spglobal.com/ratings

Primary Credit

Analysts

Antonio Zellek, CFA

Mexico City

52

-55-5081-4484

antonio.zellek

@spglobal.com

Alejandra

Rodríguez

Ciudad de México

52

-55-5081-4460

alejandra.rodriguez1

@spglobal.com

José Coballasi

Ciudad de México

52

-55-5081-4414

jose.coballasi

@spglobal.com

See the last

page for the full

contact list.

Structured Finance

Mexican RMBS: Navigating

Choppy Waters

Sept. 14, 2023

This report does not constitute a rating action

Mexico's housing market has been facing significant challenges since 2018, including relatively

slow economic growth, historically low government housing subsidies, supply constraints, and

high inflation. This has led to declining housing starts over the past five years, which in turn has

hampered the pace of mortgage origination by the country's two government-related mortgage

entities: Instituto del Fondo Nacional de la Vivienda para los Trabajadores (Infonavit) and

Fondo

de la Vivienda del Instituto de Seguridad y Servicios Sociales de los Trabajadores del Estado

(Fovissste) -- though the latter has recorded more stable origination levels.

The persistent high interest rates also resulted in tighter spreads between mortgage loan

interest rates and market benchmark rates, which slowed the issuance of new residential

mortgage-backed securities (RMBS) transactions in Mexico. As a result, Infonavit, Fovissste, and

Fideicomiso Irrevocable F/2061 constituido en Banco Invex S.A., Institución de Banca Múltiple,

Invex Grupo Financiero (Fhipo) haven't issued any new RMBS transactions during the past 18

months. S&P Global Ratings expects this trend to continue through year end and the first half of

2024.

We also expect the Mexican RMBS transactions we rate to remain stable and continue repaying

as expected. However, credit enhancement levels could decline for some Infonavit transactions if

the nonperforming portfolio deteriorates beyond our expectation and we raise our expected loss

assumptions as a result (considering their target overcollateralization payment schemes).

Key Takeaways

• The Mexican RMBS market continues to see mixed transaction performance and no

new issuance due to high interest rates and other challenging market conditions.

• We expect this trend to continue through year end and possibly persist in the first half

of 2024 due to the upcoming presidential election in June 2024.

• We also expect the Mexican RMBS transactions we rate to maintain stable performance

and continue repaying as expected, though portfolio deterioration could pressure the

credit enhancement on certain Infonavit transactions.

