1

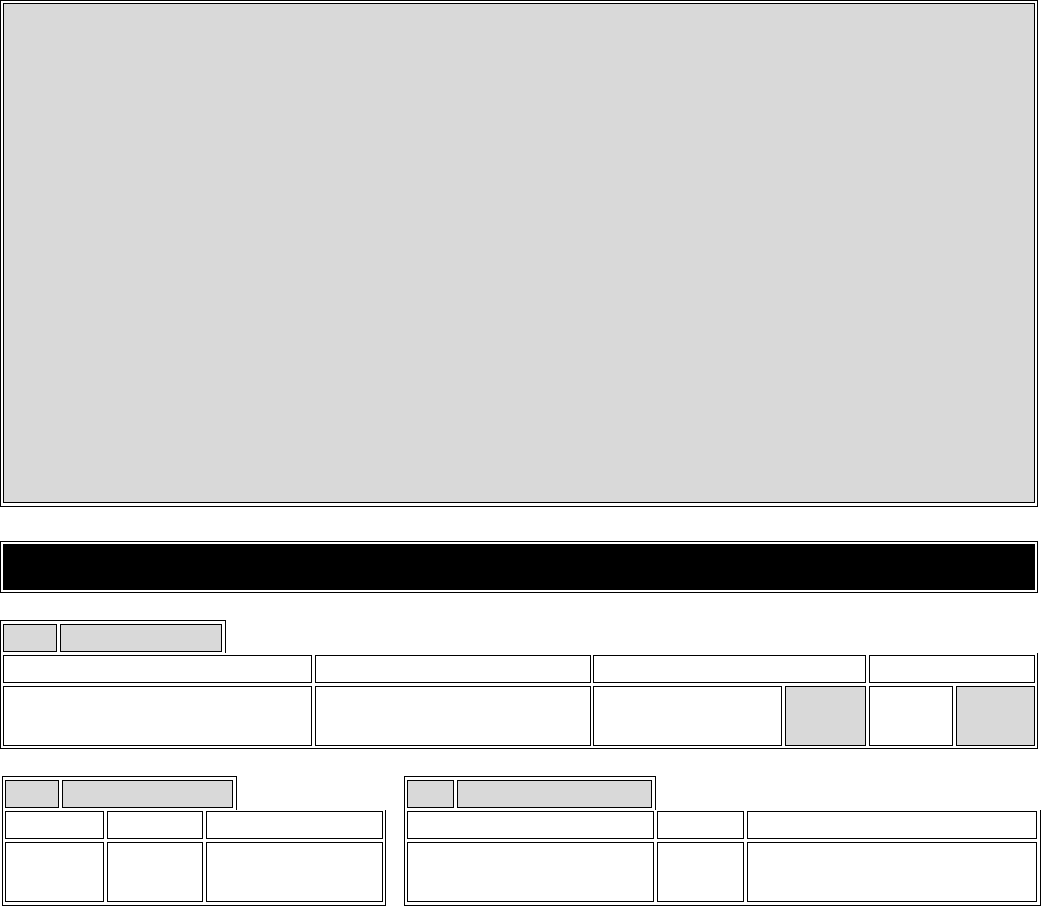

The City of New York

Department of Investigation

180 Maiden Lane, 16

th

Floor

New York, NY 10038

(212) 825-5911

Financial Background Investigation Questionnaire

You are required to complete this questionnaire (in addition to the Background Investigation Questionnaire

or Supplemental Background Investigation Questionnaire) only if your appointing entity has determined

that you meet the criteria for which it is permissible for the Department of Investigation (DOI) to review and

report your consumer credit history (pursuant to NYC Administrative Code §§ 8-102 and 8-107; 47 Rules

of the City of New York §§ 2-01 and 2-05).

Your Terms and Conditions of Appointment will not be approved unless you provide all information

requested and cooperate fully with this background investigation. If you fail to do so, you may incur

disciplinary action, including the termination of your employment or removal from your appointment.

Department o

f Investigation (DOI) background investigations are detailed and thorough; information you

provide will be verified during the investigation. A false statement or intentional omission made in this

questionnaire, or in connection with this background investigation, may result in the imposition of

disciplinary penalties, including but not limited to termination of employment or removal from appointment,

disqualification from future employment or appointment, and criminal prosecution.

Your complet

ed Financial Background Investigation Questionnaire is not a public document and cannot

be obtained through a Freedom of Information Act request. However, upon request your questionnaire

may be provided for use in another government agency’s background investigation, or for the purposes of

administrative action (e.g., internal investigations, disciplinary proceedings) by your agency, the City’s

Office of Administrative Trials and Hearings, the Conflicts of Interest Board, or others.

DOI recomm

ends that you make a photocopy of this completed questionnaire for your personal

records, and for reference in completing any future DOI Financial Background Investigation

Questionnaires.

I have read and I understand this information. Initial and date: ___________

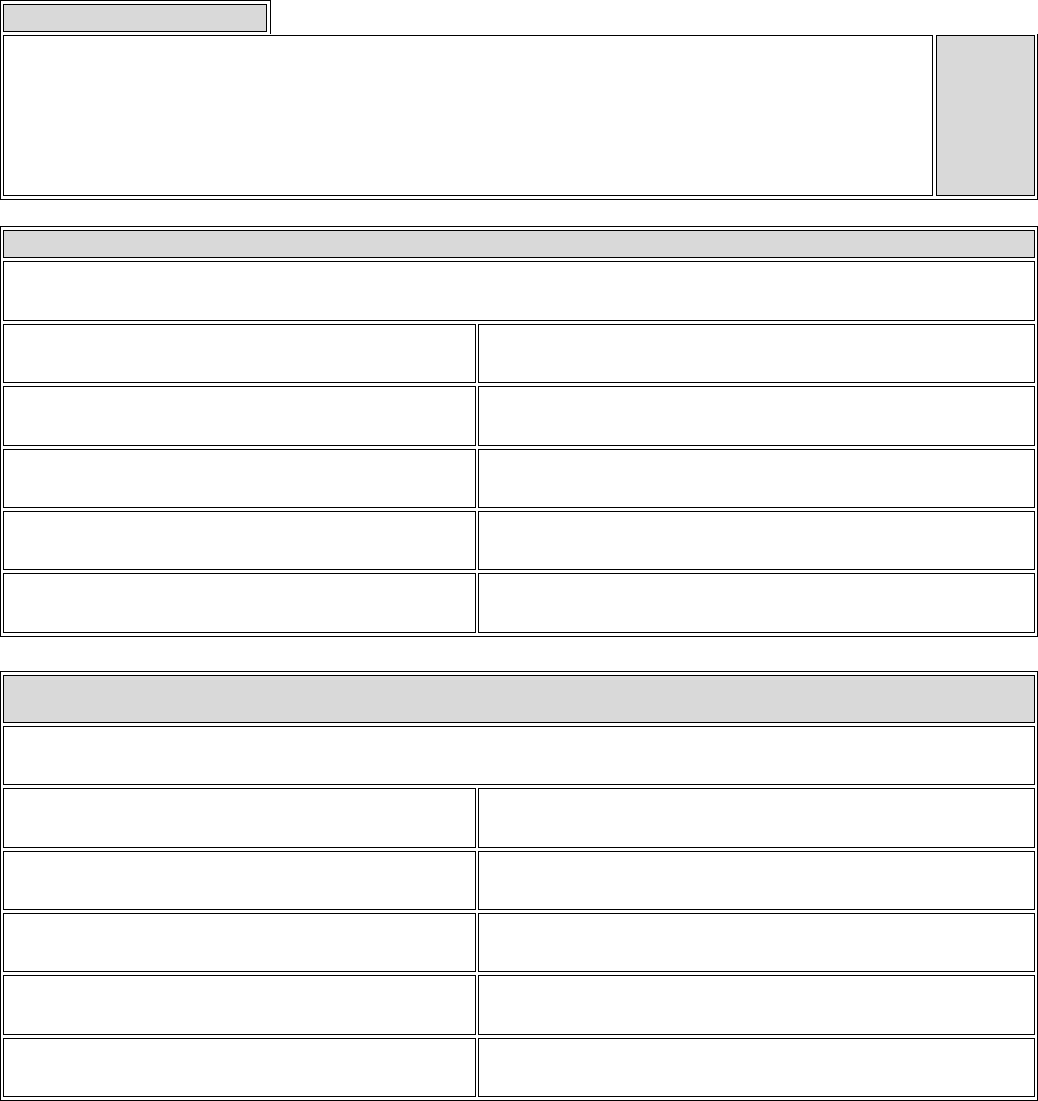

For DOI Use Only:

Candidate’s Name

____________________________

Phone Number

_________________

Investigator

____________________________

Interview Date

_________________

Supervisor

____________________________

Review Date

_________________

FBIQ (March 2020)

□ Check here if additional information is provided in the addendum. 2

DEPARTMENT OF INVESTIGATION

FINANCIAL BACKGROUND INVESTIGATION QUESTIONNAIRE

INSTRUCTIONS

This questionnaire must be typed, or completed in blue or black ink.

Every question must be answered completely and accurately.

Do not leave any question blank. Indicate “N/A” (not applicable) if a question does not apply

to you.

If you need more space to answer a question, use the addendum provided. Check the box at

the bottom of the page on which the question appears, and note in the addendum the question

and page number.

This questionnaire is an affidavit. Upon completion, it must be signed and sworn to before a

Notary Public or Commissioner of Deeds.

