all personal property for assessment

purposes. No data regarding personal property may be entered into the centralized assessment

system without a corresponding return filed by the taxpayer.

Construction in progress (“CIP”) should be reported as a partial assessment based on the cost

of construction completed as of January 1. The PVA must be aware of ongoing construction in

the county because property owners may unknowingly fail to report incomplete improvements for

taxation. This may be accomplished through a review of building permits or a field review.

Every person renting space to mobile homes is required to annually report the names and

residences of mobile home owners to the PVA, as well as a description of the property on forms

prescribed by the Department of Revenue. (KRS 132.260.)

6 - 5

For counties containing a city of the first class or consolidated local government, utility

providers are required to report new customers to the PVA on a weekly basis (KRS 132.275). If

real property which is not on the tax roll is discovered through any means by the PVA, the PVA

must list such property, assess it, initiate the current year billing cycle and pass the information on

to the County Clerk for billing as omitted property for up to five prior years. (KRS 132.290, KRS

132.310, and KRS 132.230). Omitted personal property is located and assessed by the State

Valuation Division of the Office of Property Valuation. (KRS 132.320 and KRS 132.360).

D. Estimate Submitted to the County Judge/Executive

An estimate of net assessment growth must be submitted by the PVA to the County

Judge/Executive by April 1 (KRS 133.040). This estimate enables the County Judge/Executive to

tentatively figure the tax base for the purpose of projecting property tax revenue. Once this is

done, the County Judge/Executive can begin planning the budget for the upcoming year.

E. Notification of Taxpayers

The PVA is continuously in the process of updating property values. If any property is assessed

at a higher value than the previous year or at a higher value than that listed by the taxpayer, or if

previously unlisted property is assessed, the PVA must give a notice of assessment increase to the

taxpayer (KRS 132.450).

6 - 6

It is appropriate, if the PVA so chooses, to annually inform real property owners of the assessed

value of their property. The most efficient procedure is to notify every property owner by mail.

A simple postcard, preferably computer-generated, is all that is necessary. If a mailing is used, the

information should be given even if the assessment has not changed from the previous year.

Notification by mail is more economical than using the office staff to assist the public in the

inspection of the assessment roll, and it can be a good opportunity to verify or collect current or

updated property characteristic information.

F. Preparation of the Tax Roll and PVA Recapitulation

March 1 is the closing date for the listing and assessing period for real property. Under KRS

133.040, the PVA is required to complete the tax roll for all real property in the county before the

first Monday in April.

The PVA's recap (Revenue Form 62A304) is used to report the grand total assessments for

residential, farm and commercial properties. Unmined mineral property is assessed by the

Minerals Taxation and GIS Services Division (KRS 132.820), and the totals are submitted to the

Local Support Division during the certification process.

The Department then computes the preliminary levels of assessment in each category of real

property to determine if the assessed values appear to meet the established fair cash value

standards. The coefficient of dispersion (COD), a measure of assessment equity discussed later in

this manual, will also be reviewed to ensure that it is in compliance with the Department’s

6 - 7

guidelines. If the level of assessment and the COD are acceptable, the Department issues an

approval letter, after which the PVA may begin preparing for the final recap. If they are not

acceptable, the Department directs the PVA to reexamine the assessments and take corrective

action. Various options are available should the assessment quality fail to meet the Department’s

standards (KRS 133.040, KRS 133.150, and KRS 132.660).

G. The Inspection Period

Beginning on the first Monday in May and for thirteen days following, the law requires the tax

roll be open to public inspection so that property owners may review the current assessment placed

on their property (KRS 133.045). However, a reasonable extension of time or a time other than

that provided by the statutes may be granted by the Department of Revenue if the PVA submits a

written request for the change and the change is determined to be necessary. The inspection period

cannot be held before the first Monday in May. If the PVA is advised by the Department that the

assessment level does not meet the legal requirement of fair cash value, the inspection period will

be scheduled for a later date.

H. Notice of the Inspection Period

The PVA is required to give notice of the inspection period in the newspaper with the largest

circulation in the county. This notice must state that the real property tax roll is open for public

inspection, give the dates and time the public can review the tax roll, state that a taxpayer desiring

to appeal an assessment must first request a conference to be held with the PVA prior to or during

6 - 8

the inspection period, and include information on how to file an appeal if a taxpayer who has had

a conference with the PVA disagrees with the assessment made by the PVA. The Fiscal Court is

required to supply the funds to cover the cost of this advertisement. A notice of the inspection

period should also be posted at the courthouse door at least seven days before the inspection period

is to begin. If the Department authorizes a change in dates, the same requirements apply for

notifying the public of the revised inspection period (KRS 133.045).

I. Board of Assessment Appeals

Once the inspection period has drawn to a close, the Board of Assessment Appeals, a locally

appointed three member tribunal, convenes in each county to hear any appeals taxpayers may bring

against the assessments placed on their property (KRS 133.020). The board also has the

responsibility to review the assessments of the PVA's own property, as well as that of the deputy

PVAs (KRS 132.470). Members of the board must take an oath administered by the County

Judge/Executive to “fix at fair cash value all property assessments” under appeal (KRS 133.020).

On matters involving exempt property issues, the board must “obtain and follow the advice from

the Department of Revenue relative to the taxability of such property” (KRS 133.123). The

Department of Revenue is responsible for preparing and furnishing to each PVA guidelines and

materials for an orientation and training program to be conducted for the board by the PVA on the

first day that the board convenes (KRS 133.020, KRS 133.030).

The property tax calendar states that the local Board of Assessment Appeals shall convene no

earlier than twenty-five (25) nor later than thirty-five (35) days after the end of the tax roll

6 - 9

inspection period (KRS 132.460, 133.030). The board will continue to meet for no more than five

(5) days unless an extension has been granted by the Department of Revenue. If more than 100

appeals have been filed, additional panels of the local board may be appointed, with the approval

of the Department of Revenue. The PVA or an authorized deputy must be present at all hearings

held before the Board (KRS 133.020).

J. Board of Tax Appeals

Once the local board has heard the appeal, the taxpayer is notified of the decision through the

mailing of the "Notice to Property Owner of Final Ruling of Board of Assessment Appeals",

Revenue Form 62A354. The County Clerk is responsible for mailing this notice to the taxpayer.

The notice should be mailed within three days of the decision and should be sent by certified mail

(KRS 131.340(2)). Should a taxpayer or the PVA remain dissatisfied with an assessment after the

Local Board of Assessment Appeals has issued its ruling, an appeal may be made to the Kentucky

Board of Tax Appeals (KBTA). An individual property owner may represent himself or herself

before the KBTA, but a corporation, trust, estate, partnership, joint venture, limited liability