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

2

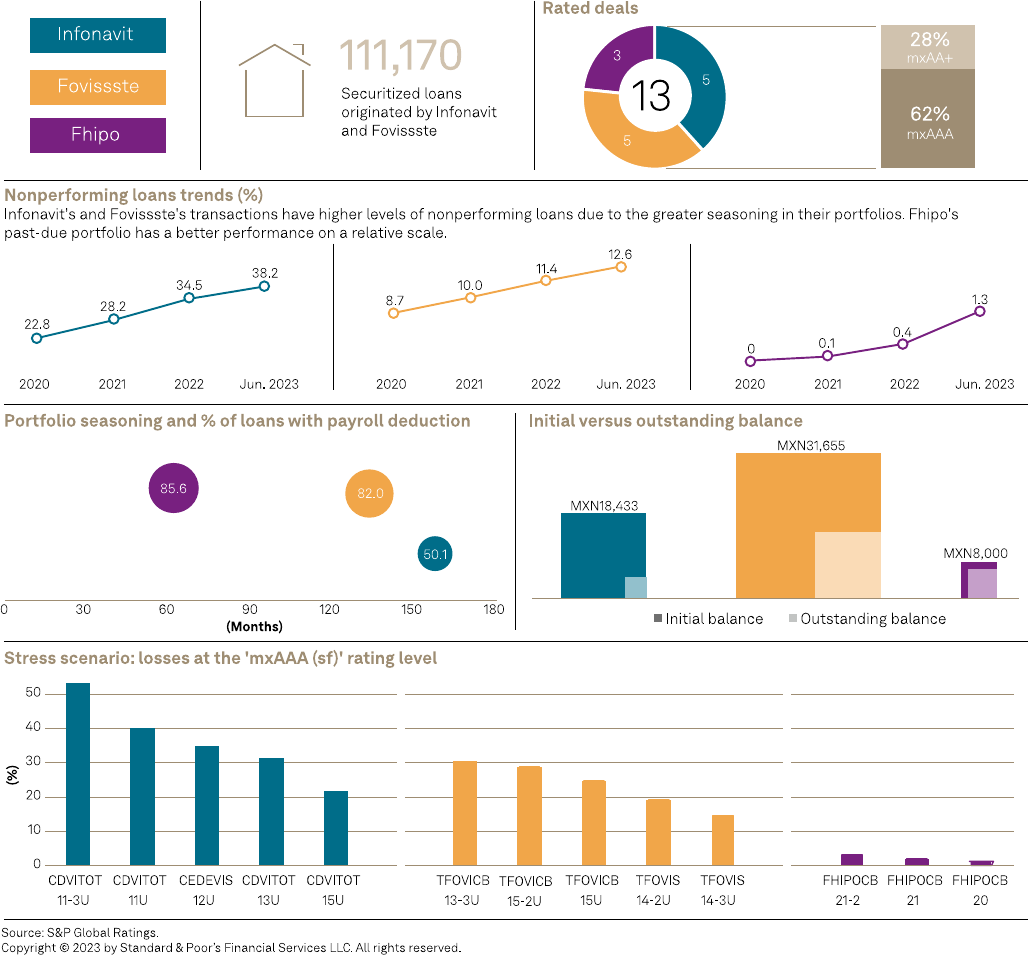

We provide more in-depth analyses of the three largest Mexican mortgage originators we rate in

the sections below. Note that Infonavit originates mortgages for private sector employees, while

Fovissste originates mortgages for public sector employees. Fhipo is a mortgage real estate

investment trust (REIT) whose portfolios consists of loans co-financed by Infonavit, Fovissste,

and other entities.