I have read and I understand these instructions. Initial and date: ____________________

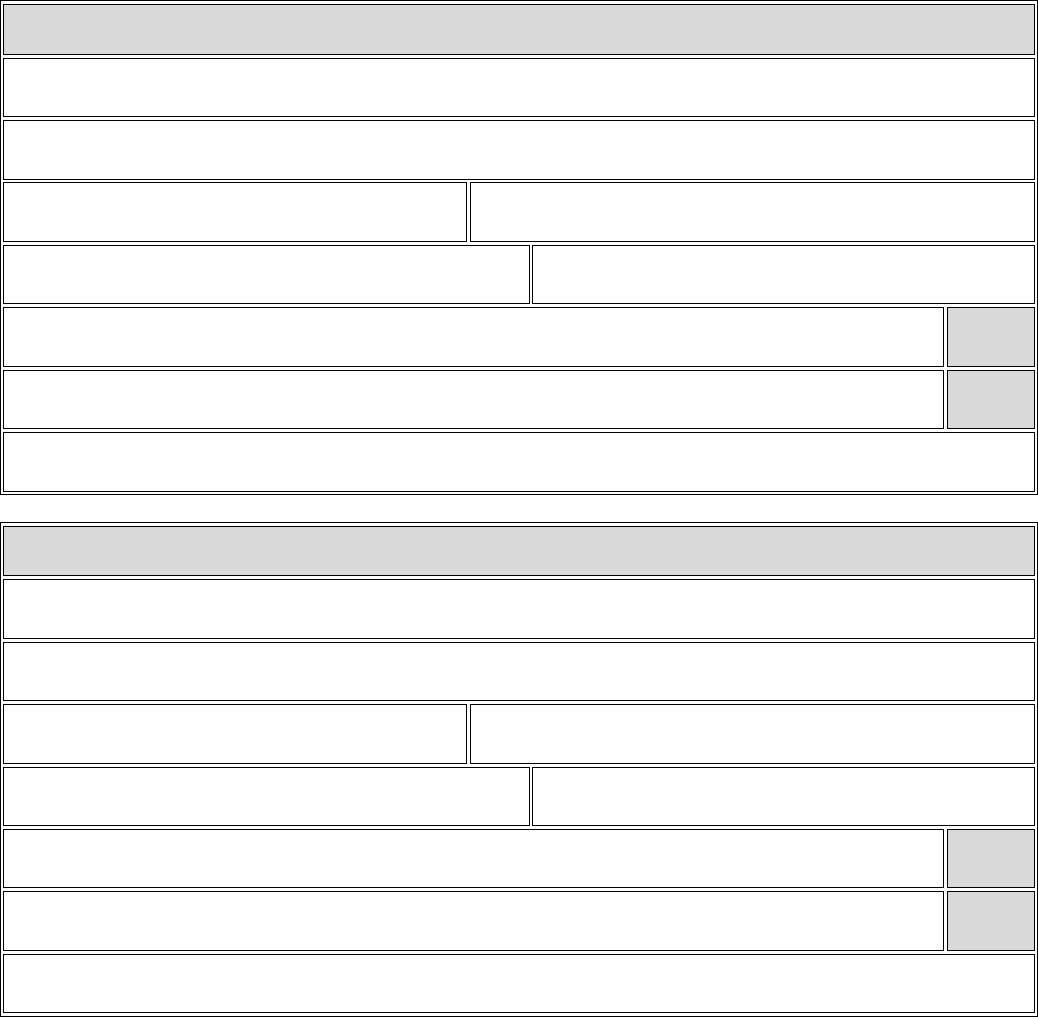

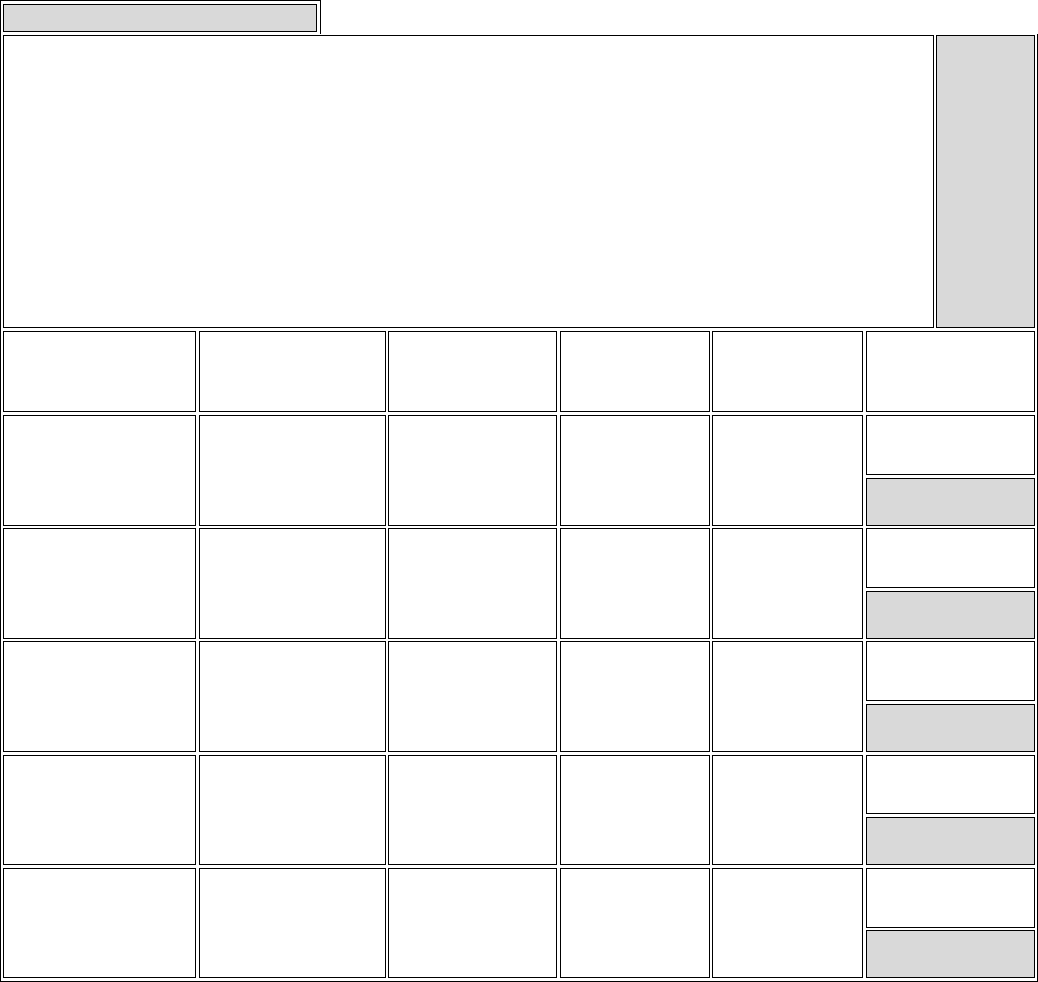

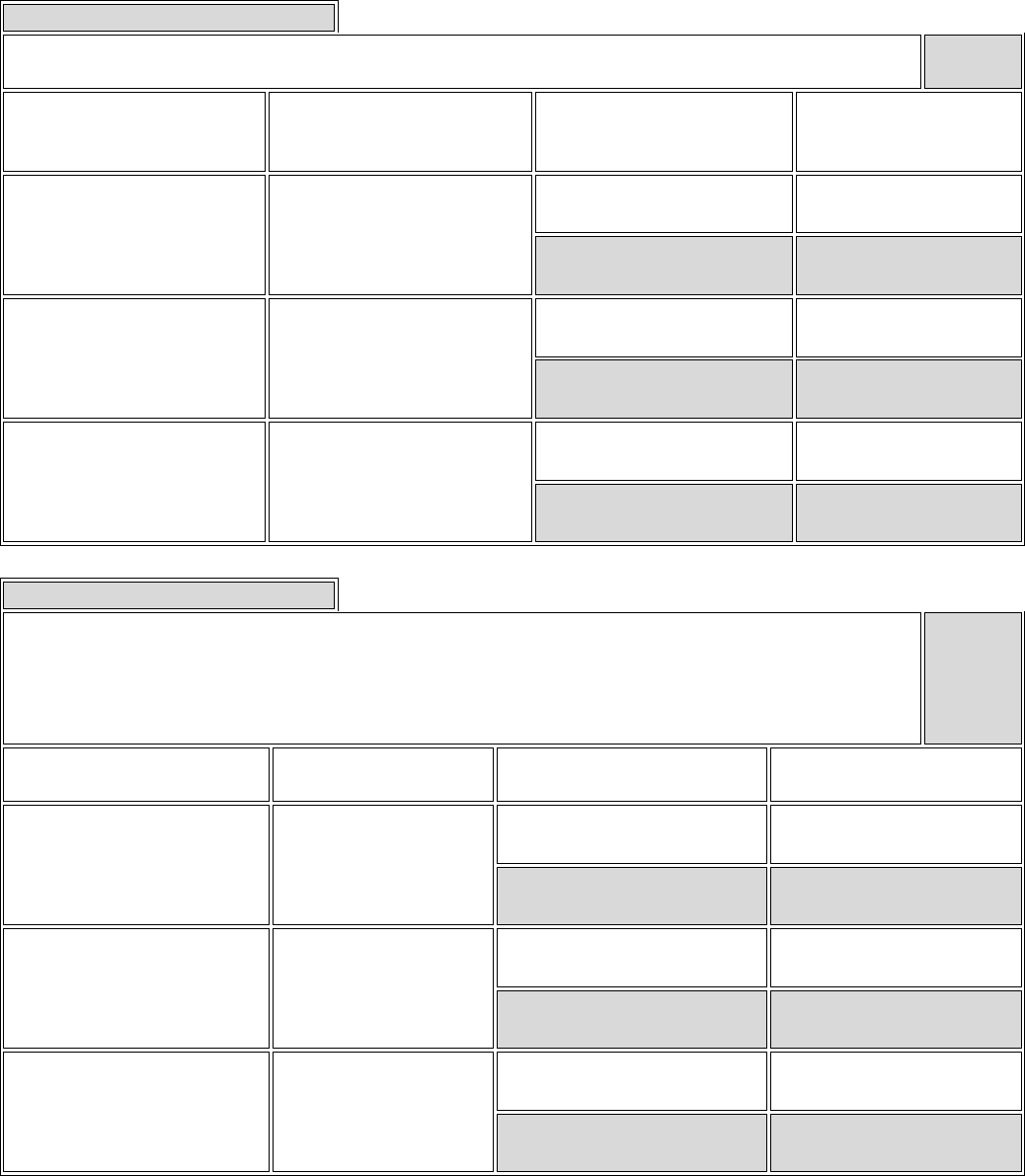

PERSONAL INFORMATION

1.

Full Name

Last Name

First Name

Middle Name

Jr., II, etc.

□ N/A □ N/A

2.

Date of Birth

Month

Day

Year

3.

