Housing Finance and Mortgage-Backed

Securities in Mexico

Luisa Zanforlin and Marco Espinosa

WP/08/105

© 2008 International Monetary Fund WP/08/105

IMF Working Paper

Monetary and Capital Markets Department

Housing Finance and Mortgage-Backed Securities

in Mexico

Prepared by

Luisa Zanforlin and Marco Espinosa

1

Authorized for distribution by David S. Hoelscher and Carlos I. Medeiros

April 2008

Abstract

This Working Paper should not be reported as representing the views of the IMF.

The views expressed in this Working Paper are those of the author(s) and do not necessarily represent

those of the IMF or IMF policy. Working Papers describe research in progress by the author(s) and are

published to elicit comments and to further debate.

This paper reviews the Mexican experience with the securitization of residential mortgages.

It highlights the key legislative and institutional reforms leading to the development of

primary and secondary mortgage markets and reports the main features and valuation

practices of the RMBS markets. The paper identifies areas warranting close attention to

improve the outlook for the Mexican RMBS market and draws some lessons from the recent

U.S. subprime mortgage market problems.

JEL Classification Numbers: O16; G21.

Keywords: Mexico; Housing Finance; Mortgage-Backed Securities; RMBS.

Author’s E-Mail Address: [email protected], [email protected]

1

The authors would like to thank David Hoelscher, Carlos Medeiros, Steve Phillips and David Robinson for

helpful comments and suggestions, to Graham Colin-Jones for helpful editorial comments and Claudia Pescetto

for her able research assistance. Special thanks to Alan Elizondo and Oscar Grajales Herce in Mexico’s

Sociedad Hipotecaria Federal for very informative and candid communications.

2

Contents

I. Introduction........................................................................................................................... 3

II. A Brief Review of Housing Finance in Mexico ................................................................... 3

III. Reforming Institutions: The Foundations for Private Mortgage Markets ............................6

IV. The Mexican Way: From FOVI to HiTo ............................................................................ 11

A. Securitization and Rise of the Mexican RMBS Market............................................... 14

V. Past lessons and Future Challenges .................................................................................... 20

Boxes

1. Brief Chronology of Important Events in the Housing Finance Sector................................ 5

2. Securitzation ......................................................................................................................... 8

3. SHF’s Guarantees Program................................................................................................. 13

4. Main Characteristics of Mexican MBS Issues.................................................................... 19

Figures

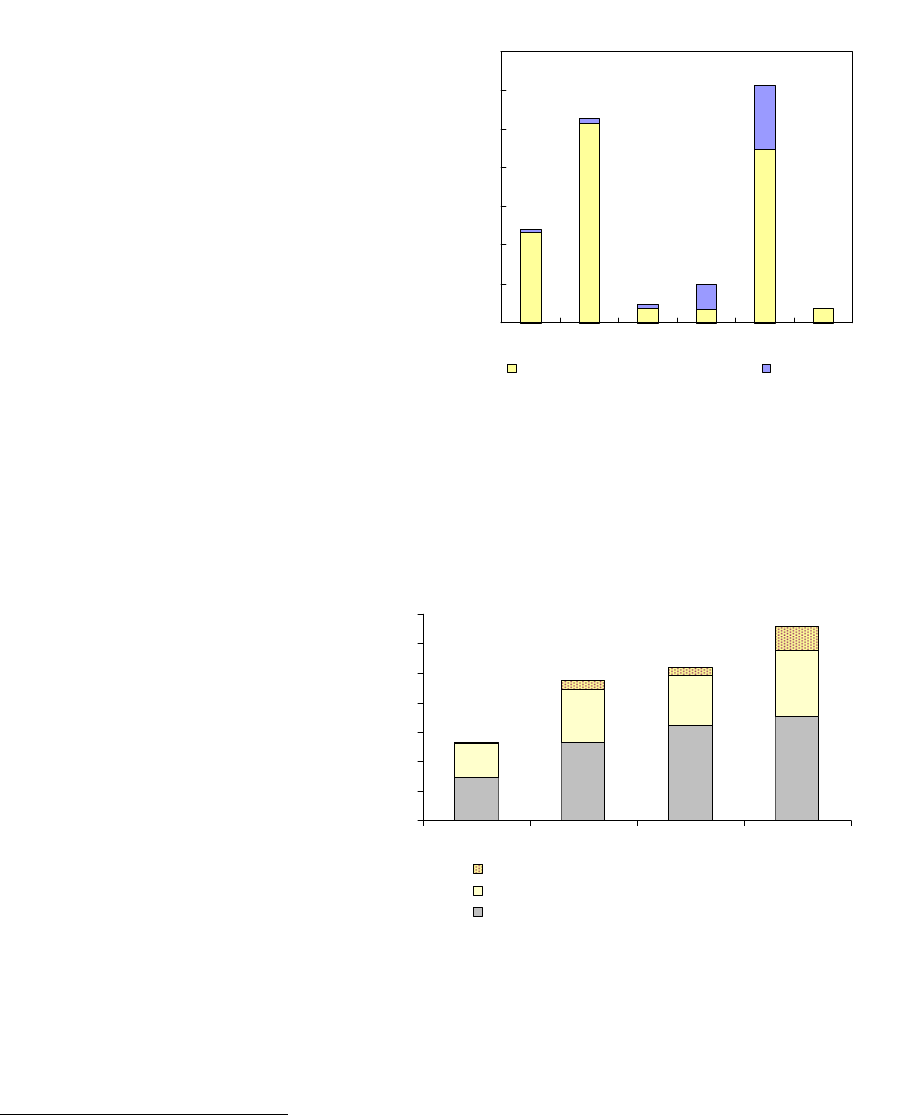

1. Latin American Local Issuance of Securitized Assets 2006............................................... 15

2. Mexico: Domestic Market Private Debt Issues by Structure.............................................. 15

3. Mexico: Historical Trends in Credit to Housing................................................................. 23

4. Mexico: Structure of Housing Finance, 2000–2005...........................................................24

References.................................................................................................................................... 25

3

I. INTRODUCTION

Widespread household access to home finance has long been a goal of governments in

Mexico. For generations, the Mexican approach focused primarily on redistributive schemes,

implemented through state-sponsored housing funds, which were notorious for their

inefficiency and poor governance. During the first part of the 1990s, the privatization of the

banking sector led to very rapid growth in mortgage loans, but the sharp increase in interest

rates following the1994 Tequila crisis contributed to record defaults and the near-collapse of

the banking sector, followed by a long period of lending retrenchment.

Current efforts to develop the mortgage markets are built on a more solid foundation.

Since 2001, the Mexican authorities have focused on developing the framework and

infrastructure to support primary and secondary mortgage markets; in contrast to previous

initiatives, the new approach places emphasis on market mechanisms, such as private

mortgage insurance, and improvements in housing repossession procedures and the property

registries. Both the primary and secondary mortgage markets have been developing in recent

years and remain a work in progress as the government continues to adapt best international

experiences to Mexican circumstances.

The paper tracks and highlights the key legislative and institutional reforms leading to

the development of primary and secondary mortgage markets in Mexico and reports

the main features and valuation practices of the RMBS markets. The paper identifies

areas warranting close attention to improve the outlook of the Mexican RMBS market and

draws lessons from recent developments in secondary mortgage markets. The remainder of

the paper is organized as follows. Section II traces the experiences of housing finance

mechanisms over the past three decades and the historical landmarks that led to the current

structure of the institutions providing housing finance in Mexico today. Section III reviews

the recent reforms in the institutional framework enabling new instruments for housing

finance to emerge and contrasts them with the experiences in other countries. Section IV

describes the roles and the functioning of the different institutions providing housing finance

and the recent developments in the local market for mortgage-backed securities. Section V

concludes by identifying possible developmental hurdles and providing policy

recommendations.

II. A

BRIEF REVIEW OF HOUSING FINANCE IN MEXICO

Over the years, government sponsored financing of low-income housing has been

channeled through multiple institutions (see also Box 1):

• In 1933, the development bank Banco de Obras Publicas (BANOBRAS) was created

to finance low-income housing.

• In 1954, Fideicomiso del Fondo Nacional de Habitaciones Populares (FONHAPO)

was created with a similar purpose.

4

• In 1963, a government trust fund Fondo de Operación y Financiamento Bancario de

la Vivienda (FOVI), operating within the central bank, was created to provide low

interest mortgages for low to moderate income households. FOVI was funded by the

central bank and the World Bank and operated as a second-tier bank, providing

funding and guarantees (up to 45 percent of loss-given default) to the banks extending

mortgages to targeted households and low-cost housing developers.

• In 1972, Instituto de Fondo Nacional de la Vivienda para los Trabajadores

(INFONAVIT) and Fondo de la Vivienda para los Trabajadores al Servicio del

Estado (FOVISSTE) were created as government-sponsored construction and housing

development funding agencies. They have been funded by a mandatory contribution

of 5 percent of gross wages. For decades they have been the workhorse of

government-sponsored low-income housing finance. Indeed, INFONAVIT still has a

large presence in the primary mortgage market—about half of the market (see below)

(Figure 1).