Chart 1

Mexican RMBS transactions

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

3

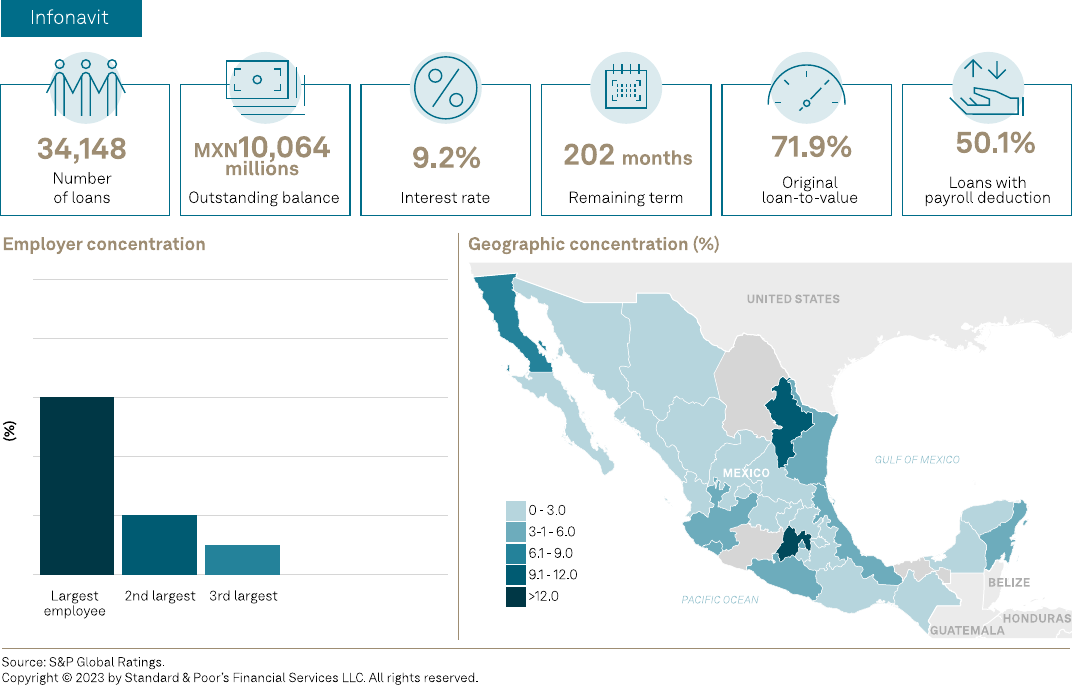

Infonavit

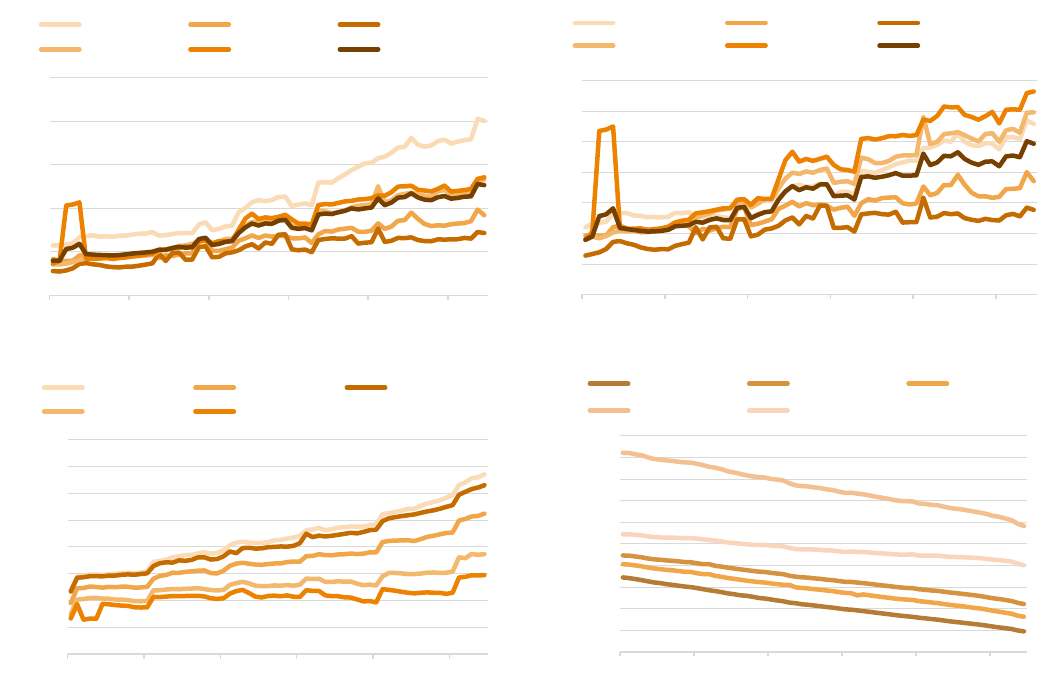

Chart 2

Characteristics of the securitized portfolios

The transactions' current credit enhancement levels are sufficient to support the ratings.

Infonavit-originated RMBS transactions have shown continuous performance deterioration since

2018. The portion of borrowers whose payments are collected through payroll discount have

declined as the portfolios seasoned. However, we believe the transactions' current credit

enhancement levels, which are in the form of overcollateralization and excess spread, mitigate

this risk, and remain sufficient to support the current ratings.

Further collateral performance deterioration could pressure existing credit protections. The

five Infonavit transactions we currently rate (see Appendix) continue to amortize as expected,

with an average outstanding balance of 24% of the total issued amount as of June 2023. Twenty-

one Infonavit transactions were paid off during the past five years.

The transactions have pro rata payment structures through which the notes are amortized to

maintain credit enhancement at the target levels. However, if nonperforming loans increase

beyond our expectations, the current credit enhancement levels may not be sufficient to

withstand the updated stress scenarios.

0

2

4

6

8

10

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

4

Nonperforming loans continue to increase as the number of borrowers with payroll deductions

decline. Nonperforming loans, which are measured as delinquency greater than 90 days as a

percentage of the outstanding balance of the portfolios, rose to 38.4% of Infonavit's portfolio as

of June 2023 from 31.7% a year earlier, according to the mortgage servicers' reports. However,

when measured as a percentage of the initial balance of the portfolios, nonperforming loans

represented 15.2% of Infonavit's portfolio in June, up from 13.8% a year earlier. This deterioration

reflects the decline in the percentage of borrowers employed in the private sector, which fell to

47.7% in June 2023 from 53.6% a year earlier.

Certain trigger events could mitigate the downside risk. The transaction structures include

early amortization events related to the securitized portfolios' performance, which could mitigate

the downside risk. If these events are triggered, the payment waterfalls would change to

sequential and the interests on the subordinated classes would be capitalized, which could

quickly deleverage the transactions. Given the observed performance so far, we would expect

some transactions to change their payment waterfall in the next 12 months due to this early

amortization events.