Place of Birth

City

State

Country

□ Check here if additional information is provided in the addendum. 3

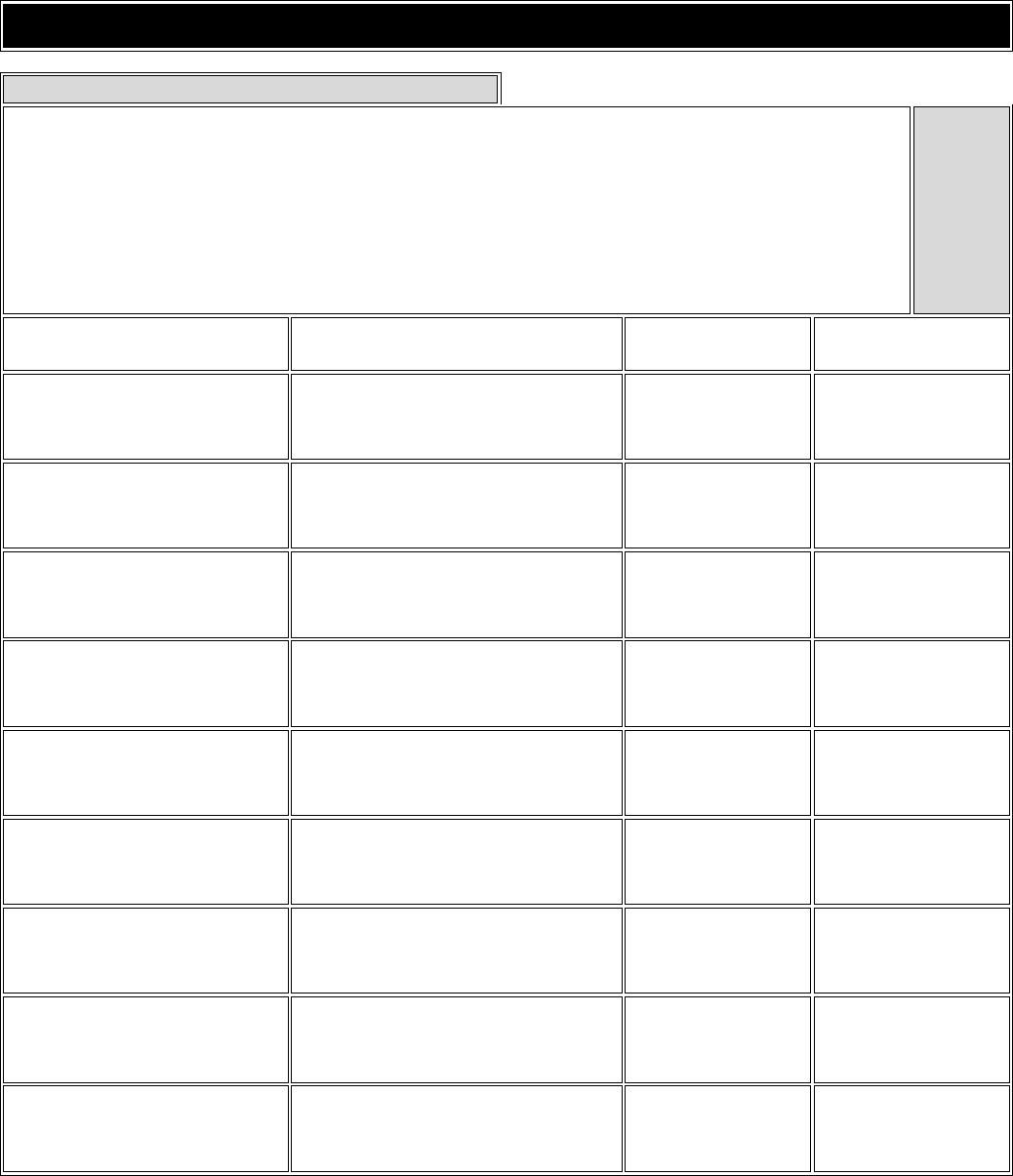

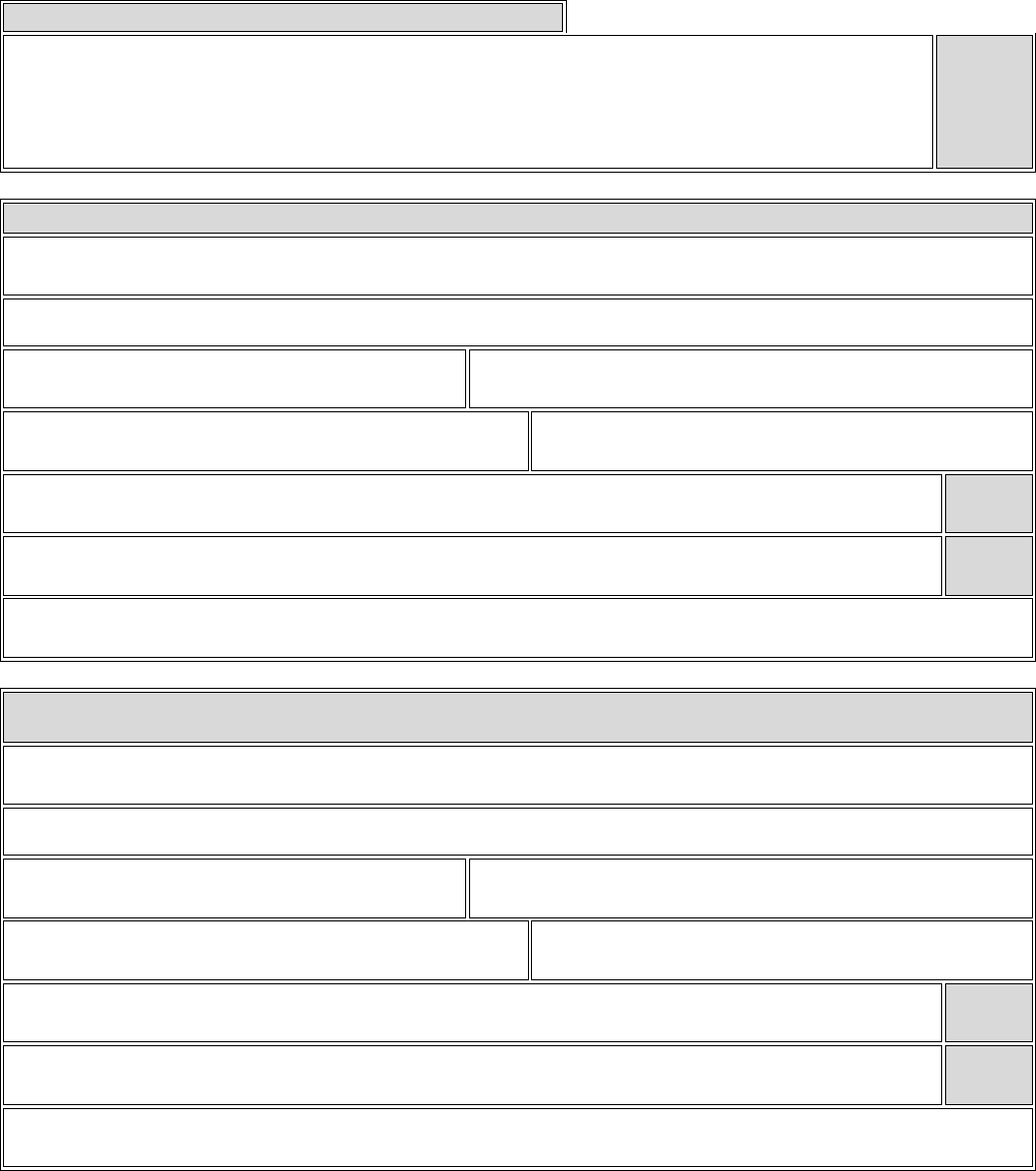

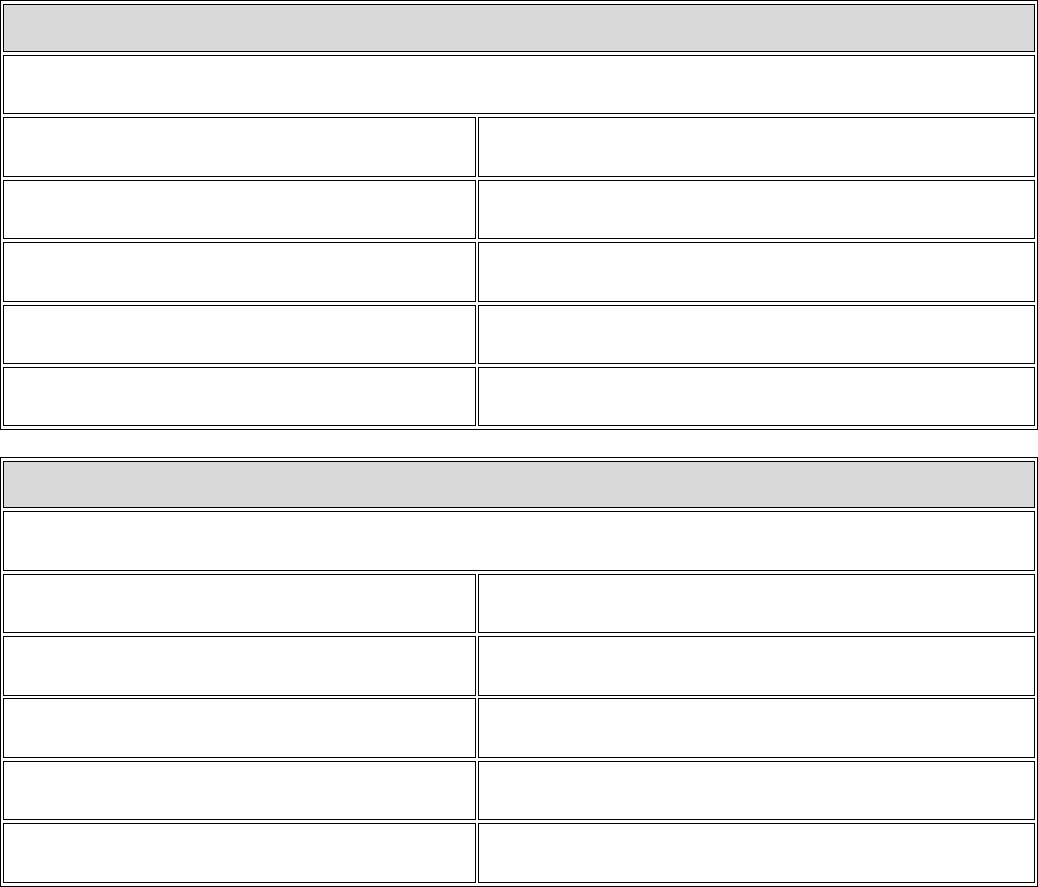

ASSETS

Bank, Brokerage, and Investment Accounts

4.

List all U.S. bank, brokerage, and investment accounts (including but not limited to

savings, checking, money market, mutual funds, cryptocurrency,

certificates of

deposit, and credit union accounts).

Include all accounts on which you or your spouse or domestic partner is named

as a primary, secondary, or joint account holder, or for which either of you is

an authorized signatory. If you have more than one account with an institution,

list each account separately.

□ N/A

Name of Financial

Institution

Name(s) of Account Holder(s) Account Type

Approximate

Current Balance

□ Check here if additional information is provided in the addendum. 4

.Retirement Accounts and Annuities

5.

List all U.S. retirement accounts (including but not limited to IRAs, deferred

compensation, Keoghs, pension, and 401(k) accounts), as well as annuities, owned

by you or your spouse or domestic partner.

□ N/A

Name of Institution Name(s) of Account Holder(s) Account Type

Approximate

Current Value

Bonds, Notes, and Bills

6.

Provide the total market value of all U.S. government-issued bonds, notes, and bills

(e.g., savings bonds, municipal bonds, treasury notes) held by you or your spouse or

domestic partner.