2

However, for years INFONAVIT was known for its lax collection

practices and poor governance.

Directed lending and interest rate caps were popular credit allocation tools deployed in

the late 1960s and 1970s as a means to secure private mortgages. Six percent of total

bank credit had to be directed to housing finance at fixed or capped nominal interest rates.

The oil shocks of the 1970s led to high inflation, negative real interest rates and large

portfolio losses for banks, contributing to the 1981 banking crisis. The banking sector was

nationalized in 1982 and the banking losses were absorbed by the government.

In the early 1980s, government securities crowded out private credit instruments,

including mortgages. During the high inflation period of the early 1980s, banks were

authorized to issue “dual index mortgages” (DIM)—which allowed negative amortization of

the inflation-induced erosion of purchasing power.

3

However, the 6 percent minimum credit

allocation to housing lending remained a binding constraint for banks which did not increase

credit to the sector. Government securities represented 70 percent of banks’ total assets.

The re-privatization of the banking sector in the early 1990s did not immediately

stimulate a private mortgage market. DIM mortgages faded away because of the

continuous erosion in households’ purchasing power, the consequent rapid increases in

outstanding loan balances and associated increases in banks’ credit and market risks.

2

The federal government contributes to INFONAVIT’s capital as stipulated in its charter (Ley del

INFONAVIT).

3

The payments on the DIMs were linked to the minimum wage index (VSM) and the difference between the

changes in the minimum wage index (VSM) and the consumer price index was tagged to the outstanding

principal (negative amortization).

5

Furthermore, the 1980s’ experience with mortgage defaults reinforced banks’ cautious

attitude towards the mortgage market.

By 1993, the introduction of legal reforms, inflation-indexed mortgages and benign

international liquidity conditions led to a rebirth of a private mortgage market. In 1992

legal reforms were introduced to modernize housing deeds. At the same time, the country

experienced a surge in capital inflows, stimulating a rapid growth in mortgage lending.

Between 1989 and 1994, total bank credit to the private sector increased from close to

13 percent of GDP to more than 50 percent of GDP, while bank mortgage lending jumped

from 1.3 percent of GDP to 2.4 percent of GDP (some 4.7 percent of total bank credit,

compared with 10 percent in 1989).

The sharp interest rate spike in the aftermath of the Tequila crisis triggered a wave of

bank mortgage defaults. The majority of mortgage lending in the early 1990s had

adjustable interest rates. After the crisis, interest rates climbed to 74 percent, leading to

massive defaults and a public sector bank bail-out. As part of a restructuring effort, mortgage

loans on banks’ balance sheets were registered in an alternative payment index, the UDI,

which was a unit of measure that averages inflation over the past 15 days. Outstanding

floating rate and dollar denominated loans were converted to long-term loans in UDIs that

carried a fixed real interest rate, while the inflation component was capitalized.

After the crisis, commercial banks relinquished almost entirely the origination of real

estate mortgages to non bank financial institutions and public sector entities. In 1994

non-bank financial intermediaries that specialized in real estate mortgages (Sofoles) were

created, with their core market consisting of low income households. As non-deposit taking

Box 1: Brief Chronology of Important Events in the Housing Finance Sector

1933 BANOBRAS was created as the first public housing institution.

1954 FONAHPO

1963 FOVI

1972 INFONAVIT and FOVISSTE created as government-sponsored private and public

(respectively) workers’ housing funds

1982 Nationalization of the banking system

1986 Institution of the DIM mortgages

1986 Institution of FOBAPROA (now Ipab), the deposit insurance scheme

1988 Deregulation of interest rates

1989 Re-privatization of the commercial banking system

1989 Abolishment of the quantitative lending requirements and of the interest rate controls.

1991/2 Re-privatization of the banking sector.

1992 Reforms in FOVI and INFONAVIT and the public housing subsidy system.

1994 Creation of SOFOLES non bank financial institutions licensed to lend to particular sectors

for specific types of activity.

2000 Amendments to the General Law on Securities and Credit.

2001 SHF commences operations.

2002 Law on Guaranteed Credit.

2003 First RMBS issued.

6

institutions, Sofoles’ main source of funding was FOVI, which also acted as their supervisor

and determined the underwriting and service requirements. Since the second half of the

1990s, Sofoles have become the main issuers of private mortgages. Efforts were also made to

step up and improve the efficiency of INFONAVIT’s activities, and as noted by Gwinner

(2006), INFONAVIT has substantially improved its management, operations, and corporate

governance.

4

Recently, it has also widened its cooperation with the private sector though the

program “Apoyo INFONAVIT.” The program allows its members to leverage their

INFONAVIT savings to obtain market-based mortgage finance. INFONAVIT also has

securitized portfolios, although the securitizations have been expensive, requiring 18–

23 percent subordination of the residual certificate for the senior certificates.

Traditionally, bank mortgage activity concentrated on the middle to upper income

segments. Lower income segments were considered high credit risk and banks were reluctant

to invest on origination platforms. However, Sofoles’ success in originating and servicing

low-to-middle income mortgages led some commercial banks to acquire some of the largest

Sofoles. New bank lending represented 7 percent of residential mortgages in 2005 compared

to only 0.2 percent in 2000.

III. REFORMING INSTITUTIONS: THE FOUNDATIONS FOR PRIVATE MORTGAGE MARKETS

A series of obstacles hindered the emergence of a primary private mortgage market

until the mid-1990s. These included directed lending practices, a lack of comprehensive

borrower credit history records that would allow the estimation of historical default

probabilities; and the absence of a framework for the sharing of available borrowers’ credit

information across banks. The only credit information sharing mechanism until the early

1990s was the public credit registry (SENICREB) operated by Bank of Mexico, but its use in

supporting credit decisions was limited. In addition, there was significant uncertainty and

lengthiness associated with the home repossession process. Foreclosures in Mexico could

take up to five months to be filed for and two years for a foreclosure sale to be ordered. Even

then, owners would not be liable for any remaining amount which would remain due in the

event the foreclosed property sold for less than the lien amount owed.

There were also significant obstacles to the development of a secondary mortgage

market through securitization (Box 2). As pointed out by, for example, Barry, Castaneda

and Lipscomb (1995), there was a lack of standardization in mortgage loans, with each

commercial bank offering its own lending terms, and making it impossible to pool them to be

securitized. Furthermore, there was no government agency or public institution in charge of

directing or overseeing loan standards. The lack of a comprehensive credit history created

difficulties in estimating not only default probabilities, but also pre-payment probabilities.

4

FOVISSSTE’s operational improvements, though not trivial, are much less significant than INFONAVIT’s.

7

Moreover, the legal framework for the sale of real estate assets necessary for a securitization

to take place was particularly cumbersome as, under Mexican law, the transfer of real estate

titles, such as mortgages, had to be registered with a central registry office, which was a

lengthy and costly process given the high fixed notary fees. In addition, by law, during a sale

of real estate assets, borrower notification was required, which tended to delay the process

significantly. Also, when a lien is registered on the property to secure a mortgage loan, such

lien did not give absolute seniority to the mortgage originator. In fact, the law specifically

identified categories of creditors whose claims will be considered senior to those of a

mortgage lender for the sale amount of a property. For example, municipalities have seniority

over other lenders for any tax amounts due and so do employees for any wages unpaid.

Finally, while real estate guarantee trusts existed prior to 2001 as legal entities that

functioned as a special purpose vehicle (SPVor SPE) in Mexico, their main objective was to

serve as a real estate trustee and were not allowed to issue debt (a key element for

securitization).

8

Box 2. Securitization

Main elements

Mortgage securitization is a technique which allows mortgage issuers to access fresh funding and to transfer market and credit risk imbedded

in their existing loans. In a securitization operation, a mortgage originator sells its loan portfolio to an independent special purpose company or

vehicle (SPE or SPV). The SPV’s funding comes from its issues of securities to capital market investors. The cash flow generated from the

interest and principal re-payment of the loans is used to service the securities backed by mortgages (mortgage-backed securities or MBSs), and

the mortgages act as their collateral.

There are a number of legal steps and infrastructure requirements for an efficient securitization of mortgages (see Lea et al. 2004). First, the

loans in the pool to be the securitized should have uniform characteristics, including terms of the loan, documentation, credit quality and

performance history. Second, mortgage foreclosure procedures, which ensure protection of creditor rights, must be relatively speedy and of

low cost to ensure high creditworthiness of the securities. In addition, mortgages must be fully transferable, as the SPV needs to acquire full

rights over the receivables from the loans and its claim on the collateral must be senior to any other claim. This is necessary to ensure that the

creditors of the originator’s bank will be voided from any claim on the collateral of the securitized loan in the event the originator were to

default. Also, the tax system must be designed to allow for the transfer of assets to be securitized without generating costs in the mere swap of

funds from the loan originator to the SPV issuer.