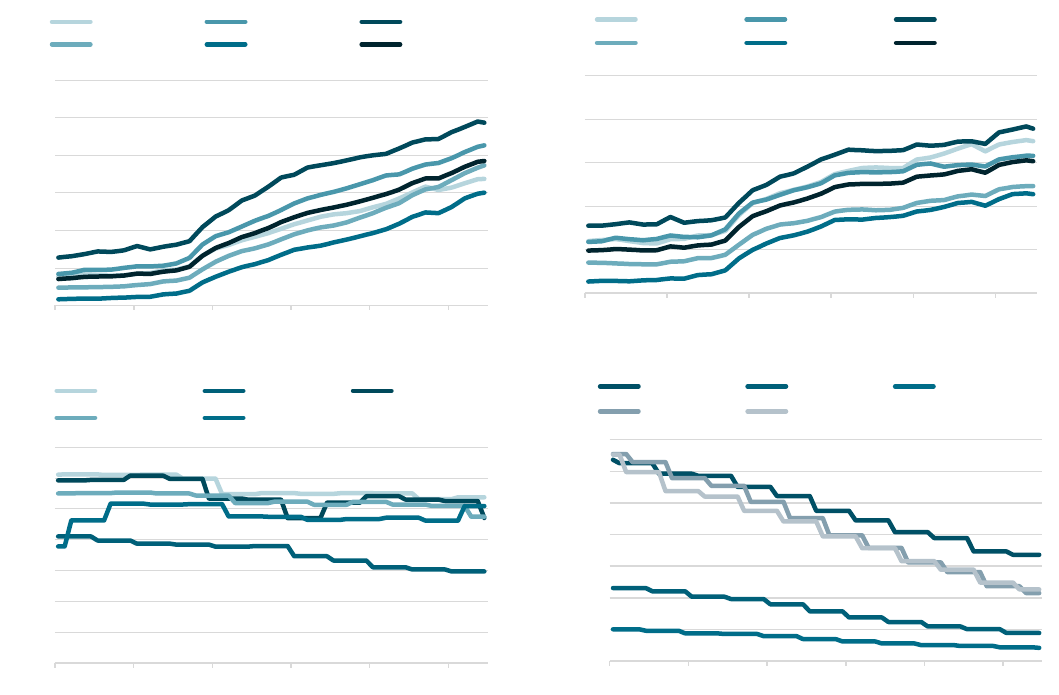

Chart 3

Performance indicators

Nonperforming loans as a % of outstanding balance

Nonperforming loans as a % of initial balance

Overcollateralization

Outstanding balance

Source: S&P Global Ratings.

Copyright © 2023 by Standard & Poor’s Financial Services LLC. All rights reserved..

0%

10%

20%

30%

40%

50%

60%

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

CEDEVIS 12U CDVITOT 11U CDVITOT 11-3U

CDVITOT 13U CDVITOT 15U Infonavit

0%

5%

10%

15%

20%

25%

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

CEDEVIS 12U CDVITOT 11U CDVITOT 11-3U

CDVITOT 13U CDVITOT 15U Infonavit

0%

5%

10%

15%

20%

25%

30%

35%

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

CEDEVIS 12U CDVITOT 11U CDVITOT 11-3U

CDVITOT 13U CDVITOT 15U

-

500

1,000

1,500

2,000

2,500

3,000

3,500

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

(Mil. MXN)