□ N/A

Total Approximate Market Value of Holdings:

□ Check here if additional information is provided in the addendum. 5

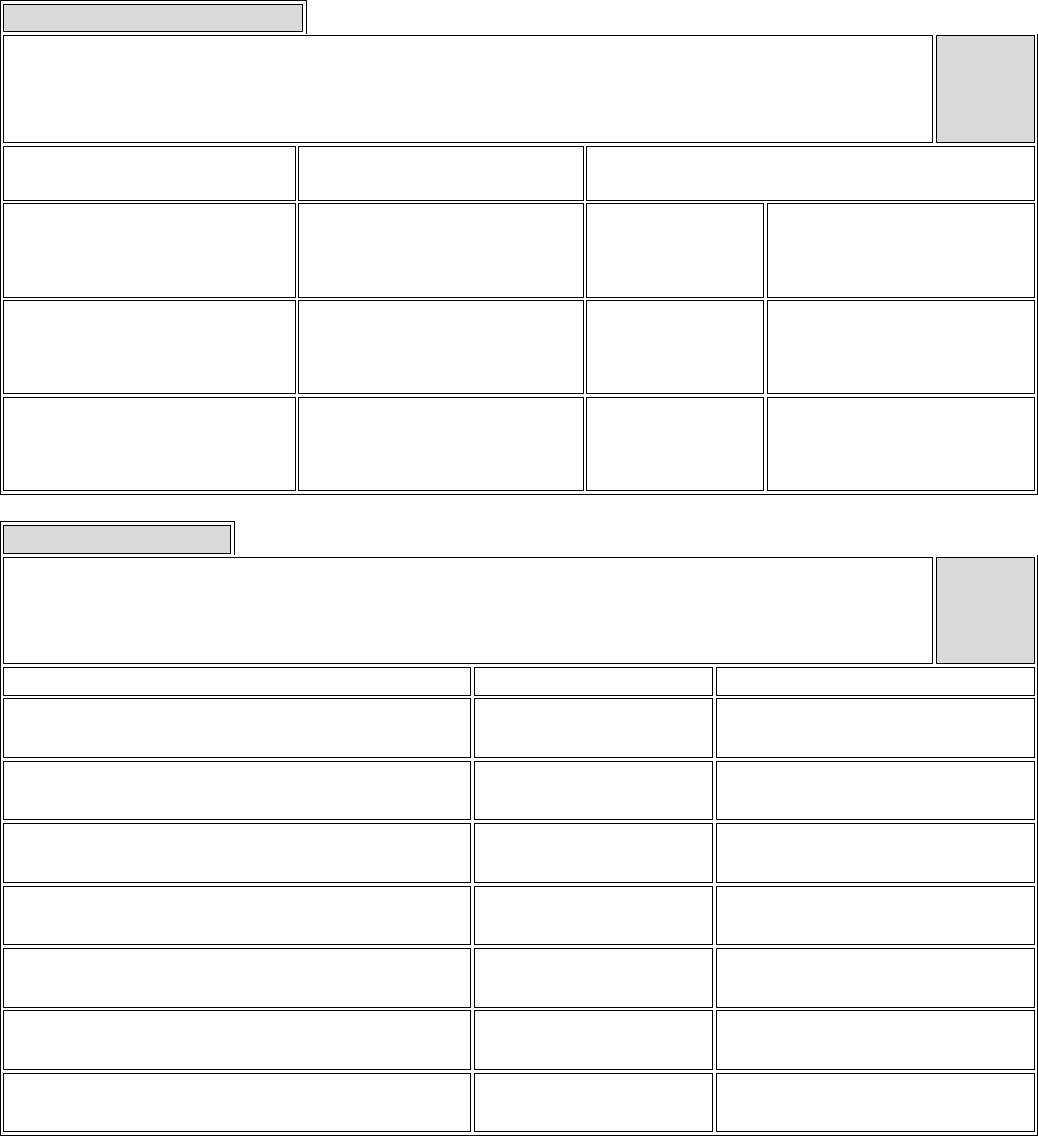

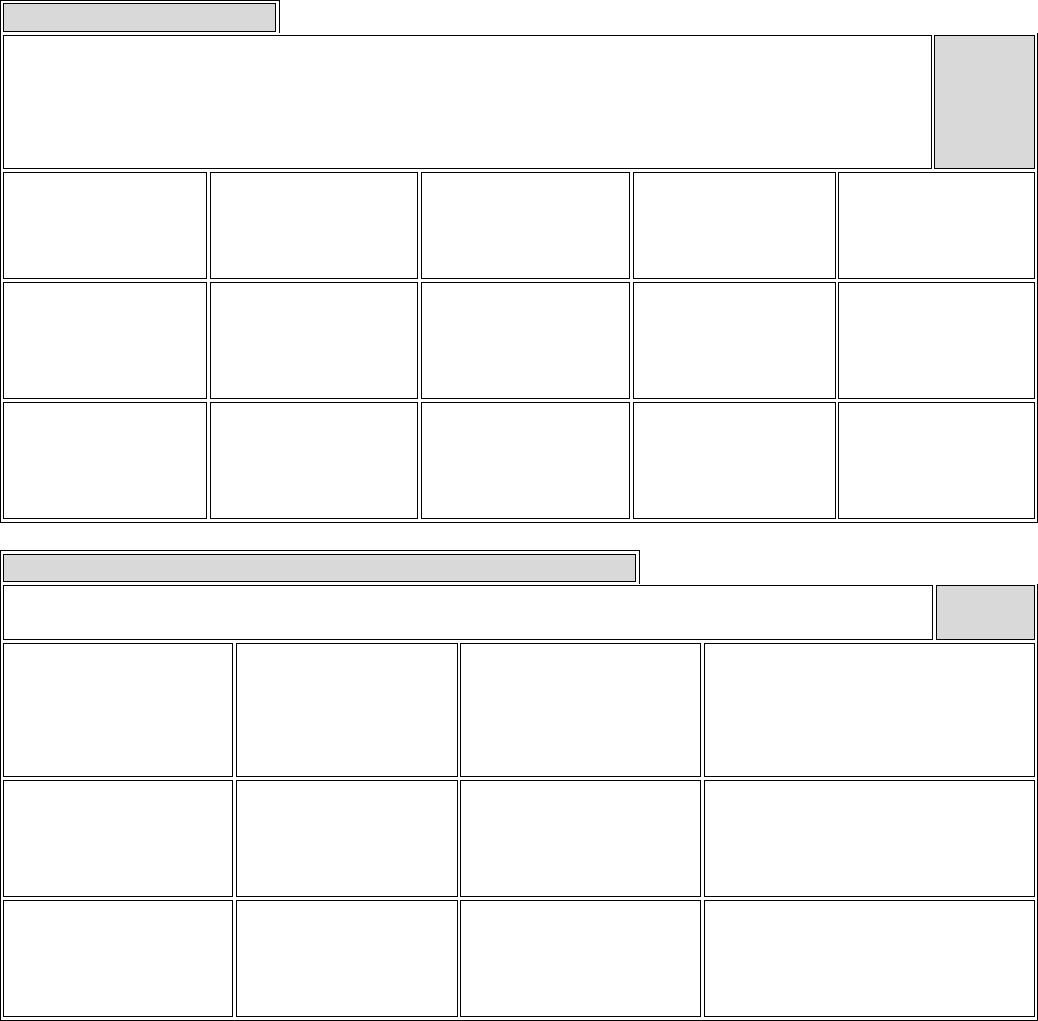

Stocks and Other Bonds

7.

List all U.S. stocks that are not held in a brokerage account, and all bonds that are

not government-issued, held by you or your spouse or domestic partner.

□

N/A

Name of

Institution/Issuer

Name(s) of Account

Holder(s)

Number of

Shares or

Face Value

of Bonds

Approximate

Current

Market Value

Dividend or

Interest Income

Earned Prior

Calendar Year

Foreign Financial Interests

8.

Provide details below if you or your spouse or domestic partner has direct control or

ownership of foreign financial businesses, foreign bank accounts, or other foreign

financial interests (including but not limited to stocks, annuities, retirement accounts,

government-issued bonds, notes, and bills, investments, or ownership of corporate

entities). Exclude U.S.-based funds or accounts managed through an employer.

□ N/A

Type of Foreign Financial Interest

Name(s) of Account Holder(s)

Value (U.S. Dollars)

□ Check here if additional information is provided in the addendum. 6

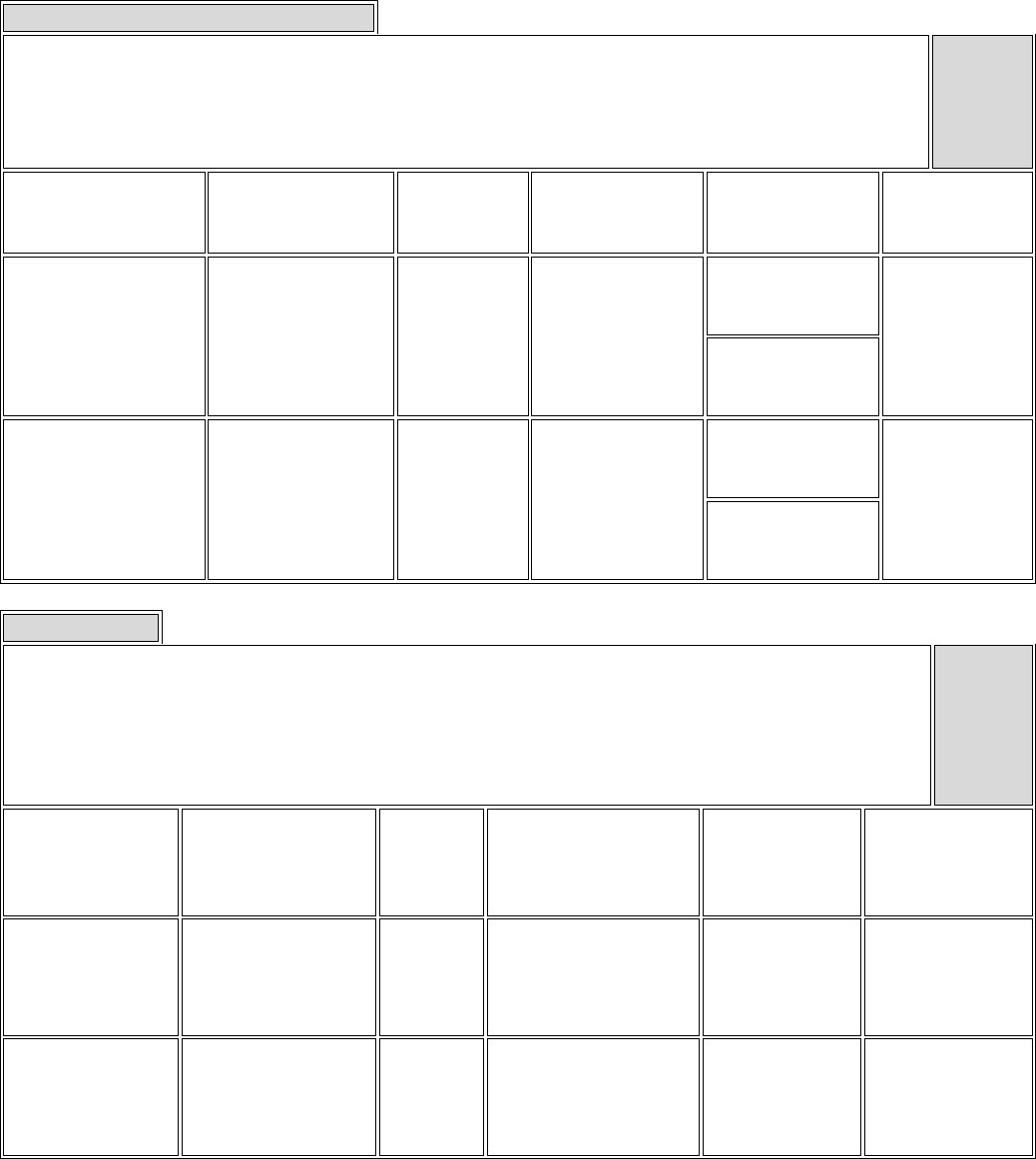

Foreign Financial Interests (Controlled by Someone Else)

9.