The SPV must be an entity of “high credit quality.” For example, in the U.S .SPVs must be capitalized, to ensure creditworthiness to the

securitized issues, and legal empowered to issue securities. These SPVs also perform a mortgage service, for which they are paid between 0.25

and 0.5 percent of the loan balance.

The pricing of MBSs should reflect the historical patterns of re-payments and defaults in the areas where the mortgage loans were originated.

Therefore, data on default rates and on pre-payment history (particularly in the absence of pre-payment penalty), are crucial for an accurate

pricing of the MBSs. In this respect, not only the collection of such data but also an agreement that financial institutions will share credit

information will be necessary for an MBS market to develop.

Main Benefits

By securitizing the mortgage loans, mortgage originators can book the proceeds from the sale of the mortgages immediately as cash. Thus, the

operation generates funding for new lending activities. By transforming the loans in securities that can be held in investors’ portfolios,

mortgage originators will also be able to access a broader pool of private sector savings. By removing the loans from the balance sheets,

mortgage originators will achieve a diversification of credit and market risk. In addition, remaining mis-match in assets and liabilities’s cash

flows and any credit risk will be removed from the mortgage originator and dispersed across market investors. Finally, the regulatory capital

requirements of the mortgage originators are typically reduced as the loans are taken off their balance sheet.

In addition, the securitized bonds backed by mortgage loans (MBSs) can be structured in different ways to either achieve a certain

diversification of risk or to cater to the investment base. The most commonly found securities which are backed by mortgage loans are so-

called pass-through securities or tranched issues.

Pass-through securities will present exactly the same characteristics as those of the underlying loans in terms of coupon, term, duration and

market risk. In particular they will also have the same pre-payment risk as the underlying loans and all market and credit risk will be passed on

to the investors.

Tranched issues are paid sequentially according to seniority in such a way that the higher tranches receive the flow of pre-payments first, and

thus have shorter duration and the lowest risk, with the lower tranches being redeemed only after the higher tranches have been redeemed in

full. This presents investors with choices on the expected duration or risk of the security to acquire. It is typical that MBSs will aim for an

investment grade rating so as to be marketed to institutional investors. Since mortgage originators may not have very high credit ratings,

mortgage securitization transactions typically require some

form of credit enhancement in order to achieve an investment grade rating

or, a rating higher than the originator bank. The enhancements can either be included in the structure of the securities, so that,

for example, the principal of the underlying pool of loans is greater than the principal value of the securities issued (over-

collaterization) or provided by a partial guarantee provided by a third party.

9

Financial Sector Reforms to Boost Private Mortgage Markets

Significant efforts have been made to overcome the obstacles to financial sector

development in general and housing finance in particular. A number of legislative and

regulatory efforts were directed to improve the ability of financial institutions to achieve

creditor information and to improve contract enforcement and creditor rights by clarifying

and streamlining foreclosures and repossession process while developing the legal

framework for guarantee trusts to be operational in the mortgage securitization process.

In the first place, the banking secrecy reform enabled banking institutions to share

information on customer credit operations, providing a strong impetus to the credit

reporting industry. A shakedown in the late 1990s of the few existing private credit bureaus

led to the emergence of one dominant entity (Buró de Crédito) that is owned by financial and

non-financial institutions. The enactment of a law in 2002 (amended in 2003) to regulate its

activities and protect privacy rights, resulted in more than 1,000 institutions feeding the

databases of Buró de Crédito with positive and negative information on more than 64 million

individual accounts and 4 million company accounts. Banks and other lenders can obtain

real-time data on customers that, in combination with their own proprietary information,

allow them to better differentiate borrower risk (calibration of scoring models) and expand

credit.

Subsequently, in 2000, a new Securities Law together with the Law on Guaranteed

Credit

5

allowed guarantee trusts (fideicomisos) to act as a full-fledged Special Purpose

Vehicle (SPV).

6

Creditors of trusts were granted rights over loan collateral with no

exclusion: this increased the legal protection of creditors’ rights over trusts with respect to,

for example, mortgages (which are junior to other categories of creditors). In addition,

foreclosure procedures were simplified in the case of trusts because the administrators of the

trusts (trustees) had the right to sell loan collateral in a public auction and without following

a judicial foreclosure process.

7

The new law also allowed financial institutions to both act as

trustees and to be beneficiaries of the trust, so that banks and non-banks (Sofoles) may hold

title to a property through a trust and, in the event that borrower fails to pay the credit, the

trustees can foreclose on the loan through out-of-court-procedures. Financial institutions

were also exempted from the registration requirements for the transfer of mortgage liens (if

they continue to service the credits), thus further streamlining the procedures for

5

Ley General de Títulos y Operaciones de Crédito.

6

In Mexican law, the trust (fideocommisso) is a contract by which a person assigns a property to a special

purpose, transfers the title of the property to a fiduciary institution to get the purpose done and appoints a

beneficiary of the trust to receive the benefits.

7

If there is no controversy in the process. If there is a controversy, then the trustees will have to undergo formal

judicial process.

10

securitization operations.

8

The new Securities law introduced a new market instrument, the

so-called “certificados bursatiles” or ceburs, which were by nature sufficiently flexible to

also be used as a vehicle for securitized issues. The law also streamlined the formalities for

the transfer of mortgage liens by exempting financial institutions from the registration

requirement as long as they continued to service the credits themselves.

In 2003, further legislation

9

established standard financial clauses for every mortgage

contract and required that loan information should appear in a standardized format so as to

allow comparison across different contracts. The law also provided that the mortgage

originator, in case of an anticipated total payment, would assign all the rights derived from

the credit to the payer. This feature introduces prepayment risk to the holders of mortgage-

backed securities just as in the U.S. case. (Caloca-Gonzalez 2006). The regulations for credit

bureau operations were also further revised to improve timeliness of data and increased depth

and quality of borrower information.

Mexico has drawn from the international experiences with secondary mortgage

markets

As in the U.S., the Mexican secondary market was launched with the support of

government sponsored initiatives. In the U.S., the secondary mortgage market developed

through government sponsored agencies. However, SHF departed from the U.S. scheme

where government sponsored agencies buy mortgages from loan originators who comply

with certain standards, pool them together and use them to back their issues of securities

which are serviced with the proceeds from the underlying mortgages. In Mexico, originators

have been issuing directly mortgage-backed securities in the market and benefiting from

credit enhancements provided by SHF in the form of financial guarantees to mortgage

originators meeting SHF’s origination standards.

As in the U.S., the use of credit enhancements by private mortgage issuers have been

used to boost the ratings of mortgage-backed securities beyond their originator’s rating.

Recently, in Mexico, as in the U.S., private credit enhancements have also been provided by

global companies such as MBIA, FIGC, AIG, Genworth and AMBAC.

Some features of the Danish model have also attracted significant attention in Mexico.

The most important feature of the Danish secondary mortgage market has been its high

liquidity. The mortgage bonds are highly liquid because the large pools of securitized loans

offer uniform characteristics such as coupon, rate of amortization, and loan to value ratios.

Liquidity is also supported by a market-making scheme where ten commercial banks trade all

8

If there is no controversy in the process. If there is a controversy, then the trustees will have to undergo formal

judicial process.

9

Ley de Transparencia y de Fomento a la Competencia del Crédito Garantizado (2002).

11

open-for-issuance mortgage bonds at a common price. Issuance and trading is done through

the Danish Central Depository Institution (VP) and the pass-through bonds have the same

characteristics of the underlying pool of mortgage loans (see Frankel et al.)

10

. The adoption of

VP’s technological platform in Mexico is expected to contribute to help liquidity and smooth

trading of the RMBS market. As in the U.S., mortgages in Denmark, and Mexico have a

penalty-free prepayment clause, subjecting the holder of the mortgage to prepayment risk.

However, in Denmark, unlike in the U.S., regulation requires a strict matching of cash flows

between the underlying loan and bond servicing flows. The result is that prepayment risk is

held by investors who, relative to the U.S. housing agencies, accept larger fluctuations in the

duration measures of their bond portfolios (see Frankel et al. ). As in the U.S., the Mexican

scheme has no provisions to fend against prepayment risk.

IV. THE MEXICAN WAY: FROM FOVI TO HITO

In 2001, Sociedad Hipotecaria Federal (SHF) was created with a view to developing the

secondary mortgage market. Originally, the SHF was seen as playing a role similar to that

of the Federal Housing Agencies (FHA) in the U.S., such as Fannie Mae and Ginnie Mae,

providing partial mortgage credit guarantees and acting as a second-tier bank for Sofoles.