CEDEVIS 12U CDVITOT 11U CDVITOT 11-3U

CDVITOT 13U CDVITOT 15U

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

5

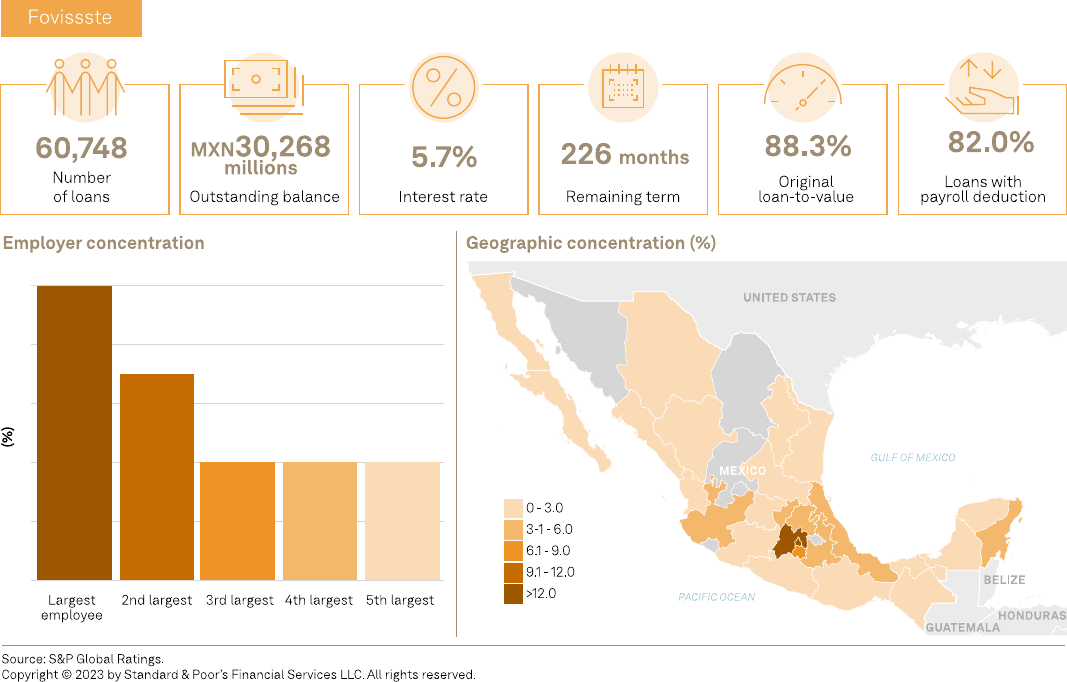

Fovissste

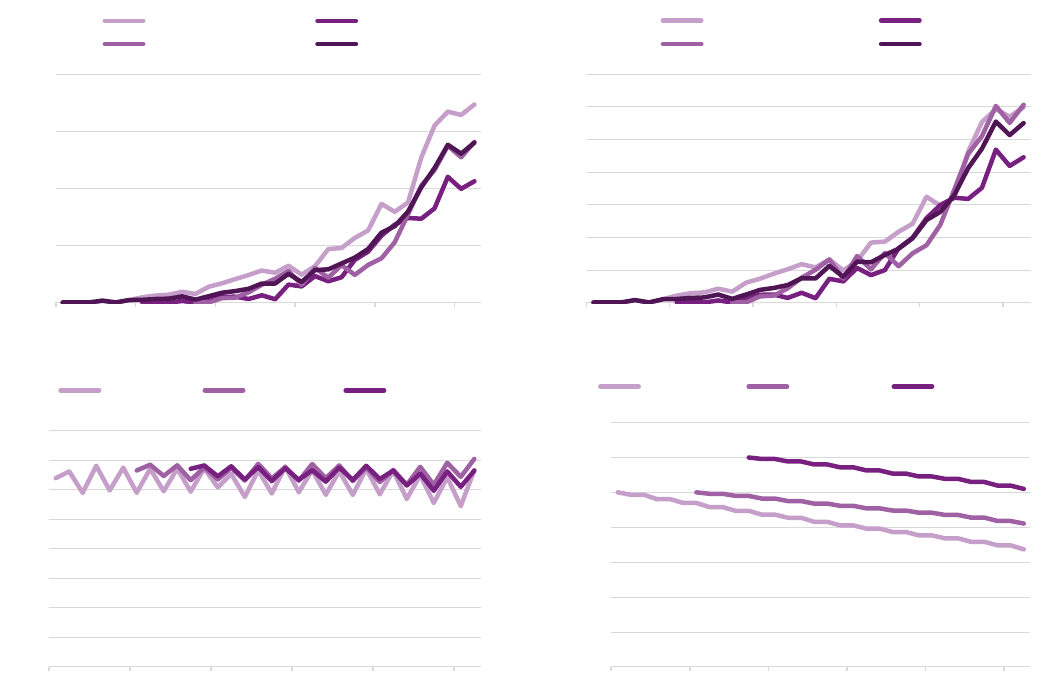

Chart 4

Characteristics of the securitized portfolios

Borrowers' employment stability tempers rising nonperforming loan levels. Fovissste-

originated transactions have also seen higher levels of nonperforming loans, though at a lower

rate than Infonavit. This mainly reflects the public sector's greater employment stability relative

to the private sector. The Fovissste transactions' full-turbo payment structures (in which all

inflows are destined to amortize the notes after paying expenses and interests) have also allowed

them to increase their credit overcollateralization levels.

The transactions continue to benefit from increasing overcollateralization and greater

performance stability. The five Fovissste-originated and serviced transactions we currently rate

(see Appendix) have solid overcollateralization levels that continue to increase due to their full-

turbo amortization scheme (in which all inflows from collections after covering expenses and

interest are used to amortize the unpaid balance of the notes). Overcollateralization levels rose

24% year over year, on average, as of June 2023.

0

2

4

6

8

10

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

6

Nonperforming loans increased due to stronger borrower characteristics. Nonperforming loans

rose, on average, to 9.8% of the portfolios as of June 2023 from 9.0% a year earlier. However,

these levels are within our expectations, and we believe they reflect the greater employment

stability in the public sector compared to the private sector.

We expect the transactions' performance to remain stable, based on their increasing

overcollateralization levels and the greater stability in the underlying portfolios' performance.

Before 2021, Fovissste had taken the lead in new issuance volume, issuing one or two

transactions per year. However, the fund stopped securitizing its portfolio in 2021 due to the high

interest rate environment. As a result, we don't expect Fovissste to participate in the

securitization market for the remainder of this year.

Chart 5

Performance indicators

Nonperforming loans as a % of outstanding balance

Nonperforming loans as a % of initial balance

Overcollateralization

Outstanding balance

Source: S&P Global Ratings.

Copyright © 2023 by Standard & Poor’s Financial Services LLC. All rights reserved..

0%

5%

10%

15%

20%

25%

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

TFOVICB 13-3U TFOVIS 14-2U TFOVIS 14-3U

TFOVICB 15U TFOVICB 15-2U Fovissste

0%

2%

4%

6%

8%

10%

12%

14%

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

TFOVICB 13-3U TFOVIS 14-2U TFOVIS 14-3U

TFOVICB 15U TFOVICB 15-2U Fovissste

0%

10%

20%

30%

40%

50%

60%

70%

80%

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

TFOVICB 13-3U TFOVIS 14-2U TFOVIS 14-3U

TFOVICB 15U TFOVICB 15-2U

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23

(Mil. MXN)