Provide details below if you or your spouse or domestic partner has a foreign interest

that someone else controls on your behalf (including but not limited to stocks,

annuities, retirement accounts, government-issued bonds, notes, and bills,

investments,or ownership of corporate entities). Exclude U.S.-based funds or

accounts managed through an employer.

□ N/A

Type of Foreign

Financial Interest

Name(s) of Account

Holder(s)

Name of Person

Who Controls the

Financial Interest

Your

Relationship to

Them

Value (U.S.

Dollars)

□ Check here if additional information is provided in the addendum. 7

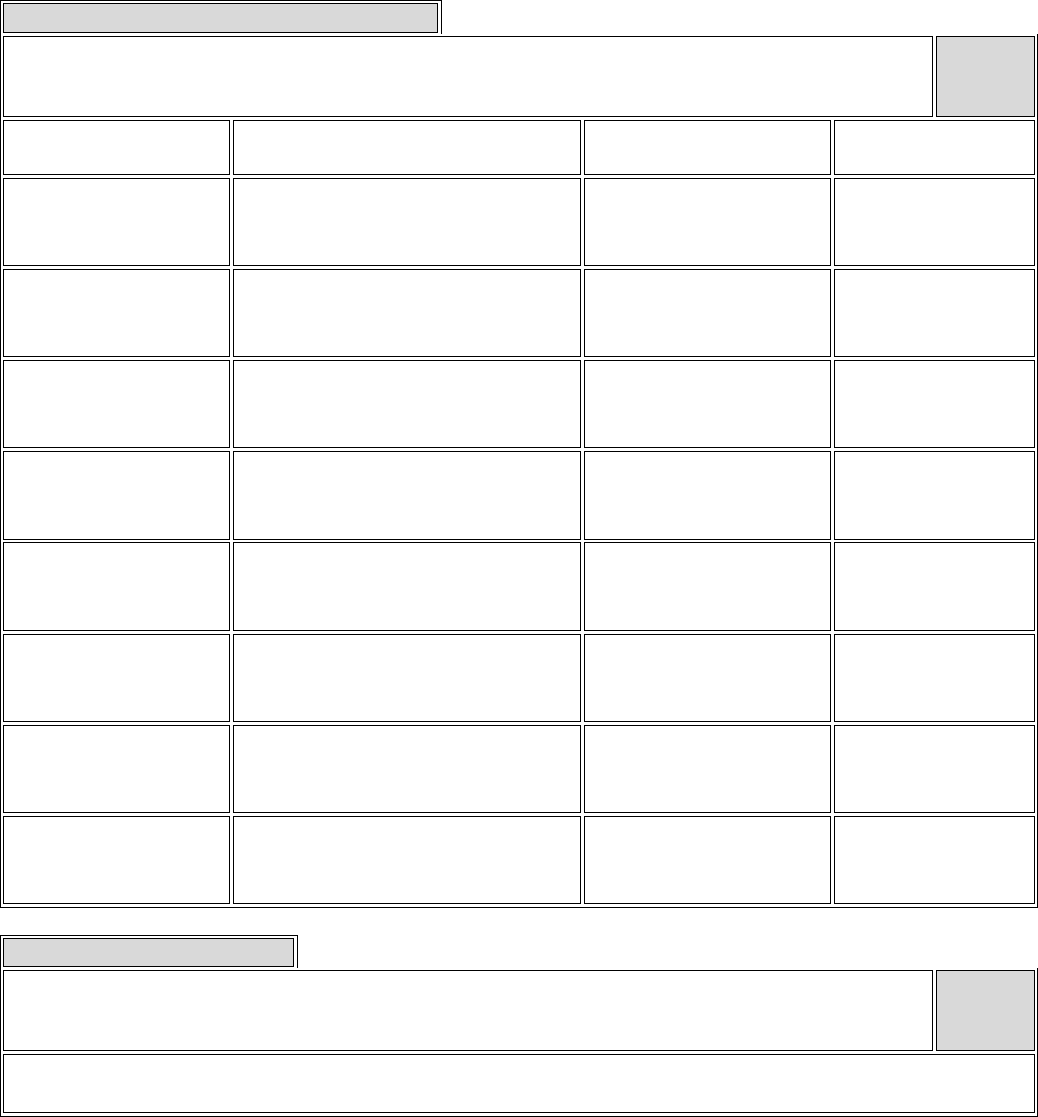

Money Owed to You or Your Spouse or Domestic Partner

10.

If you or your spouse or domestic partner is owed money (e.g., personal loans,

promissory notes), provide details below.

□

N/A

Debtor #1

Full name of debtor

Relationship to you

Home address

Date of loan (month/year)

Reason for loan

Original amount of loan

Repayment terms

Payment frequency:

Interest rate:

Date loan is due (month/year)

Approximate outstanding balance

Debtor #2 □ N/A

Full name of debtor

Relationship to you

Home address

Date of loan (month/year)

Reason for loan

Original amount of loan

Repayment terms

Payment frequency:

Interest rate:

Date loan is due (month/year)

Approximate outstanding balance

□ Check here if additional information is provided in the addendum. 8

Debtor Employment/Business with the City of New York

11.

Provide details below if a debtor listed in response to Question 10 is employed by

the City of New York (or any of its agencies) or does business with the City of

New York (or any of its agencies).

Doing business with the City includes

receiving funds from the City, having

contracts with the City, providing materials or services to the City, having matters

pending before the City, or holding any franchise, license, permit, or other privilege

from the City.

□ N/A

Debtor’s Full Name

Debtor’s City Agency

or Nature of Business with the City

Debtor’s Title/Position

Pension or Retirement Benefits

12.

If you are collecting a pension or retirement benefit, provide details below. Include

New York City retirement systems (e.g., NYCERS, TRS) and any government or

private retirement system or pension plan.

□ N/A

Name of Retirement or Pension Fund

Total Received Annually

Interests in Businesses, Firms, Entities, or Other Organizations

13.

List any interest, direct or indirect, which you or your spouse or domestic partner has

in a business, firm, partnership, entity, or other organization, other than through

ownership of publicly-traded stocks or bonds. Include all ownership interests,

whether or not income has been received from them.

□ N/A

Name of Entity Nature of Interest

Date

Acquired

(Month/Year)

Approximate

Current Market

Value of

Interest

Income Earned

Prior Calendar

Year

□ Check here if additional information is provided in the addendum. 9

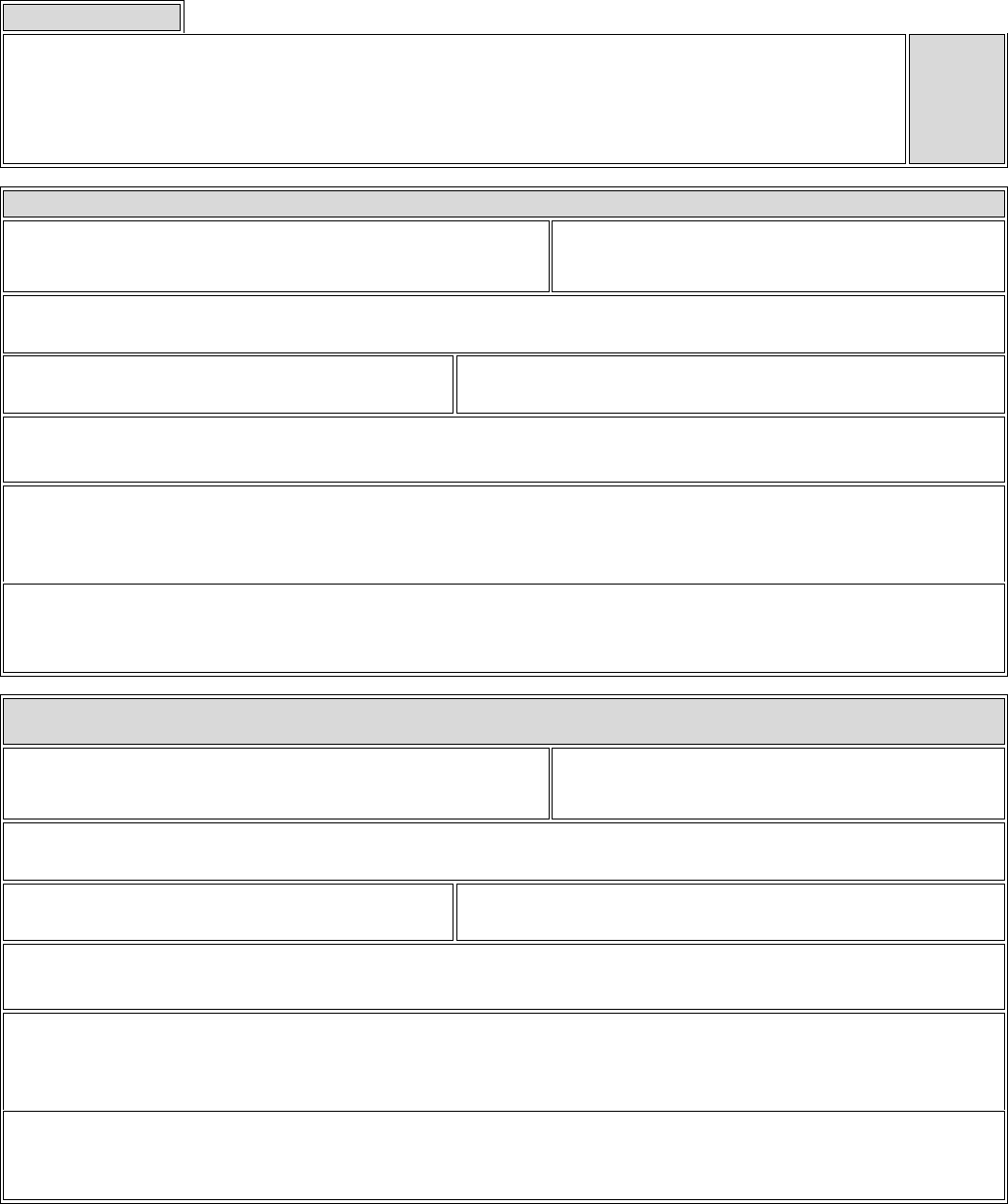

Ownership of Real Property in the United States

14.