11

However, the SHF was designed to gradually reduce its direct second-tier bank role, shifting

toward supporting financial institutions in issuing mortgage-backed securities (MBSs)

directly in the capital markets.

SHF began selling partial financial guarantees and mortgage insurance to Sofoles (Box

3). The main guarantee programs consisted in a partial financial guarantee (Garantia de Pago

Oportuno or GPO) which provides protection for timely payment of the obligation of the

MBSs, similar to a credit line; and a default payment guarantee (GPI) or mortgage

insurance

12

which pays the financial intermediary or the trust up to 35 percent

13

of the

10

However, in Denmark, the pre-payment risk is reduced by a feature of the mortgage loans whereby a

borrower can deliver a bond in lieu of the mortgage payment. This feature has the advantage that the purchase

of the bonds on the market by the borrower does not cause a pre-payment event. It also has the advantage that

when mortgage bonds are trading at a discount, the borrower can take advantage of such discount to repay his or

her mortgage. This also implies that mortgage investors benefit from early repayment of mortgage loans for

bonds trading below par (and thus can re-invest their proceeds at a higher interest). In addition, mortgages are

transferable among borrowers which makes pre-payment risk in Danish mortgage securities less exposed to

demographic factors than in the U.S. securities (Frankel et al. 2004). This feature of the Danish model is not

being adopted in Mexico.

11

Direct SHF financing of Sofoles is to be discontinued in 2009 and, by 2013, SHF is to be a self-sufficient agency.

The latest data available show that, as of the end of 2005, the agency held close to US$15 billion in direct home loans,

up from US$13 billion in 2002.

12

Mortgage Insurance is a mechanism to transfer the credit risk from mortgage loans to an insurance company

at relatively low down payments. In various countries, such as the U.S. Canada, Australia and Hong Kong, this

insurance has been successful in promoting a mortgage market with reduced down payment (For example,

mortgage insurance can be structured to reduce the expected value of the loss on the loan for the bank. For

(continued…)

12

outstanding balance of the mortgage loan, plus interest thereon, and unpaid service and

insurance fees, after a mortgage loan is delinquent for six consecutive months. Such

guarantees are designed to provide bond insurance to MBS investors.

14

SHF also offers a swap to meet the housing finance needs of low to medium-income

households. SHF sells a swap of UDI for minimum salary payments. This allows borrowers

to make payments in multiples of minimum salaries against UDI denominated mortgages.

The structure of the mortgage for the borrower is similar to that of earlier DIMs. In order to

hedge against losses in the event that UDIs rise above the minimum wage, SHF sells the long

VSM position to FOVI which, eventually, would be bearing such losses.

example: given a 5 percent down payment, and a 15 percent mortgage insurance, the bank has at-risk 80 percent

of value of the loan).

13

Initially it was 25 percent and it was increased in April 2004.

14

The program of partial financial guarantees, which are paid for by the securitizing agents, relieves the market

from the liquidity risk associated with shortfalls in principal and interest. The mortgage insurance guarantee

provides a “first loss” position with respect to losses due to default of the underlying loans. Since the presence

of the guarantees lowers the probability of a principal loss for the investor and ensures the timely payment of

bonds until foreclosure, such guarantees effectively increase the credit quality of securitized loans. Through

financial guarantees, the credit quality of securitized loans can well exceed the credit quality of the originating

institution. Effectively, the guarantee scheme is supporting increased securitization activity by originating

institutions as they can sell the high-quality part of the credit to the market while not increasing their own

exposure to household sector risks.

13

The criteria set by SHF to condition the sale of GPI or GPO have the important effect

of inducing standardization in mortgage products. In particular, mortgages have to meet

Box 3. SHF’s Guarantees Program

Different kinds of guarantee programs are directed both to mortgage borrowers and to lenders

seeking to securitize mortgage portfolios. In general, SHF sets specific criteria to qualify for such

guarantees.

Guarantees for mortgage borrowers

• A swap of UDI for minimum salary payments (VSM). This swap allows borrowers in

UDI-denominated loans to reduce the risk of mortgage debt by transforming payments in

multiples of minimum salaries. The structure of the mortgage for the borrower is similar

to that of a loan in UDIs. However, the risk that an increase in UDIs is higher than the

increase in the minimum wage is taken over by SHF upon payment of a fee.

Guarantees for lenders

• A default payment guarantee (GPI) or mortgage insurance

1

will pay to the relevant

financial intermediary or the trust up to 35 percent

1

of the outstanding balance of the

mortgage loan, plus interest thereon, and for unpaid service and insurance fees, after a

mortgage loan is delinquent for six consecutive months and foreclosure takes place. The

fee for the GPI is paid for by the borrower, through the financial intermediary.

• A mortgage insurance scheme (GI) which insures the lender for up to 70 percent of the

outstanding balance of the mortgage loan, plus interest thereon, and for unpaid service and

insurance fees for certain loans, including those that contain an up-front subsidy from the

government.

Financial Guarantees for RMBS issuers

• A timely payment partial guarantee program, Garantia de Pago Oportuno (GPO), is

designed to provide assurance of timely payment of principal and interest up to 85 percent

of the outstanding balance of principal and interest for those loan portfolios that comply

with certain requirements. (However, the maximum protection acquired by any institution

has been 25 percent so far.) Timely payment guarantee is a credit enhancement at the deal

level of the structure, and is similar to a credit line. If the trust does not have sufficient

cash to make a given payment, the line of credit can be drawn to pay both interest and

principal. Once the line of credit is repaid, it can be drawn down again, if the need arises.

The fee to the provider of the GPO is part of the expenses of the trust.

To qualify for SHF’s support, mortgages have to be originated and underwritten following

specific requirements–among others, debt-to-income ratios, loan-to-value ratios, property type and

values, and reporting requirements for the financial intermediaries. Should a loan not comply with

the eligibility criteria, the trust would have to reimburse SHF for any payment made under the

guarantee for that specific loan.

14

debt specific income ratios, loan to value ratios, property type and values, and reporting

requirements for the financial intermediaries. In addition, SHF reviews all the loans to be

securitized before awarding GPO guarantees.

While initially SHF was the only provider of mortgage insurance and financial

guarantees, recently private sector financial guarantee providers have entered the

market. Regulatory changes in the insurance sector passed in 2006 led to the licensing of

two foreign mortgage insurance companies to operate in Mexico. Financial guarantee

providers such as Ambac, Genworth FMO, IFC and most recently MBIA, have been recently

competing with SHF in the provision of these guarantees.

Future plans of SHF include the development of a comprehensive mortgage data base.

SHF will oversee Mortgage Information Statistics (FIEH), which is designed to include

borrower characteristics, house prices and loan payment history. All such information will

become available to mortgage lenders, insurers and investors in securitized loan pools and

will provide an essential tool to enhance transparency and efficiency in the mortgage

markets. However, this project was not fully operative at the time of this paper was written.

Recently, Hipotecaria Total (HiTo) was set up with the goal of expediting the

securitization process. Although mortgage securitizations can be carried out through a

Trust, the process can take up to a month. In an effort to expedite the process, the Danish

central depository institution (VP), in collaboration with SHF, set up a technological platform

in HiTo to launch a system that is open to any party interested in the securitization of a

mortgage portfolio. HiTo allows the continuous interface of banks, Sofoles and the Mexican

depository institution INDEVAL so as to expedite and reduce risks in the securitization

process.

A. Securitization and Rise of the Mexican RMBS Market

The structured finance market has experienced extraordinary growth since its

inception both in asset types and debt structures. Total issues of structured securities

reached over US$6 billion in 2006—tripling in volume since 2004.

15

Mexico has the largest

issuance volume in Latin America. Early structured issues comprised primarily bridge loans

for construction to developers; federal tax participation revenues (transfers from the federal

government to states and municipalities); toll road receivables and consumer credit flows.

15

Data according to Fitch. There were two operations in 2004 and 2005 identical in nature for US$4.5 billion

and US$2.4 billion by Banamex and Banorte, respectively. However, the two operations, which concerned the

securitization of a loan by IPAB (the deposit insurance agency), were only possible because of a legal loophole

in the terms of the original loans which is not present in other loans by IPAB. Therefore, similar operations

cannot be repeated, and therefore, excluded from the total for comparison purposes.

15

Mortgage backed securities (MBS) based on residential mortgage loans (RMBS) made

their first appearance in late 2003

and by 2006 they had become the

largest structured asset class,

representing over 25 percent of total

local structured issues.

16

As of October

2007 there were over US$6.4 billion

RMBS issues outstanding in the

Mexican bond market by seven

different Sofoles, two banks and

INFONAVIT.

Favorable global liquidity conditions

and a growing local institutional

investor base have supported the

new structured issues. Securitized

structures are particularly attractive to pension fund managers because they typically carry a

high credit rating and long duration which matches well with their natural liability structure

and prudential regulatory

regulations.