TFOVICB 13-3U TFOVIS 14-2U TFOVIS 14-3U

TFOVICB 15U TFOVICB 15-2U

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

7

Fhipo

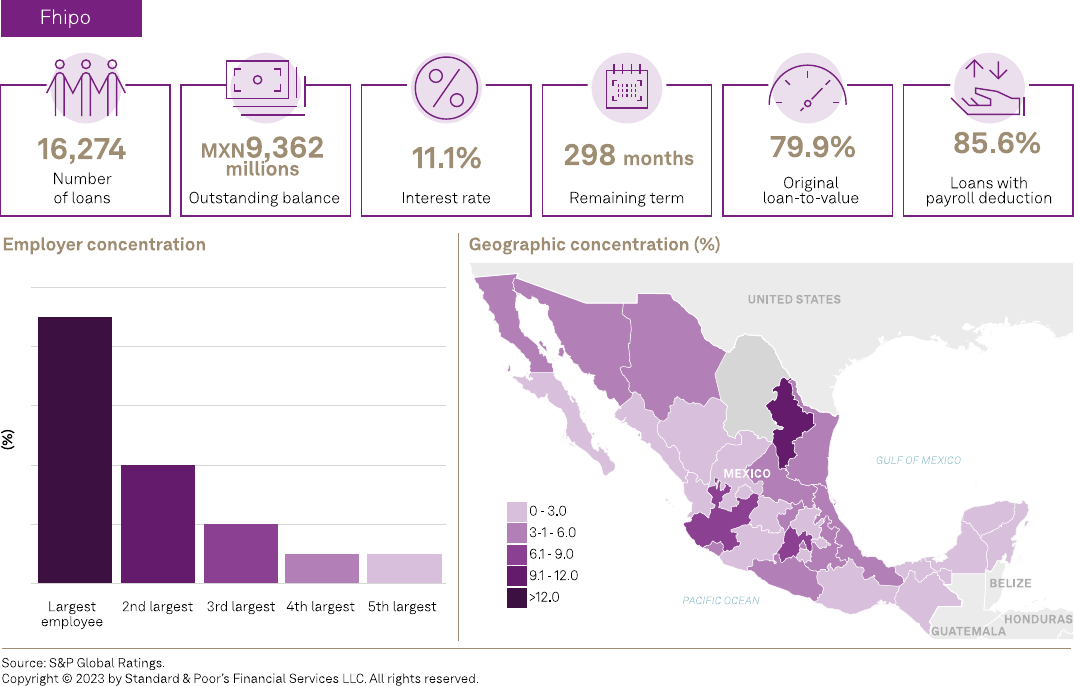

Chart 6

Characteristics of the securitized portfolios

Favorable credit quality and strong credit coverage support the ratings. Unlike Infonavit and

Fovissste, Fhipo has seen very low levels (approximately 1%) of nonperforming loans and stable

credit enhancement levels. This is likely due to the greater credit quality of the securitized

portfolios, which consists of Mexican peso-denominated loans originated jointly with Infonavit.

The transactions consist of better credit quality loans with lower expected loss levels. S&P

Global Ratings rates three transactions that are originated by Fhipo (see Appendix). The

transactions are backed by the portion of a portfolio of Mexican peso-denominated residential

mortgage loans that were originated jointly with Infonavit under Infonavit's Más Crédito program.

The program provides financing for workers who have already paid down a loan with Infonavit and

have shown adequate payment behavior. The loans were originated in Mexican pesos and have

better credit quality relative to those originated by Infonavit and Fovissste, based on their lower

expected loss levels.

We expect the transactions' good performance trend to continue in the near term. The Fhipo

transactions were issued in 2020 and 2021, and thus have a short performance track record than

the other Mexican RMBS transactions we rate. However, on a relative scale, the past-due

portfolio levels have a better performance trend compared to traditional Infonavit loans.

According to the servicer's reports, the past-due portfolio has remained at very low levels, with

0

2

4

6

8

10

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

8

nonperforming loans levels at 1.1% as of June 2023, compared with 0.25% a year earlier. We

believe the transactions' credit protection levels continue to support the ratings, and we expect

the transactions' performance to remain stable over the next 12 months.

We also expect no new issuance through year end. In 2020 and 2021, Fhipo was an active

participation in the RMBS securitization market in terms of new issuances. However, the trust

hasn't issued any new transactions since then. As a result, given current market conditions, we

don't expect any new issuances for the remainder of this year.

Chart 7

Performance indicators

Nonperforming loans as a % of outstanding balance

Nonperforming loans as a % of initial balance

Overcollateralization

Outstanding balance

Source: S&P Global Ratings.

Copyright © 2023 by Standard & Poor’s Financial Services LLC. All rights reserved.