List any residence, including your current primary residence, or item of real

estate located in the U.S., or in a U.S. territory or commonwealth, in which you or

your spouse or domestic partner has

an ownership interest, whether direct or

indirect. Include all real property (e.g., houses, condominiums,

shares in

cooperative apartments, commercial properties, investment properties).

□ N/A

U.S. Property #1

Property address

Type:

□

House

□

Condominium

□

Co-op Apartment

□

Other: ______________________

Date purchased (month/year)

Name of seller

Approximate acquisition cost

Approximate current value

Annual maintenance cost (e.g., for co-op or condo)

□

N/A

Total annual rental income received

□

N/A

Time spent there (e.g., three nights per week, weekends, holidays)

□ Check here if additional information is provided in the addendum. 10

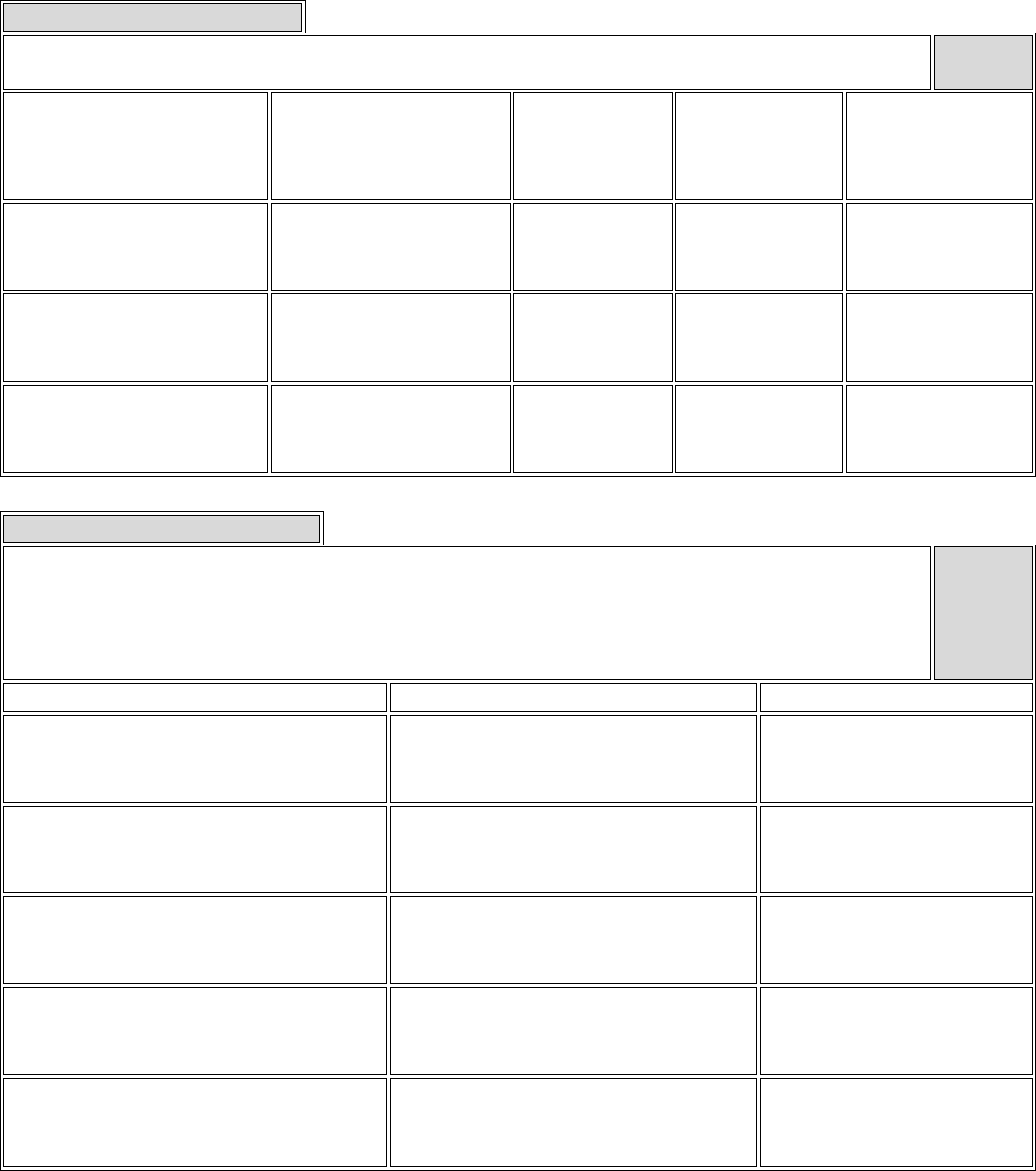

U.S. Property #2

□

N/A

Property address

Type: □ House □ Condominium □ Co-op Apartment □ Other: ______________________

Date purchased (month/year)

Name of seller

Approximate acquisition cost

Approximate current value

Annual maintenance cost (e.g., for co-op or condo)

□

N/A

Total annual rental income received

□

N/A

Time spent there (e.g., three nights per week, weekends, holidays)

U.S. Property #3

□

N/A

Property address

Type: □ House □ Condominium □ Co-op Apartment □ Other: ______________________

Date purchased (month/year)

Name of seller

Approximate acquisition cost

Approximate current value

Annual maintenance cost (e.g., for co-op or condo)

□

N/A

Total annual rental income received

□

N/A

Time spent there (e.g., three nights per week, weekends, holidays)

□ Check here if additional information is provided in the addendum. 11

Ownership of Real Property in Foreign Countries

15.

List any residence or item of real estate located in a foreign country (not in the U.S.

or in a U.S. territory or commonwealth) in which you or your spouse or domestic

partner has an ownership interest, whether direct or indirect. Include all real property

(e.g., houses, condominiums, shares in cooperative apartments, commercial

properties, investment properties).

□ N/A

Foreign Property #1

Property address

Type: □ House □ Condominium □ Co-op Apartment □ Other: ______________________

Date purchased (month/year)

Name of seller

Approximate acquisition cost

Approximate current value

Annual maintenance cost (e.g., for co-op or condo)

□

N/A

Total annual rental income received

□

N/A

Time spent there (e.g., three nights per week, weekends, holidays)

Foreign Property #2

□

N/A

Property address

Type:

□

House

□

Condominium

□

Co-op Apartment

□

Other: ______________________

Date purchased (month/year)

Name of seller

Approximate acquisition cost

Approximate current value

Annual maintenance cost (e.g., for co-op or condo)

□

N/A

Total annual rental income received

□

N/A

Time spent there (e.g., three nights per week, weekends, holidays)

□ Check here if additional information is provided in the addendum. 12

Other Sources of Income

16.

List all income you or your spouse or domestic partner has received within the past

12 months from any source not

addressed by your previous answers in this

questionnaire (including but not limited to inheritances, gambling winnings, alimony,

child support, and public assistance).

□ N/A

Source of Income

Name(s)

of Income Recipient(s)

Approximate Amount Received

□

one-time sum

□ total received annually

□

one-time sum

□

total received annually

□

one-time sum

□

total received annually

Personal Property

17.

List each individual item of personal property (including but not limited to jewelry, art

and collectibles, motor vehicles, watercraft, and aircraft) with a value of $5,000 or

more, which is held directly or indirectly by you or your spouse or domestic partner.

Do not include personal clothing or household furniture.