The strong growth in RMBSs

was supported by SHF. Those

RMBSs that satisfy the loan

origination criteria, which would

make them eligible for SHF

support through credit

enhancements, are commonly

referred to as Borhis

17

in the local

market. However there are also

other types of mortgage-backed

securities outstanding. In the case

of Borhis, SHF offers support to

the liquidity of the issues by acting as “market maker” and thus committing to buy Borhis

both in the primary and secondary markets. Under normal conditions, SHF buys at a price

based on its own cash flow and computed according to a methodology based on certain

prepayment and default assumptions.

16

Data by Fitch.

17

Bonos Respaldados por Hipotecas.

Figure 2. Mexico: Domestic Market Private Debt Issues

by Structure

0

2000

4000

6000

8000

10000

12000

14000

2003 2004 2005 2006

MBS

Structured Securities (non-MBS)

Domestic Debt Securities (non structured)

Figure 1. Latin America Local Issuance of Securitized Assets

2006

0

1000

2000

3000

4000

5000

6000

7000

Argentina Brazil Chile Colombia Mexico Peru

In Million US dollar

s

Structured Finance Issues (non- RMBS) RMBS

Source: Fitch.

16

More recently, Mexico has adopted the Danish technological platform which enabled

mortgage originators to start issuing RMBSs closer to the Danish ones. The important

difference between these RMBSs and those previously in the Mexican market is that the

existing series can be augmented by re-opening it during the first year up to a pre-established

maximum and increasing the size of each issue in the market, thereby allowing it to achieve

higher liquidity.

18

A loan’s monthly payments will cause some bonds to be withdrawn from

the pool in the amount the loan pays down. These pass-through securities will be issued

through the centralized agency, HiTo. The first re-openable MBSs, so-called “Borhis

fungibles”, made their appearance in late 2006.

Issuers and Investors

Sofoles were the first and by far the most active users of the new financial instruments,

but INFONAVIT has quickly followed. As of October 2007, Sofoles accounted for

60 percent of total outstanding RMBS stock of issuances, while commercial banks

represented around 5 percent of issues. This has been due, in part, to the structural decline in

Sofoles’ funding sources, together with the rising demand for housing credit, which gave

strong incentives to Sofoles to securitize their portfolios. Following the success of the initial

RMBS structures, INFONAVIT rapidly became one of the largest issuers in the market, and

in October 2007 accounted for around 27 percent of the outstanding stock of RMBS issues in

the market. Commercial banks’ large deposit base had so far been sufficient to finance

lending activities. However, in the course of late 2006 and early 2007 several banks entered

the market and opened some of the largest issues outstanding (Box 5).

Local institutional investors dominate the market for structured issues. To date, the bulk

of RMBS issues are held by domestic pension funds and insurance companies. As tranched

issues appeared, institutional investor interest concentrated in the senior tranches. This strong

demand reflects a number of factors:

• First, Mexican MBSs are typically denominated in UDIs

19

and thus generate inflation-

linked returns matching pension funds’ liability structures (Box 5);

18

Every fungible Bori structure has reopening periods ranging from one to three years.

19

The UDI is a unit of account the value of which is updated daily and reflects the changes in the consumer

price index. On the 10 and the 26 of each month the Bank of Mexico publishes the UDI’s value for the next

fifteen days. On the 10 and the 26

th

day of the month the change in UDI value will be equal to the change in the

consumer price index in the previous 15 days of the month, the value for the days between the 10 and 26

th

will

be computed by distributing the total increase in the CPI across the number of days in the period. The UDI had

a value of 1 on April 4, 1995 (as of 4/2007 approximately 3.85).

17

• Second, by enhancing the credit profiles through financial guarantees, over-

collateralization, and junior tranches, structured issues achieve an investment grade

credit rating that local issuers would otherwise not achieve;

• Third, structured issues carry slightly higher yields than the comparable government

securities; and

• Finally, the terms of the underlying loans, together with those of the securing

collateral, allow structured issues to have a relatively long duration with respect to

other instruments in the local market, which tend to be concentrated on the short-end

of the yield curve.

Subordinated tranches of MBS issues reportedly have had less appeal, but appetite for

such tranches appears to have been growing recently. More recently, high liquidity in

international markets generated some foreign investor interest for MBSs as securities with a

relatively higher yield. Local mutual funds have also been attracted to them because of the

yield pick-up they offer. However, in some cases, junior tranches have been reportedly

retained by the originating institutions, thus preventing them from fully divesting their credit

risk.

Valuation and Rating

In Mexico, there is a high degree of uncertainty surrounding the parameters used to

model the cash flows from the RMBSs’ underlying assets. In particular, there is a lack of

comprehensive historical data on default rates, prepayment rates, and recovery rates and on

the length of the foreclosure process. In addition, recent legislative reforms affecting the

foreclosure process (as discussed above) may have altered the significance of the available

historical information, so that most of the relevant parameters in the valuation process have

to be assumed.

20

The lack of historical and market data housing prices further complicates assessment of

loan-to-value ratios and of the over-collateralization of portfolios. In principle, house

values for mortgages in portfolios guaranteed by SHF must be formally appraised; however,

most of the time, house prices for loan purposes have been supplied directly by the

construction companies. The authorities are also aware of the need to deter fraudulent

appraisals as these would compromise the valuation of RMBS, and the integrity of the

investors’ (e.g. pension funds’) portfolios.

20

For example, repayments rates are typically assumed to be constant, imputed either to the loan pool or to each

single loan. While in Mexico typically there are no restrictions or penalties on prepayments, the cost of

re-financing mortgages is high, thus prepayment rates have tended to be less sensitive to interest rates than in

the U.S. Market reports suggest the constant pre-payment rate has been assumed at 5 percent, and indeed

according to an SHF White Paper, historical experience with prepayments has been around this level.

18

The government bonds denominated in UDIs (Udibonos) used as benchmark bonds for

the pricing of the securities have been illiquid, complicating the price discovery process

for the securities valuation in the RMBS market. These bonds were the only local UDI-

denominated securities with a term structure relevant to RMBSs. However, historically, the

Udibono market usually has been very illiquid (it is heavily influenced by pension funds that

do not trade Udibonos actively).

Currently, the only source of information for RMBS prices in the secondary market are

the local price vendors.

21

The models used by these agencies to price the securities are not

fully clear; however, SHF is working with the price vendors to improve practices. SHF is not

required to buy the bonds at the prices announced by the vendors.

The valuation of RMBSs relies heavily on rating agencies’ review process. High ratings

make securities suitable for pension fund portfolios. Factors behind the high rating of the

early Borhis, beyond SHF’s partial financial guarantee, include SHF’s incentives to Sofoles

to issue loans with conservative loan-to-value ratios, mortgage insurance, and the UDI -VSM

swap for all UDI-denominated loans. In more recent issues, since the junior tranches

22

effectively provide an additional buffer for the senior tranches, the senior tranches have not

needed a financial guarantee to attain an “AAA” rating on the local Mexican scale. Some

issues which had a senior tranche with a total financial guarantee were rated “AAA” on the

global ratings scale. Because the mortgages in most securitizations are covered by mortgage

insurance for up to 35 percent of the losses, even the junior tranches still qualified for an “A”

rating.

23

However, for the initial rating of the securities, rating agencies have tended to rely

heavily on SHF’s due diligence on the quality of the loan portfolio to be securitized.

Furthermore, some have suggested that rating agencies should play a more proactive role in

the rating review of RMBSs, as there are reports that downgrades to RMBSs occurred only

after irregularities had become readily apparent.

21

Price vendors are institutions created in Mexico because of the structural illiquidity of the private issues

market. Such institutions are supposed to be independent and to provide price information for market operators.

22

Junior tranches are also referred to as “mezzanines.”

23

Local scale A is equivalent to BB- on the international scale.

19

Box 4. Main Characteristics of Mexican MBS Issues

The main features of the MBSs in the market have reflected, to a large extent, the type of originating

institution. MBS issues by Sofoles are typically denominated in UDIs and thereby are inflation-linked. The

underlying loans are mostly standardized, and carry enhancements purchased through SHF or other insurers (see

below). Issues originated by Infonavit

1

tend to have underlying loans more diverse in nature, although, reportedly, all

sharing the same duration of the structured paper that was issued. Typically the characteristics of INFONAVIT’s loans

depend on the borrowers’ income level and the size of the house to be purchased.

1

These issues carry no direct

financial guarantees but include over-collateralization as a form of credit enhancement. Because INFONAVIT is a

government-sponsored institution, there is a perception on the part of investors that these products also have an

implicit government guarantee. Diversified MBS issues by commercial banks have emerged at a fast pace. Such issues

are mostly structured to reflect the fixed peso characteristics of the mortgages extended by banks. Interestingly, not all

of these RMBs carry mortgage insurance and guarantees offered by SHF. Instead, the enhancements in a number of

commercial bank issues consist of extended liquidity facilities (or total financial guarantees) by large international

insurance institutions and tranched structures to support the credit ratings.