0.0%

0.5%

1.0%

1.5%

2.0%

Nov-20 May-21 Nov-21 May-22 Nov-22 May-23

FHIPOCB 20 FHIPOCB 21

FHIPOCB 21-2 Fhipo

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

Nov-20 May-21 Nov-21 May-22 Nov-22 May-23

FHIPOCB 20 FHIPOCB 21

FHIPOCB 21-2 Fhipo

0%

2%

4%

6%

8%

10%

12%

14%

16%

Nov-20 May-21 Nov-21 May-22 Nov-22 May-23

FHIPOCB 20 FHIPOCB 21 FHIPOCB 21-2

-

500

1,000

1,500

2,000

2,500

3,000

3,500

Nov-20 May-21 Nov-21 May-22 Nov-22 May-23

(Mil. MXN)

FHIPOCB 20 FHIPOCB 21 FHIPOCB 21-2

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

9

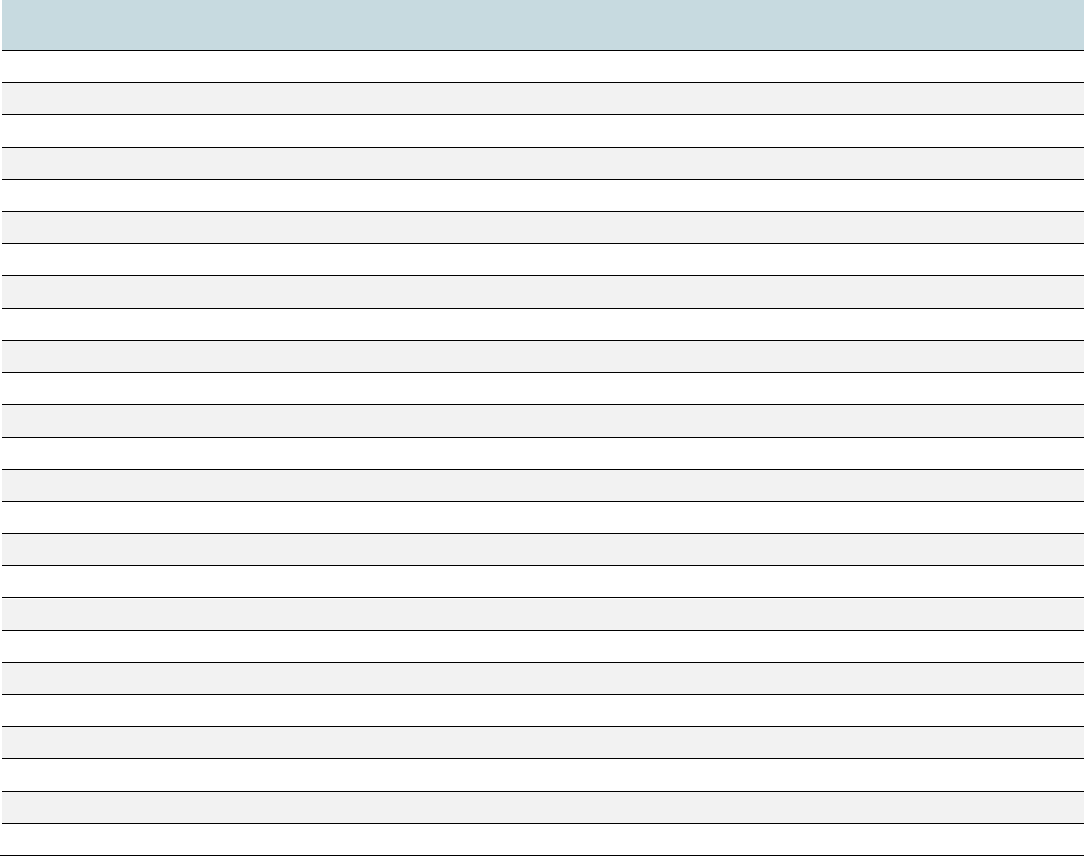

Appendix

The table below shows the Mexican RMBS transactions currently rated by S&P Global Ratings.

Mexican RMBS transactions rated by S&P Global Ratings

Transactions Type Current rating Legal maturity date Outstanding balance

(mil. UDIs/MXN)(i)