□ N/A

Description of Item

Year of Acquisition

Value

□ Check here if additional information is provided in the addendum. 13

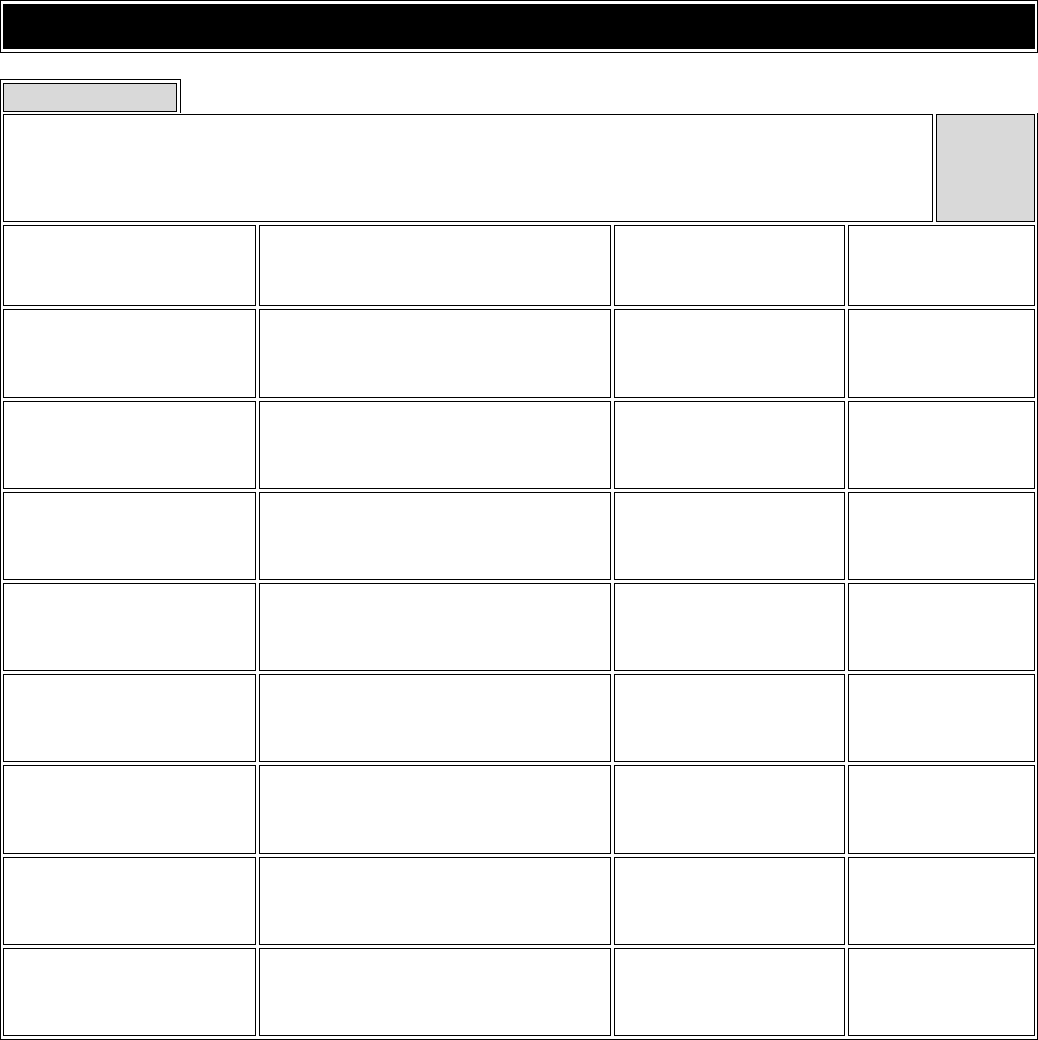

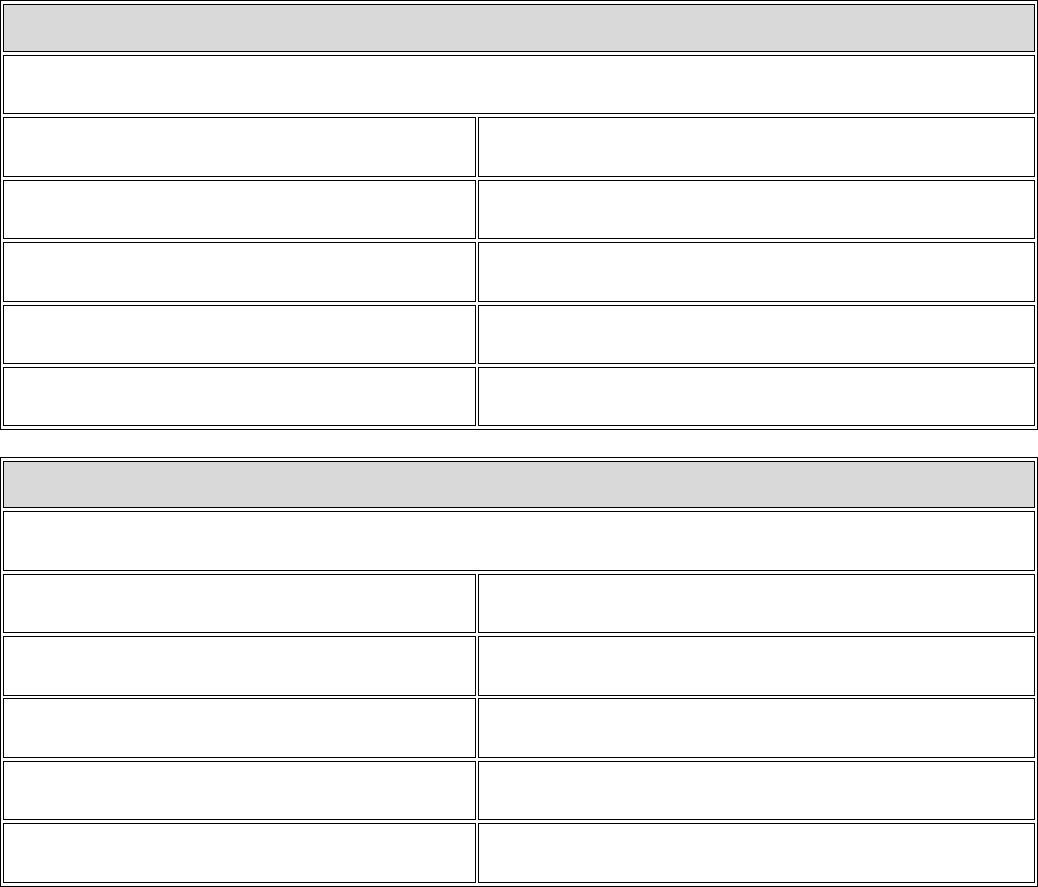

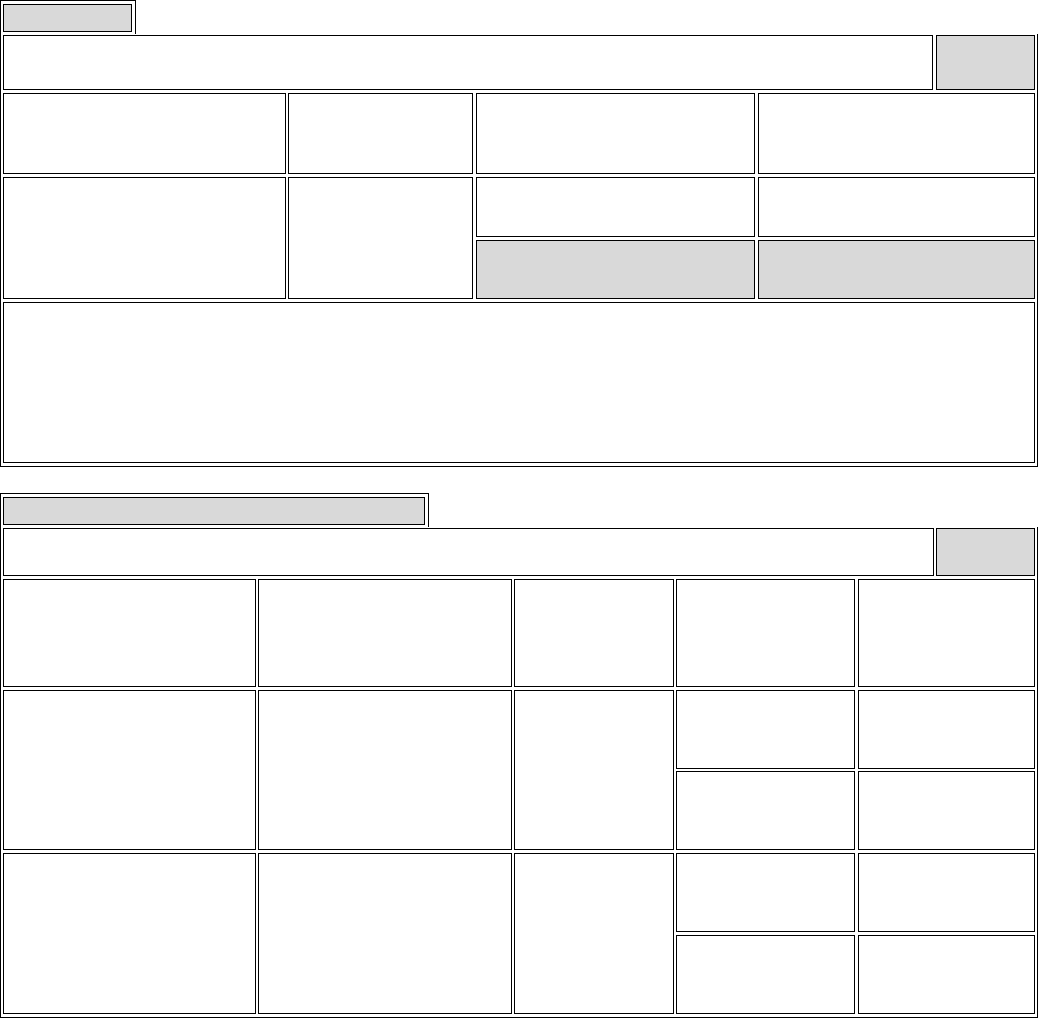

LIABILITIES

Credit Cards

18.

Provide details below for all credit cards that list you or your spouse or domestic

partner as a primary or secondary account holder and that carry a monthly

balance of $5,000 or more. Include bank, retail, travel, and entertainment credit

cards.

□ N/A

Name of Issuer

or Bank

Type of Card (e.g., American

Express, Discover, MasterCard,

Visa)

Account Holder(s)

Current

Balance

□ Check here if additional information is provided in the addendum. 14

Mortgages and Loans

19.

List each creditor to whom you or your spouse or domestic partner is indebted for

$5,000 or more (whether secured or unsecured).

Include

personal loans, student loans, mortgages, home equity loans,

car loans/leases, and any other debts or obligations made, guaranteed, or co-signed

by either you or your spouse or domestic partner.

□ N/A

Creditor #1

Name of creditor (if creditor is a person, also state your relationship to them)

Nature of debt

Nature of security (e.g., house, car, unsecured)

Date incurred (month/year)

Original amount of debt

Length of loan (years)

Interest rate

Payment frequency

Amount of each payment

Year loan is due

Approximate outstanding balance

Creditor #2 □

N/A

Name of creditor (if creditor is a person, also state your relationship to them)

Nature of debt

Nature of security (e.g., house, car, unsecured)

Date incurred (month/year)

Original amount of debt

Length of loan (years)

Interest rate

Payment frequency

Amount of each payment

Year loan is due

Approximate outstanding balance

□ Check here if additional information is provided in the addendum. 15

Creditor #3

□

N/A

Name of creditor (if creditor is a person, also state your relationship to them)

Nature of debt

Nature of security (e.g., house, car, unsecured)

Date incurred (month/year)

Original amount of debt

Length of loan (years)

Interest rate

Payment frequency

Amount of each payment

Year loan is due

Approximate outstanding balance

Creditor #4 □ N/A

Name of creditor (if creditor is a person, also state your relationship to them)

Nature of debt

Nature of security (e.g., house, car, unsecured)

Date incurred (month/year)

Original amount of debt

Length of loan (years)

Interest rate

Payment frequency

Amount of each payment

Year loan is due

Approximate outstanding balance

□ Check here if additional information is provided in the addendum. 16

Creditor #5

□

N/A

Name of creditor (if creditor is a person, also state your relationship to them)

Nature of debt

Nature of security (e.g., house, car, unsecured)

Date incurred (month/year)

Original amount of debt

Length of loan (years)

Interest rate

Payment frequency

Amount of each payment

Year loan is due

Approximate outstanding balance

Creditor #6 □

N/A

Name of creditor (if creditor is a person, also state your relationship to them)

Nature of debt

Nature of security (e.g., house, car, unsecured)

Date incurred (month/year)

Original amount of debt

Length of loan (years)

Interest rate

Payment frequency

Amount of each payment

Year loan is due

Approximate outstanding balance

□ Check here if additional information is provided in the addendum. 17

Non-Commercial Creditors’ Associations with the City of New York

20.

This question does not apply to commercial lending institutions (e.g., commercial

banks, credit unions, mutual companies). If a non-commercial lender/creditor listed

in response to Question 19 is employed by the City of New York (or any of its

agencies), or if they do business with the City of New York (or any of its agencies),

provide details below.

Doing business with the City

includes receiving funds from the City, having

contracts with the City, providing materials or services to the City, having matters

pending before the City, or holding any franchise, license, permit, or other privilege

from the City.

□ N/A

Full Name of Creditor (Institution or Person)

Creditor’s City Agency

or Nature of Business with the City

Outstanding Judgments

21.

List all judgments entered against you or your spouse or domestic partner that are

outstanding (except tax judgments and liens, which should be disclosed in

Question 22). Include documentation with your background paperwork.

□ N/A

Name of Creditor and Court

Where Judgment Was Filed

Date of Judgment

(Month/Year)

Garnishment

Yes/No

Original

Amount

Amount

Outstanding

□ Yes □ No

□ Yes □ No

□ Yes □ No

□ Yes □ No

□ Check here if additional information is provided in the addendum. 18

Tax Judgments and Liens

22.

List all tax judgments and/or liens entered against you or your spouse or domestic

partner within the past seven years, even if they have been satisfied.

Candidates undergoing a background investigation must satisfy all

outstanding tax judgments and liens with the appropriate tax authority, either

by making full payment or by entering into a payment agreement.

Include documentation of your full payment with your background paperwork

(e.g., receipt, bank statement, canceled check, certificate of release of federal tax

lien, satisfaction of judgment), or a copy of your

current installment payment

agreement and documentation of your three most recent payments.