Coupon: Interest rates on MBS issues have averaged between 5 to 6 percent in real terms. More recent issues have

carried lower coupons reflecting both an easing of real rates in the economy and a compression in MBS spread vis-à-

vis their benchmark UDIbono bonds. While early issues carried a significantly higher spread (around 120–140 basis

points) with respect to the UDIbono yield curve, the more recent ones which ranged around 80–90 basis points. Over

time the spreads for Sofoles-issued MBSs have been compressed owing to the greater demand and higher liquidity of

the market provided by SHF’s activity on the secondary market. However, the compression in spreads also reflected

changes in the structure of the RMBS, in particular, the increased use of mezzanine tranches as the market developed

(see below). More recent issues have also benefited from a total financial guarantee (rather than just the partial GPO

guarantee) on the senior notes which brought a further decline in issuance spreads to around 40–50 basis points above

the UDIbono benchmark.

Term : RMBS term has ranged from 10 to 30 years with most of the most recent issues around 30 years. They carry

the longest maturities available for a private (and public) sector security on the market. The typical term for other

types of asset-backed issues in Mexico has been from five to seven years.

Credit Enhancements: Most of the issues by Sofoles are structured so as to comply with requirements to qualify for

the SHF partial financial guarantee (GPO). The qualification requirements for GPO are that the holders underlying

mortgages need to hold a UDIs-VSM swap and that underlying mortgages are covered by the mortgage insurance

guarantee (GPI). There are also loan-to-value ratio requirements which cannot exceed 80 percent for UDI-

denominated mortgages and 90 percent for peso-denominated loans. Most MBSs have over- collateralization (OC)

implying that the value of the principal assets backing a certain issue exceeds the value of the security outstanding.

The OC levels have been variable in the order of 0.8 up to 15 percent. In more recent deals, the initial collateralization

has been close to 1.0 percent with the over-collateralization expected to build to a higher target value as the bond

principal amortizes. Most recently, several issues appeared a total financial guarantee (so called full wrap), which

covers 100 percent of shortfalls in principal and interest payments. Such guarantee is a liquidity guarantee that does

not cover against losses due to default but ensures timely payment. However, the issues carrying such guarantee had a

subordinated structure (see below) that would be the first to absorb the credit losses.

Structure: Given the absence of a market for below investment grade rated securities, early issues were single-

tranched with credit enhancements provided by SHF in the form of mortgage insurance (GPI) and a financial

guarantee (GPO). A small equity position, typically around 4 percent was retained, and fully provisioned for, by the

originator. More recently, issues have had a senior and a subordinated (or junior) tranche structure as typical in

mature debt markets and a broader variety of credit enhancements. When issues are tranched, receipts are distributed

by tranche seniority, i.e. accruing to the senior tranches first, while losses are distributed inversely. Because , in

general, mortgages in these securitizations have mortgage insurance for the first 35 percent of the losses, junior

tranches typically have still qualified for an A rating on a local scale.

1

As the junior tranche, or mezzanine, effectively

provides an additional buffer for the senior tranches, these tranches do not need a financial guarantee to attain a AAA

local rating. Some senior tranched with a total financial guarantee (100 percent fullwrap) qualified for a AAA global

rating. The senior tranches have represented about 80 percent of the portfolios while junior or “mezzanine” tranches

have ranged between 3 to 12 percent. Equity positions between 4 and 8 percent have been retained by the originating

institution.

20

V. PAST LESSONS AND FUTURE CHALLENGES

The recent rapid growth in housing finance through private mortgages appears

grounded on more solid primary and secondary markets than in the past. Private

mortgage lending has been steadily increasing since the beginning of 2003, and all

expectations are that the trend will continue. The resilience of the new housing finance

framework is based on the fact that most new mortgages are inflation-indexed or have fixed-

peso rate interest, and the bulk of the origination has taken place through non-deposit taking

institutions. In addition, the standardization of mortgage issuance, including SHF’s

requirements of strict origination practices in terms of underwriting and eligibility criteria,

has facilitated access to local funding by mortgage issuers at relatively low rates.

The development of the mortgage bond market with pass-through securities has

enabled financial institutions to reduce on-balance sheet risk. In particular, credit, market

and maturity mismatch risks are transferred to securitizing vehicles while creating

increasingly liquid bond pools in the local capital markets.

A number of infrastructural issues merit close attention to assure the future

development of secondary mortgage markets. In particular, there is still a need to improve

public property registries. These registries are still paper based and not systematized, raising

the cost of collateral verification. The role of auditors and credit rating agencies will have to

be strengthened to increase their credibility. In many instances, auditors are reportedly able

to check only 5 to 10 percent of the titles of a portfolio pool. As recommended in the 2006

FSAP Update, issuers and regulators should consider standards for the inclusion of due

diligence firms to review the files of the loans that make up collateral pools.

24

25

The mortgage-backed securities valuation methodology has to be adapted to the

Mexican situation. Although reliance on highly theoretical models is a common problem

with the valuation of structured products in general, in the case of Mexico, the problem is

compounded due to a lack of mortgage prepayment and default history. SHF has been

cognizant of this problem and has sought to develop centralized prepayment and default

databases, but these are not yet fully operational.

The absence of a market for lower-rated securities means that the mezzanine or junior

tranches of the securitized portfolios are held by the originating institutions. This

24

Technical Note on Housing Finance, prepared for the 2006 FSAP Update

(http://wbln0018.worldbank.org/FPS/fsapcountrydb.nsf/FSAPexternalcountryreports?OpenPage&count=5000

).

25

To illustrate the concern, the FSAP Technical Note on Housing Finance reported that 30 percent of a pool for

which SHF was asked to provide mortgage insurance suffered from deficiencies in documentation, ranging

from missing credit bureau reports to missing or deficient appraisals. Furthermore, the rating agency did not

review any loan files, nor did the institutions that were offering credit enhancements.

21

situation tends to reduce the risk-diversification value of securitization for those institutions,

as they would be retaining the riskiest tranches of the loan portfolios. In turn, this would also

imply that the capital relief they can obtain from securitization is limited.

SHF’s role as liquidity provider in the RMBS market may represent a contingent fiscal

liability under stress events. As a market-maker, SHF has an explicit commitment to buy

Borhis, both in the primary and secondary markets, even under stress events. So far, no limit

has been explicitly set as to the total amount of Borhis that SHF could buy. In the event of a

stress-induced off-load of RMBSs, the SHF would step in to maintain liquidity, leaving the

bank vulnerable to market losses. In this context, SHF would benefit from stress test analysis

to periodically reassess its level of liquidity. While SHF provisions on the basis of expected

losses, reinsures part of the risk from its mortgage insurance products with international

insurance corporations, and fully hedges its VSM-UDI liabilities with FOVI, it would be

important to assess on a regular basis the institution’s liquidity under stress events.

While there is little risk of providing incentives for overbuilding, incentives for

substandard house construction may exist. The program of guarantees for construction

companies, is aimed at increasing further the amount of funding directed to the housing

sector without increasing the associated risk to the lenders. However, the program effectively

relieves the lender of the market risk associated with construction activity, and thus provides

an incentive to relax quality standards.

Large securitizations by INFONAVIT might complicate RMBS pricing in the market

and crowd out private sector issuers. INFONAVIT has been able to issue RMBSs at very

compressed spreads relative to the benchmark government bonds. This is somewhat

surprising, given that its mortgages are not generally standardized and there are significant

problems in valuing the housing constituting its collateral. This highlights, as discussed

earlier, the importance that markets assign to implicit public guarantees on the securities.

Such guarantees, which constitute a contingent liability for the government, may lead to the

crowding-out of other private sector issuers, while obscuring the pricing process in the

market.

The recent troubles in the U.S. mortgage market have raised questions about the

possibility of a similar replay in Mexico—but there are significant differences between

the two markets. The fast pick-up in private mortgages in Mexico was preceded by several

years of stagnation and has come from a low level. Furthermore, RMBS remains a very small

share of the domestic mortgage market in Mexico, with considerably less serious systemic

implications. Finally, the complex securities currently generating volatility in the

U.S. markets, such as CDOs, are practically non-existent in the Mexican financial sector.

Nevertheless, the recent troubles in the U.S. mortgage market suggest that the

securitization model carries some vulnerabilities. The recent turmoil in financial markets

is a reminder that the RMBS valuation process is intrinsically complex, even in countries

22

with long historical series and sophisticated technological platforms. In addition, in Mexico,

there is a concern that rating agencies have been slow in reviewing the ratings for entities

facing financial difficulties (e.g., a recent downgrade was issued only after a default event).

The securitization model relies heavily on loan origination and servicing standards. As loans

are transferred off-balance sheet, many authors have pointed out the potential for an inherent

weakening of the borrower-lender relationship within the securitization vehicle structure (e.g.