Fovissste - Bursatilizaciones de Hipotecas Residenciales

TFOVICB 13-3U Senior mxAAA (sf) Nov. 27, 2043 UDI122.06

TFOVIS 14-2U Senior mxAAA (sf) March 27, 2044 UDI284.79

TFOVIS 14-3U Senior mxAAA (sf) Sept. 27, 2044 UDI209.66

TFOVICB 15U Senior mxAAA (sf) Jan. 27, 2045 UDI748.75

TFOVICB 15-2U Senior mxAAA (sf) May 26, 2045 UDI511.29

Infonavit - Bursatilizaciones de Hipotecas Residenciales

CEDEVIS 12U Senior mxAAA (sf) Feb. 20, 2040 UDI193.29

Constancia Preferente Subordinated mxAA+ (sf) Feb. 20, 2040 UDI24.16

Infonavit Total - Bursatilizaciones de Hipotecas Residenciales

CDVITOT 11U Senior mxAAA (sf) July 20, 2039 UDI47.32

CDVITOT 11-2U Subordinated mxAA+ (sf) July 20, 2039 UDI3.00

Constancia Preferente Subordinated mxAA+ (sf) July 20, 2039 UDI2.50

CDVITOT 11-3U Senior mxAAA (sf) Dec. 20, 2039 UDI23.87

Constancia Preferente Subordinated mxAA+ (sf) Dec. 20, 2039 UDI2.91

CDVITOT 13U Senior mxAAA (sf) Oct. 21, 2041 UDI123.59

CDVITOT 13-2U Subordinated mxAA+ (sf) Oct. 21, 2041 UDI7.13

Constancia Preferente Subordinated mxAA+ (sf) Oct. 21, 2041 UDI7.23

CDVITOT 15U Senior mxAAA (sf) Sept. 21, 2043 UDI130.99

CDVITOT 15-2U Subordinated mxAA+ (sf) Sept. 21, 2043 UDI8.76

Constancia Preferente Subordinated mxAA+ (sf) Sept. 21, 2043 UDI6.00

Fhipo - Bursatilizaciones de Hipotecas Residenciales

FHIPOCB 20 Senior mxAAA (sf) Dec. 15, 2050 MXN1,681.95

FHIPOCB 21 Senior mxAAA (sf) June 5, 2051 MXN2,052.06

FHIPOCB 21-2 Senior mxAAA (sf) Oct. 12, 2051 MXN2,549.42

(i)Outstanding balance as of June 2023. 1 UDI = MXN7.766768 as of June 30, 2023. MXN--Mexican Pesos. UDI--Unidad de Inversion (a Mexican inflation-linked unit).

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

10

Related Research

• Financiamiento Estructurado en América Latina: Estadísticas de seguimiento, Aug. 10, 2023.

• Credit Conditions Emerging Markets Q3 2023: Inflation Peaked, Risks Remain, June 27, 2023

• Análisis Detallado: Instituto del Fondo Nacional de la Vivienda para los Trabajadores

(Infonavit), June 12, 2023.

• Análisis Actualizado: Fondo de la Vivienda del Instituto de Seguridad y Servicios Sociales de

los Trabajadores del Estado (Fovissste), Jan. 5, 2023.

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

11

Contact List

Primary credit analyst

Primary credit analyst

Primary credit analyst

Antonio Zellek, CFA

Mexico City

+52

-55-5081-4484

antonio.zellek@spglobal.com

Alejandra Rodriguez

Mexico City

+52

-55-5081-4460

alejandra.rodriguez1@spglobal.com

Jose Coballasi

Mexico City

+52

-55-5081-4414

jose.coballasi@spglobal.com

Primary credit analyst

Analytical manager

Daniela Ragatuso

Mexico City

+52

-55-5081-4437

Leandro de Albuquerque

São Paulo

+55

-11-3039-9729

leandro.albuquerque@spglobal.com

Mexican RMBS: Navigating Choppy Waters

spglobal.com/ratings

Sept. 14, 2023

12

Copyright © 2023 by Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit

-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may

be modified, reverse engineered, reproduced or distributed in any form by any means, or

stored in a database or retrieval system, without the prior written permission of

Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawfu

l or unauthorized purposes. S&P and any third-

pa

rty providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness

or availability of the Content. S&P Parties are not responsible for any errors or omis

sions (negligent or otherwise), regardless of the cause, for the results obtained from

the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as i

s” basis. S&P PARTIES DISCLAIM ANY AND ALL

E

XPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE,

FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTE

NT WILL OPERATE WITH

ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incide

ntal, exemplary, compensatory,

punitive, special or consequential damages, costs, expenses, legal fees, or los

ses (including, without limitation, lost income or lost profits and opportunity costs or losses

caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit

-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of

fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hol

d, or sell any securities or to make any

investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content fol

lowing publication in any form or format.

The Content should not be relied on and is not a substitu

te for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when

making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registe

red as such. While S&P has obtained

information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or

independent verification of any information

it receives. Rating

-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to

acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes,

S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties

disclaim any duty whatsoever arising out

of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been

suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order

to preserve the independence and objectivity of their respective activities. As a result,

certain business units of S&P may have information that is not available to other S&P business units. S&P has established pol

icies and procedures to maintain the

conf

identiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or fro

m obligors. S&P reserves the right to

disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.spglobal.co

m/ratings (free of charge), and

www.ratingsdirect.com (subscription), and may be distributed through other means, including v

ia S&P publications and third-party redistributors. Additional information

about our ratings fees is available at

www.spglobal.com/usratingsfees.

STANDARD & POOR’S, S&P and RATINGSDIRECT are

registered trademarks of Standard & Poor’s Financial Services LLC.