□ N/A

Name of Tax

Authority

Name of

Responsible

Taxpayer

Date of

Judgment

(Month/Year)

Original

Amount

Amount

Outstanding

Date Satisfied

(Month/Year)

□ Not satisfied

□

Not satisfied

□ Not satisfied

□

Not satisfied

□

Not satisfied

□ Check here if additional information is provided in the addendum. 19

Money Owed to Tax Authorities

23.

Provide details below if you or your spouse or domestic partner owes money

(not including tax judgments or liens) to federal or state tax authorities.

Include documentation (e.g., installment payment agreement)

with your

background paperwork.

□ N/A

Name of Tax

Authority

Name of

Responsible

Taxpayer

Tax Year

Amount

Outstanding

Details of

Most Recent

Payment

Anticipated

Date of

Satisfaction

Date

Amount

Date

Amount

Tax Audits

24.

If a tax authority has audited any tax return filed by you or your spouse or domestic

partner within the past five years, provide details below. This does not include tax

assessments or tax bills.

Include

a copy of the tax authority’s findings, or your most recent

correspondence with the tax authority, with your background paperwork.

□ N/A

Name of Tax

Authority

Name of Audited

Taxpayer

Tax

Year

Findings of Audit

Interest or

Penalties

Assessed

and/or Paid

Outcome or

Status

□ Check here if additional information is provided in the addendum. 20

Bankruptcies

25.

Provide details below if you or your spouse or domestic partner has filed a petition

under any chapter of the bankruptcy code, or has been the subject of a bankruptcy

or reorganization proceeding, within the past 10 years. Include

with your

background paperwork a copy of the bankruptcy discharge documents and

list of creditors (chapter 7), or a copy of the chapter 11 or 13 plan.

□ N/A

Bankruptcy #1

Name of filer

Bankruptcy petition type

□

Chapter 7

□

Chapter 11

□

Chapter 13

Name of court

Date filed (month/year)

Date of discharge or acceptance of plan (month/year)

Total debt discharged for chapter 7

Terms of repayment for chapter 11 or chapter 13 (include total repayment amount; length of plan in

months or years; frequency of payments; and current balance)

Detailed explanation of the reason for filing for bankruptcy

Bankruptcy #2 □ N/A

Name of filer

Bankruptcy petition type

□

Chapter 7

□

Chapter 11

□

Chapter 13

Name of court

Date filed (month/year)

Date of discharge or acceptance of plan (month/year)

Total debt discharged for chapter 7

Terms of repayment for chapter 11 or chapter 13 (include total repayment amount; length of plan in

months or years; frequency of payments; and current balance)

Detailed explanation of the reason for filing for bankruptcy

□ Check here if additional information is provided in the addendum. 21

Evictions

26.

If you have ever been evicted from a property you owned or rented, or at which you

resided, provide details below.

□

N/A

Property Address

Date of

Eviction

(Month/Year)

Amount Owed at Time

of Eviction

Current Balance

□

N/A

□

N/A

Reason for Eviction:

Child Support Payment Obligations

27.

List any child support payments you are currently obligated to make.

□

N/A

Name of Recipient

(e.g., Custodial

Parent, Child Support

Agency)

Name of Child

Date

Commenced

(Month/Year)

Frequency

and Amount of

Payments

Most Recent

Payment

Frequency

Date

Amount

Amount

Frequency

Date

Amount

Amount

□ Check here if additional information is provided in the addendum. 22

Court-Ordered Child Support Payments

28.

If you have been ordered by a court to make child support payments, provide details

below.

□

N/A

Name and Location of Court

(e.g., Supreme Court of the State of

New York County, Family Court of

the State of New York)

Date of Most

Recent Order of

the Court

(Month/Year)

Case Name

and Index Number

Frequency

and Amount of

Payments

Frequency

Amount

Frequency

Amount

Outstanding Balances Due on Child Support Payments

29.

If you have an outstanding balance due on any child support payment, provide

details below.

□

N/A

Amount Owed

Date of Last Child

Support Payment

Reason Child Support is Outstanding

□ Check here if additional information is provided in the addendum. 23

Civil Litigation and Lawsuits

30.

If you have been involved as a plaintiff, defendant, or respondent in any civil litigation

or lawsuit commenced within the past 10 years, provide details below.

□

N/A

Title of Action

and Date Commenced

(Month/Year)

Status or Outcome

of Litigation

Amount You Owed

or Were Awarded

Date Paid

(Month/Year)

□

Owed

□

Awarded

□

N/A

□

Owed

□

Awarded

□

N/A

□

Owed

□

Awarded

□

N/A

Administrative Proceedings

31.

If you have been involved as a party to, or have been the subject of, an administrative

proceeding (e.g., disciplinary proceeding

, censure, Conflicts of Interest Board

enforcement action) commenced within the past 10 years, provide details below.

Do not include any Equal Employment Opportunity matters, or matters you

have reported as a whistleblower.

□ N/A

Disposition

(Month/Year)

Government

Agency Involved

Fine or Penalty

Imposed

Status of Fine

or Penalty

□

No fine/penalty

□

N/A

□

No fine/penalty

□

N/A

□

No fine/penalty

□

N/A

□ Check here if additional information is provided in the addendum. 24

Government Benefits

32.

Provide details below if you have ever been informed of an overpayment of, or if you

have been requested or required to repay, a federal, state, or local

government-issued benefit or payment (e.g., public assistance, food stamps,

unemployment insurance, workers’ compensation, Medicaid, Social Security, public

pension, public housing/Section 8 rent subsidy).

□ N/A

Benefit-Issuing

Entity

Date of

Overpayment

(Month/Year)

Date of

Notification of

Overpayment

(Month/Year)

Amount Owed Status

□ Satisfied

□ Outstanding

□ Satisfied

□ Outstanding

Financial Arrangements (Potential Conflicts of Interest)

33.

List any financial arrangements that may present a potential conflict of interest with

your City employment.

□

N/A

Description of the

Financial

Arrangement

Name of Other

Involved Party

Basis of Potential

Conflict of Interest

Your Plan to Resolve the

Potential Conflict of Interest

(e.g., advice from COIB,

resignation, divestiture,

recusal)

25

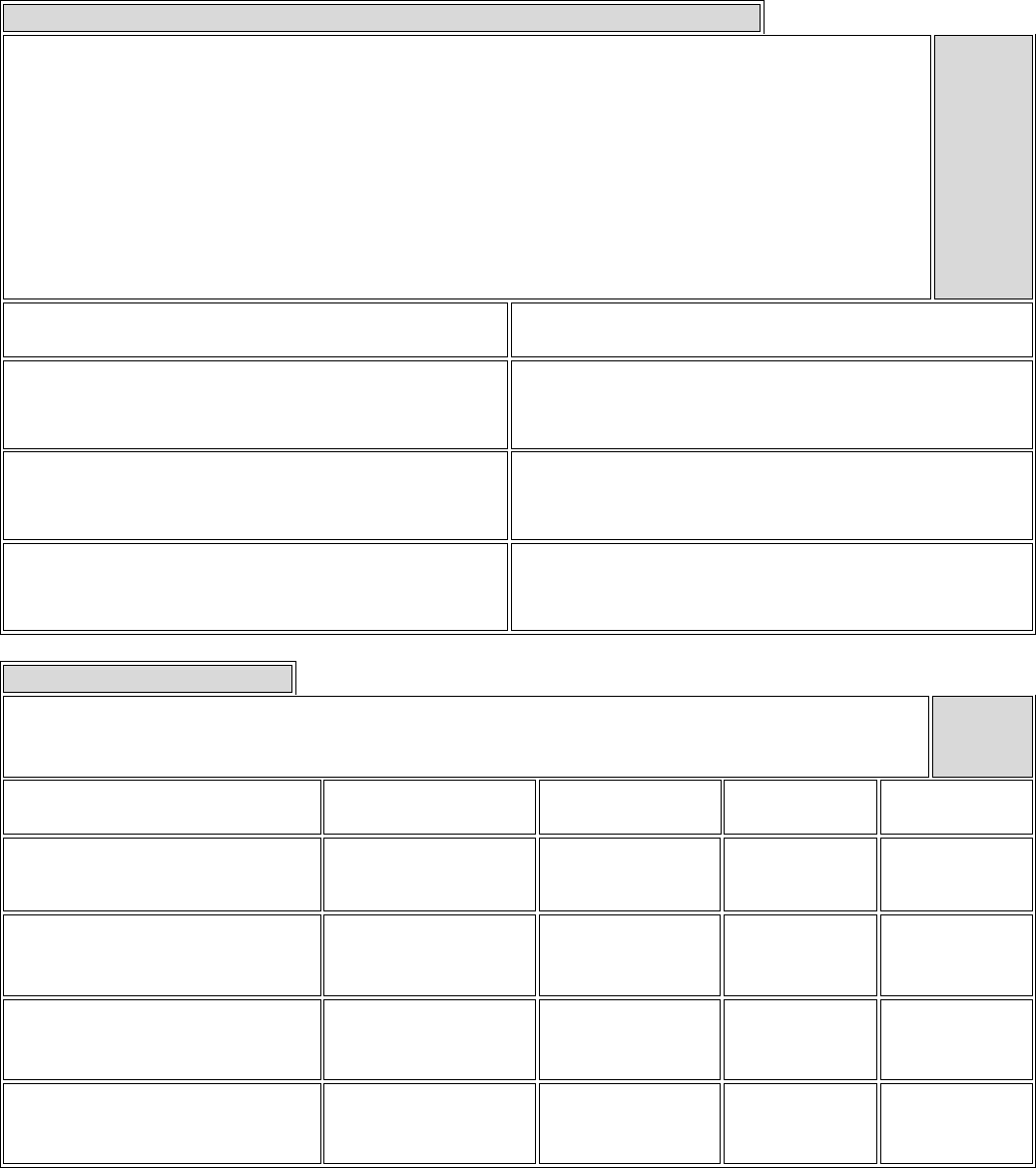

CERTIFICATION AND SIGNATURE

This Questionnaire must be signed and sworn to by you before a

Notary Public or Commissioner of Deeds.

I, ____________________________________, being duly sworn, state that

I have read and I understand all of the questions and answers contained in the

foregoing 24 pages of this questionnaire and the _____ page(s) of the addendum

that I have attached hereto; that I have supplied full and complete information in

answer to each question herein to the best of my knowledge, information and belief;

and that all information I have supplied is true.

I further understand that a false statement or intentional omission made in

this report or in connection with this background investigation may result in the

imposition of disciplinary penalties, including but not limited to termination of

employment or removal from appointment, disqualification from future employment

or appointment, and criminal prosecution.

___________________________________

Candidate’s Signature

State of

________________

County of

________________

Subscribed and sworn to before me this _______ day of _____________________, 20 _______

__________________________________

Notary Public or Commissioner of Deeds

ADDENDUM

(make additional copies of this blank page if needed)

Question _______ Page ________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Question _______ Page ________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Question _______ Page ________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Last Name: ___________________ Last four digits of SSN: __________ Date: __________