Davison (2007)). In addition, in the event that securitization model runs into liquidity

problems, either because of rising defaults or because of an inability to place new issues,

financial institutions may have to buy back their own loans, thus repurchasing the credit risk

they had sought to lay off. Finally, the securitizations structured through fideicommisos

which are common in Latin America may be even more vulnerable to losses than those

structured through SPVs in the U.S., because they do not have their own capital.

23

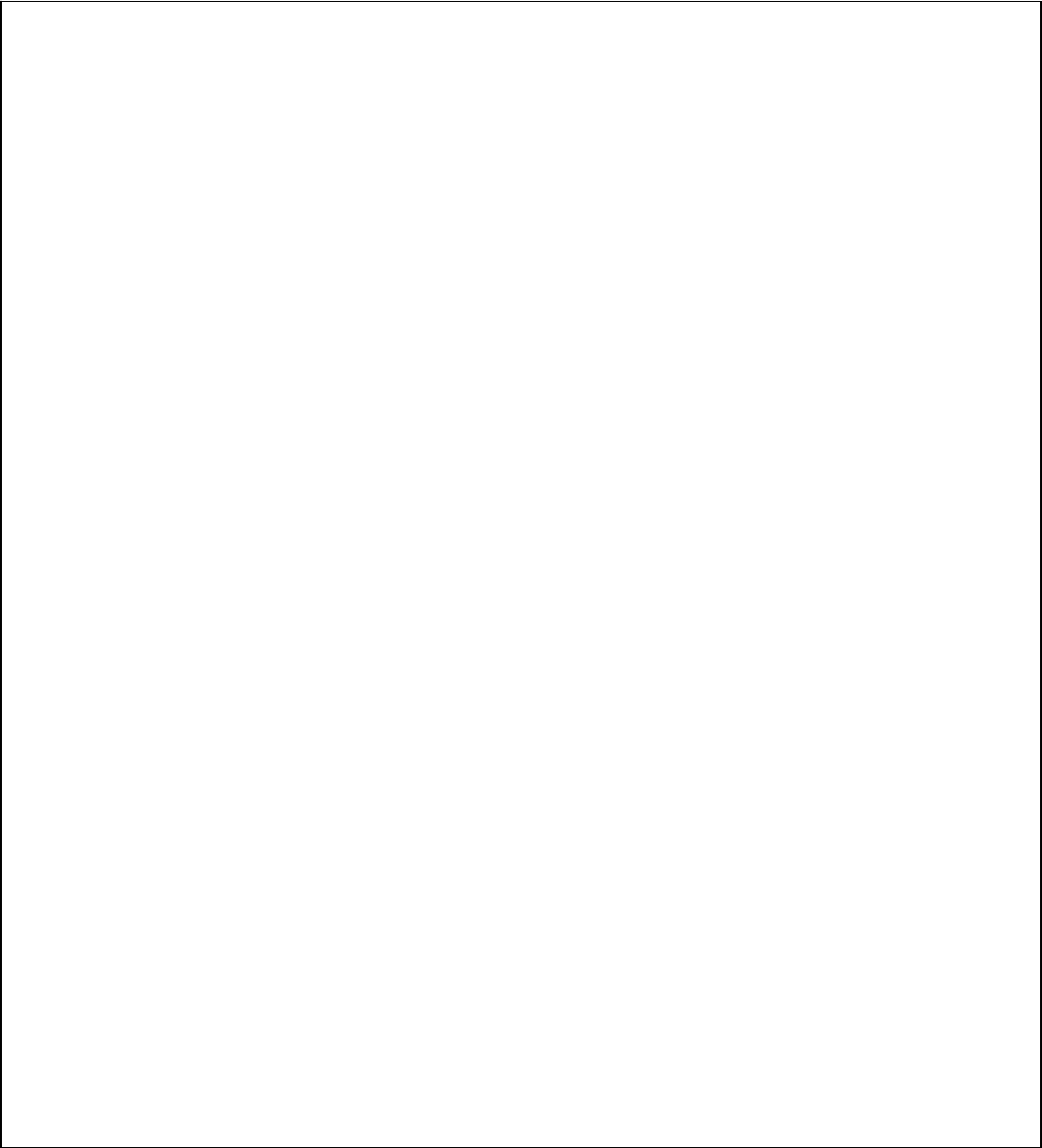

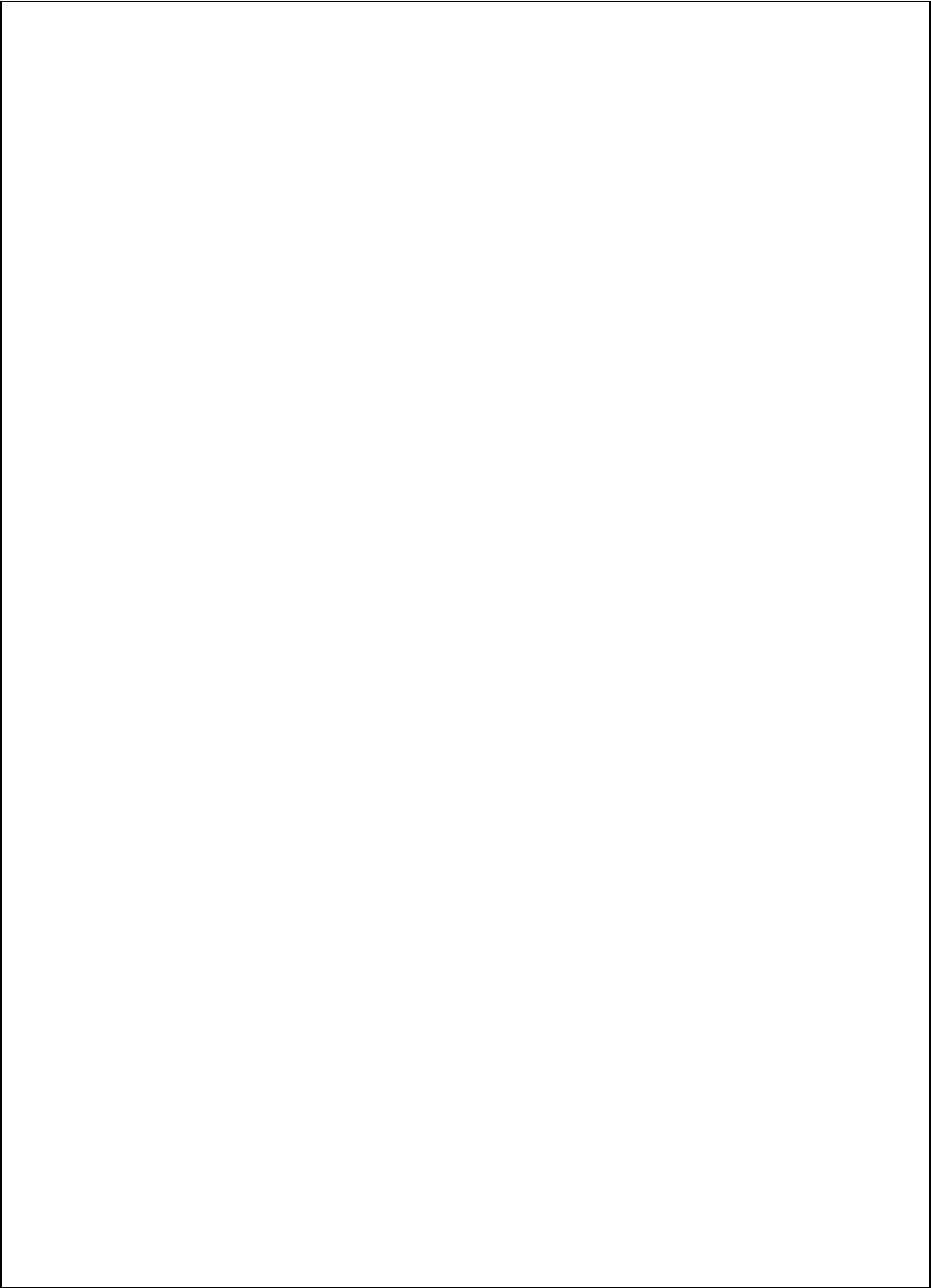

Figure 3. Mexico: Historical Trends in Credit to Housing

Source: CONAVI, Bank of Mexico, Dealogic and Fund Staff calculations.

Financial Sector Credit to Housing

(In percent of GDP)

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

40.00

Housing Credit by the Banking Sector

Housing Credit by Sofoles

Total Housing Credit by Financial Insitutions

Composition of Housing Finance

(In percent of GDP)

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

18.00

20.00

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

18.00

20.00

Private sector (including MBS)

Public sector

Total lending for housing purposes

24

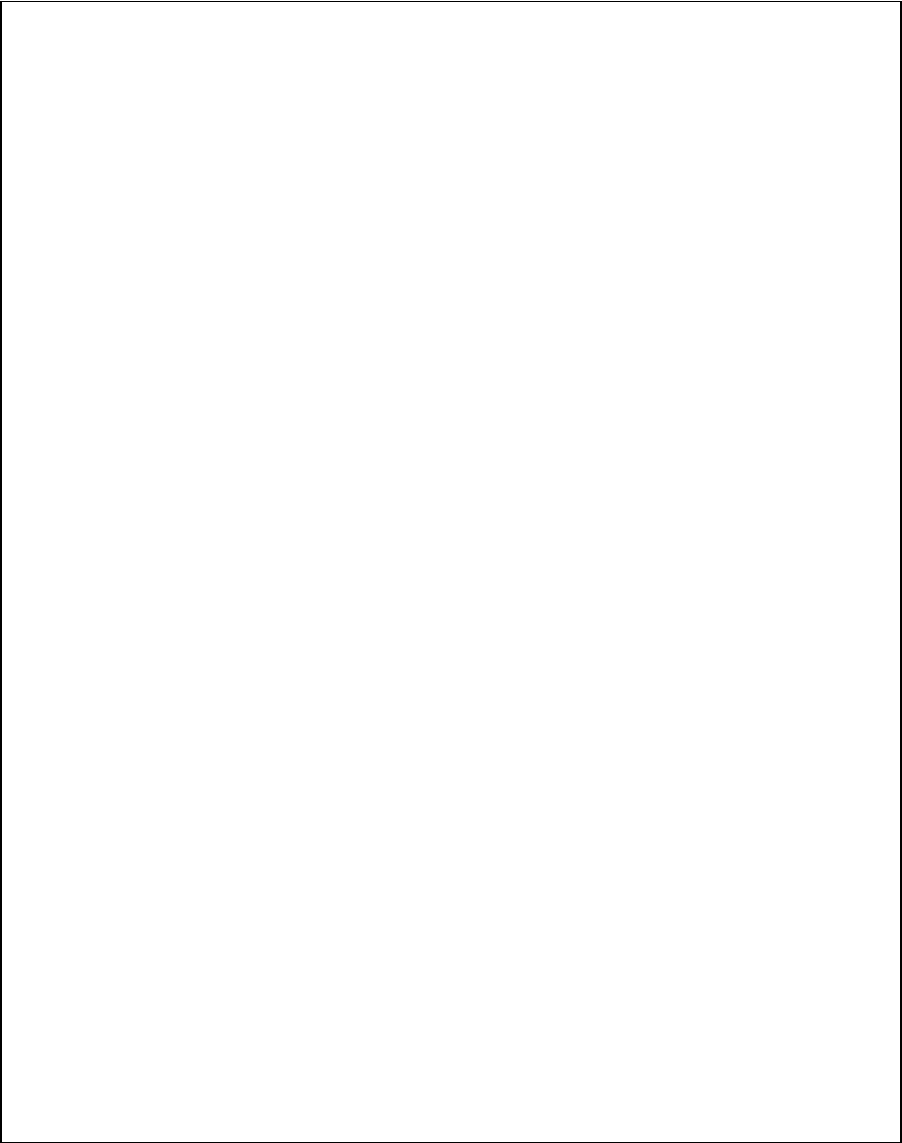

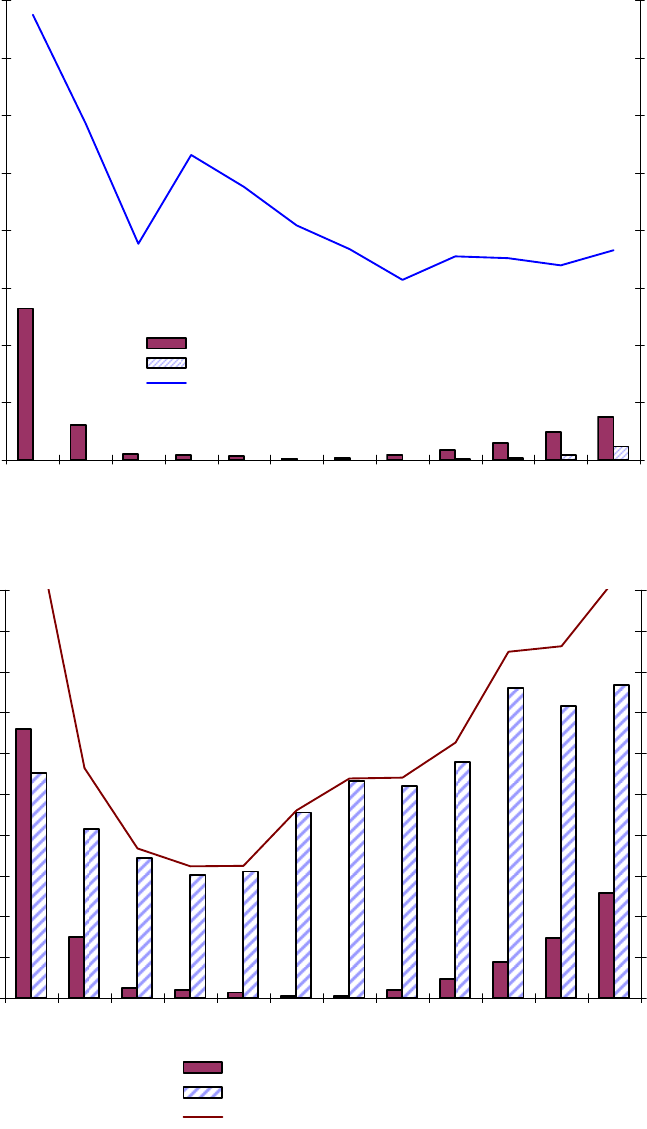

Figure 4. Mexico: Structure of Housing Finance, 2000-2005

Source: Conavi, Bank of Mexico, Dealogic and Fund Staff calculations.

Housing Finance by Program Type

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

2000 2001 2002 2003 2004 2005

In million pesos

Infonavit SHF Fovissste

Fonhapo Banks Sofoles

Other public institutions MBS

Housing Finance by Funding Source

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

2000 2001 2002 2003 2004 2005

In million pesos

Public sector agencies Private sector financial institutions MBS

25

REFERENCES

Barry, C., Castaneda G. and J.B. Lipscomb (1995) “The Structure of Mortgage Markets in

Mexico and Prospects for Their Securitization” Journal of Housing Research Vol. 5,

n.2, pp. 173–204.

BIS, Committee on the Global Financial System (2006) “Housing Finance in the Global

Financial System” CGFS Papers # 26; January.

Caloca Gonzalez, M. (2006) “Mortgage Backed Securitization: New Legal Developments in

Mexico.” http://www.natlaw.com/pubs/spmxbk8.htm

CGFS Working Group Report (2006) “Housing Finance in the Global Financial Market”

Bank for International Settlements, CGFS Papers 26.

Chiquier, L. O. Hassler and M.J. Lea (2004) “Mortgage Securities in Emerging Markets”

World Bank Policy Research WP 3370.

Credit Suisse (2006) “Mexico Mortgage Market” Fixed Income Research. September 26.

Current Housing Situation in Mexico (2005) and (2006) by CIDOC and SHF with support

from CONAVI and Harvard University Joint Center for Housing.

Davison, Andrew Davidson (2007) “Six Degrees of Separation” The Pipeline. September.

Frankel, A.; Gyntelberg, J. Kjeldsen, K. and M. Persson M. (2004) “The Danish Mortgage

Market,” BIS Quarterly Review, March.

Gwinner, W. (2006), FSAP Update, Mexico, Technical Note on Housing Finance

http://wbln0018.worldbank.org/FPS/fsapcountrydb.nsf/FSAPexternalcountryreports?

OpenPage&count=5000

Haber, S. (2005) “Banking with and Without Deposit Insurance: Mexico’s Banking

Experiments , 1884–2004” Stanford University, Mimeo.

Kjelsen, K. (2004) “Mortgage Credit in the USA and in Denmark” Monetary Review,

Danmarks Nationalbank; 2

nd

Quarter.

Lea, M.J. and S.A. Bernstein (1996) “Housing Finance in an Inflationary Economy: The

Experience with Mexico” Journal of Housing Economics 5, pp. 87–104.

Pikering, N. (2000) “The Sofoles: Niche Lending or New Leaders in the Mexican Mortgage

Market?” W00-2 Joint Center for Housing Studies, Harvard University.

Rogers, J. and R. Zepeda (2006) “Mexico Looks to Denmark on Mortgage-Backed

Securities” Global Banking and Financing Policy Review, Vol. , pp. 123–6.

SHF (2006) “White Paper” http://www.shf.gob.mx/files/pdf/06%20Portfolio%20Information.pdf.

SHF (2007) “Strategy 2007–2013” http://www.shf.gob.mx/files/pdf/Estrategia%202007- 2013.pdf.